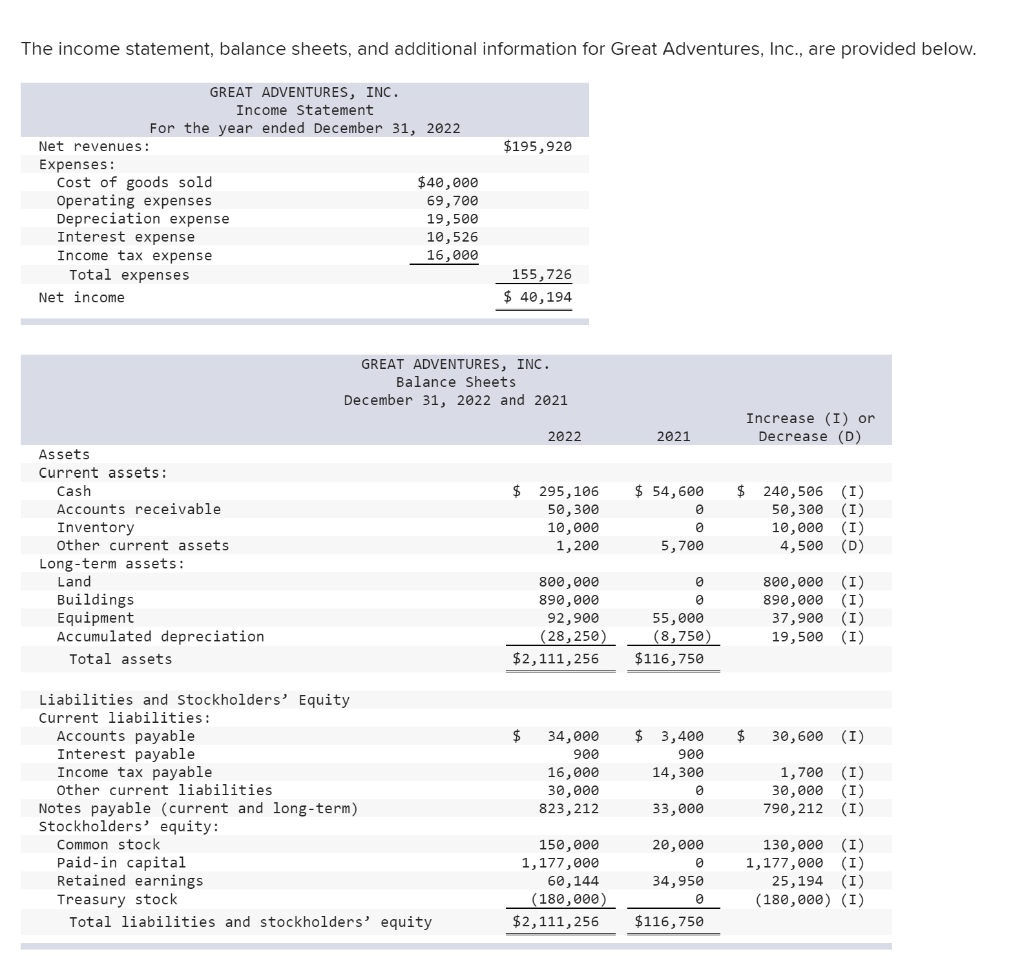

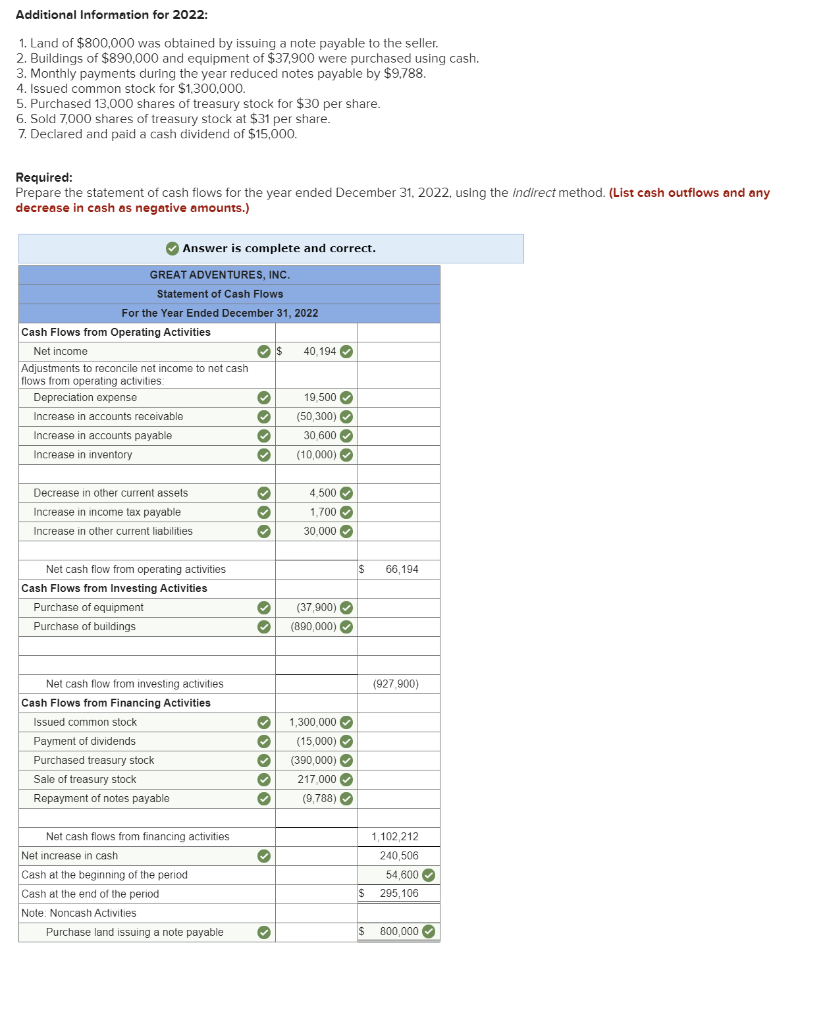

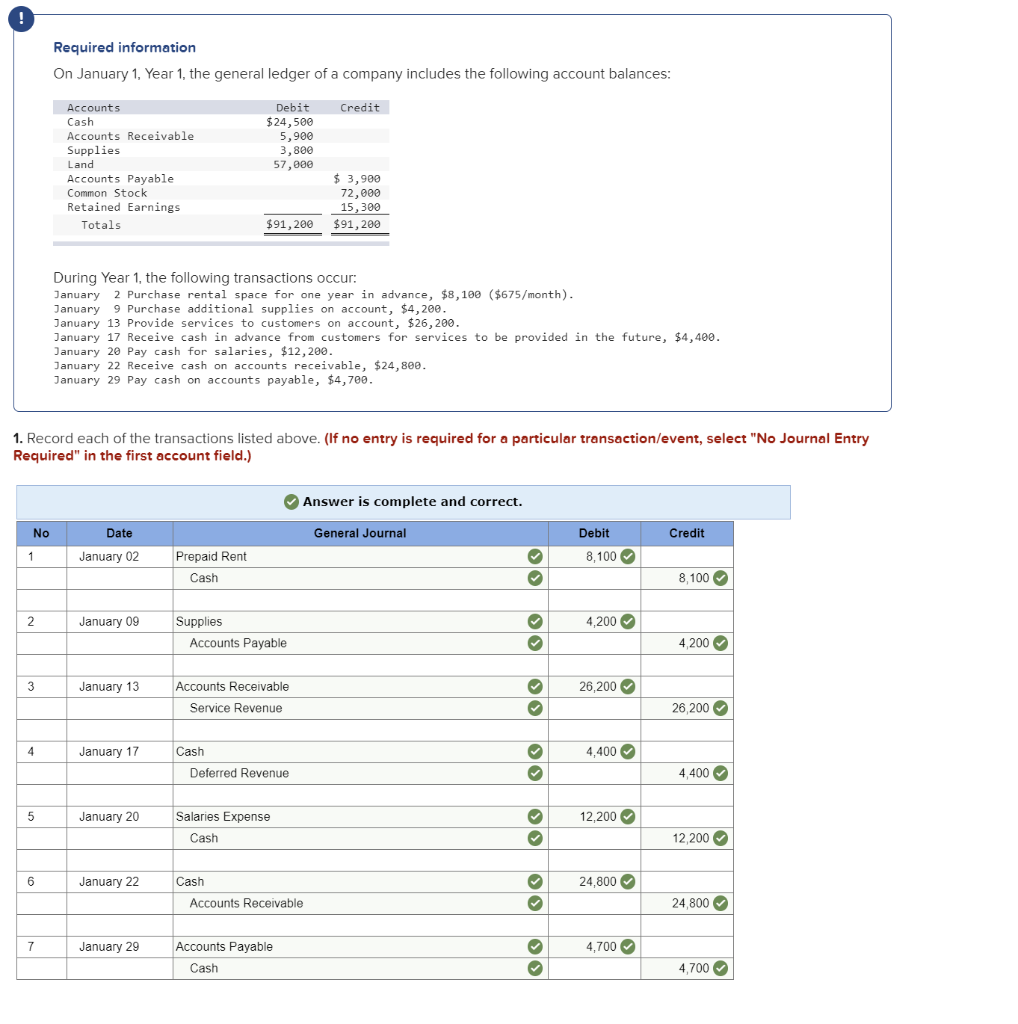

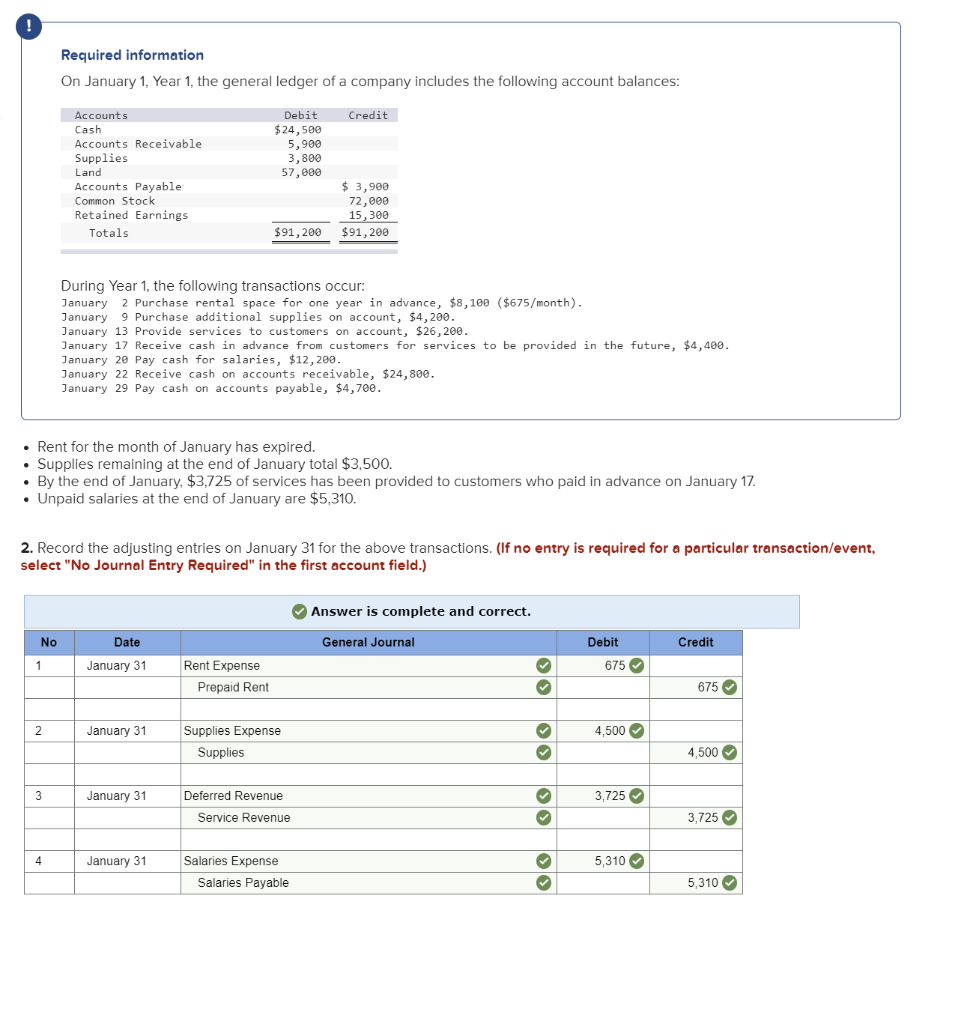

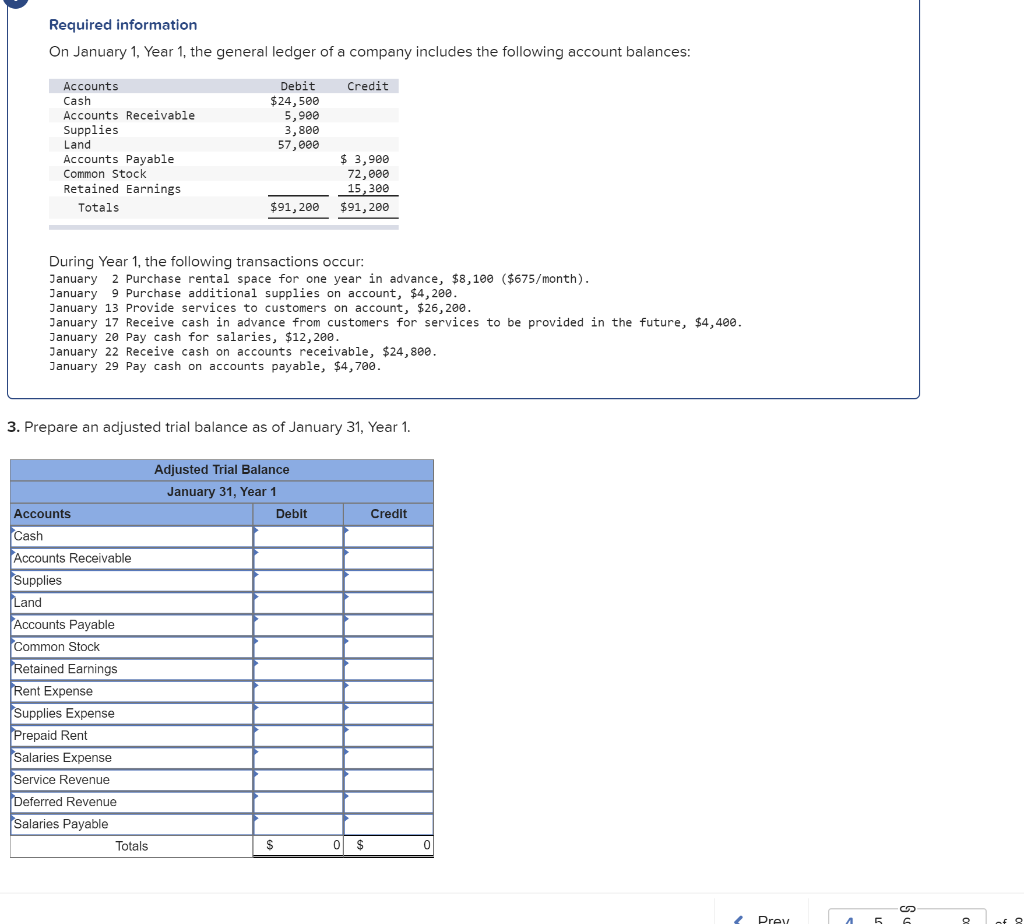

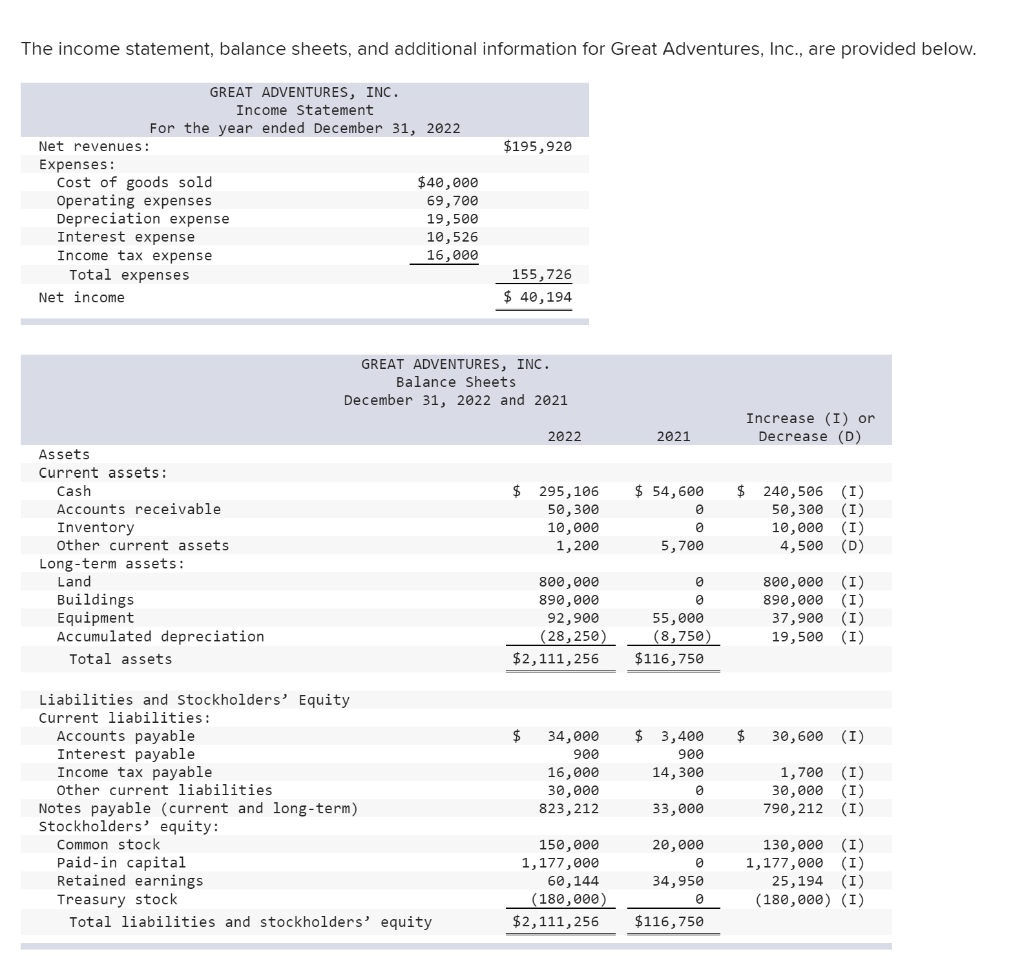

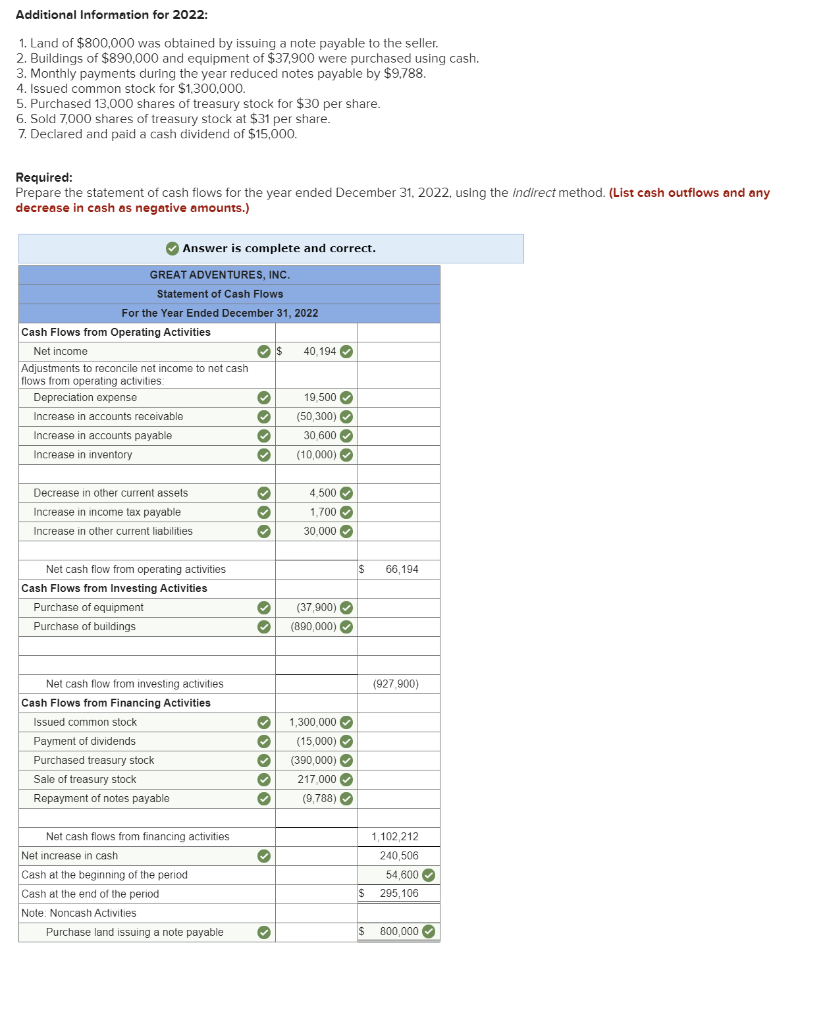

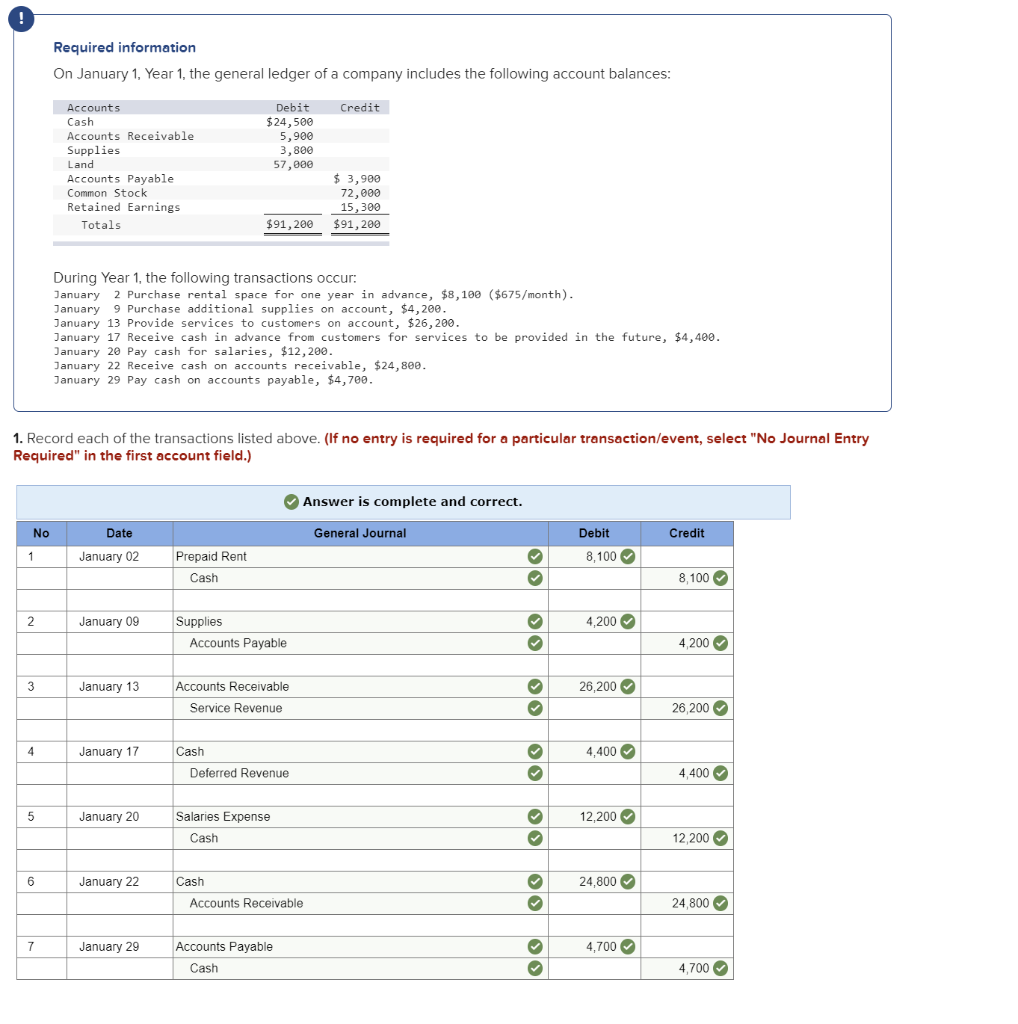

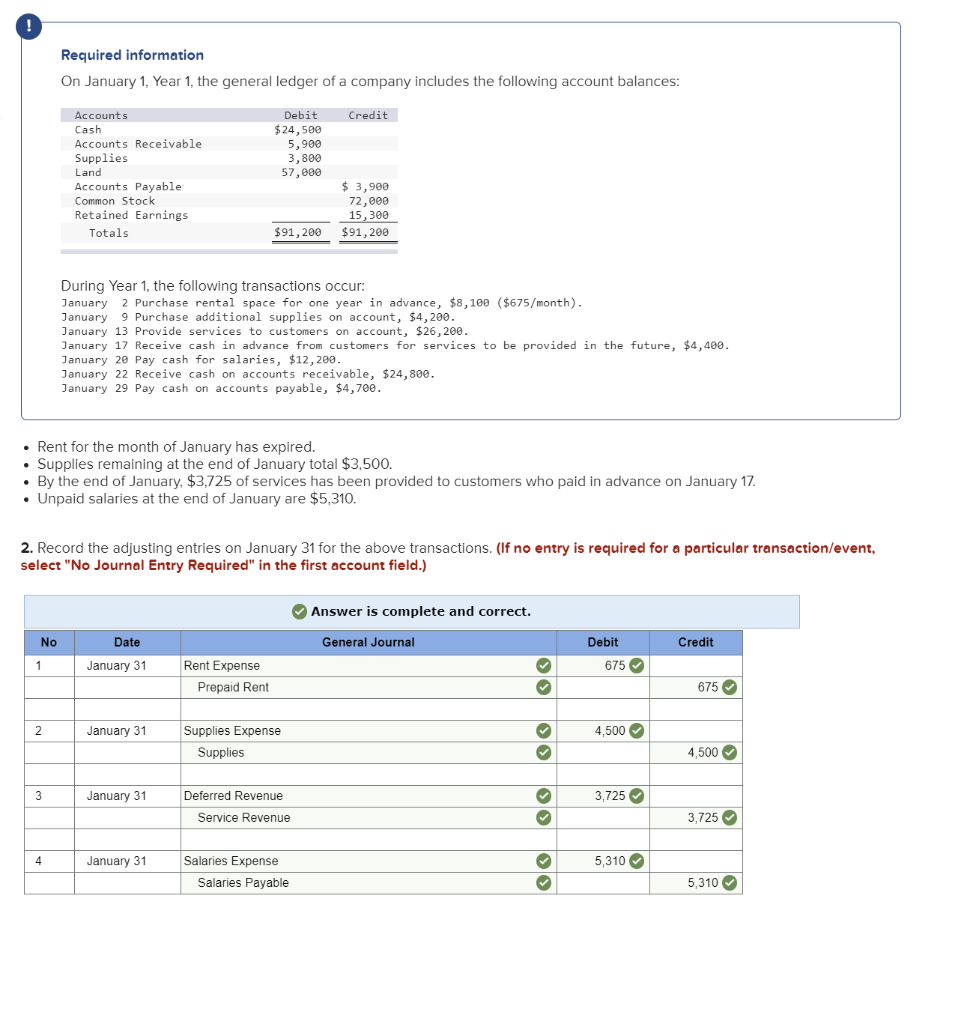

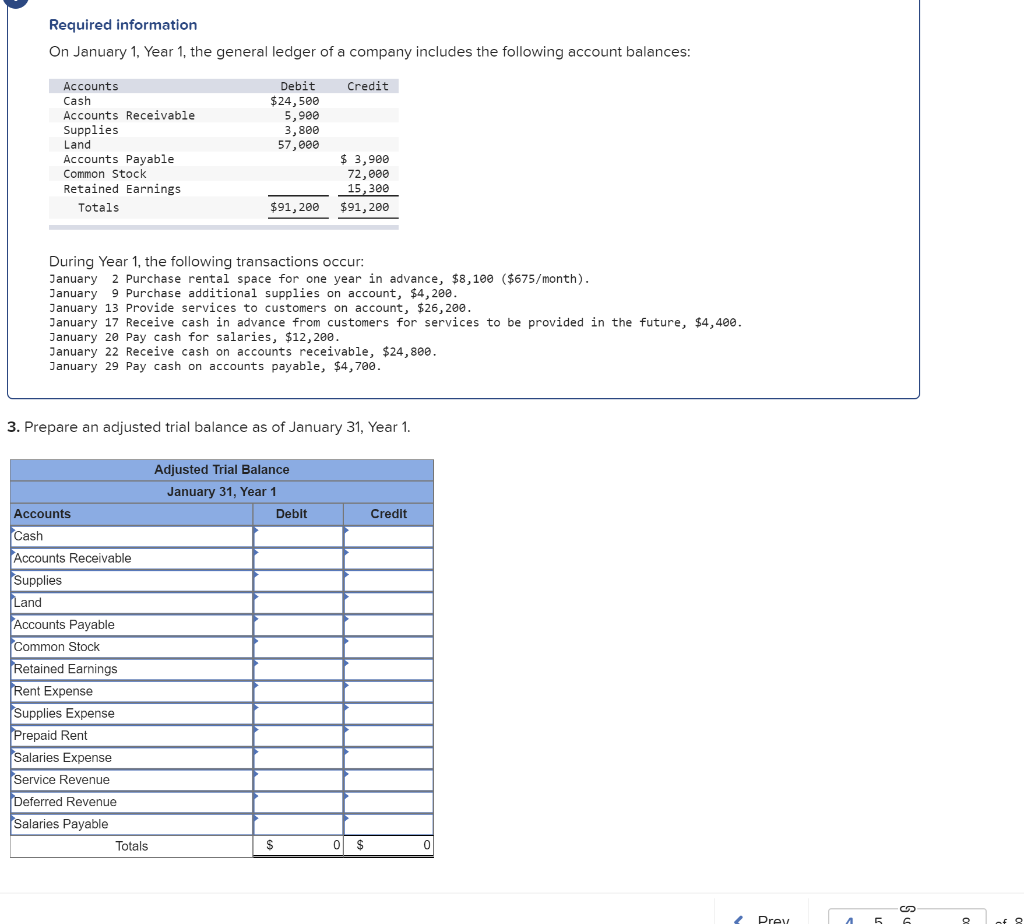

The income statement, balance sheets, and additional information for Great Adventures, Inc., are provided below. $195,920 GREAT ADVENTURES, INC. Income Statement For the year ended December 31, 2022 Net revenues: Expenses: Cost of goods sold $40,000 Operating expenses 69,700 Depreciation expense 19,500 Interest expense 10,526 Income tax expense 16,000 Total expenses Net income 155,726 $ 40,194 GREAT ADVENTURES, INC. Balance Sheets December 31, 2022 and 2021 2022 2021 Increase (I) or Decrease (D) $ 54,600 $ 295, 106 50,300 10,000 1,200 240,506 50,300 10,000 4,500 (I) (I) (I) (D) 5,700 Assets Current assets: Cash Accounts receivable Inventory Other current assets Long-term assets: Land Buildings Equipment Accumulated depreciation Total assets 800,000 890,000 92,900 (28,250) $2,111,256 800,000 890,000 37,900 19,500 (1) (I) (I) (I) 55,000 (8,750) $116,750 $ $ $ 30,600 (I) Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Other current liabilities Notes payable (current and long-term) Stockholders' equity: Common stock Paid-in capital Retained earnings Treasury stock Total liabilities and stockholders' equity 34,000 900 16,000 30,000 823,212 3,400 900 14,300 1,700 (I) 30,000 (I) 790,212 (I) 33,000 20,000 150,000 1,177,000 60,144 (180,000) $2,111, 256 34,950 130,000 (I) 1,177,000 (1) 25,194 (I) (180,000) (I) $116,750 Additional Information for 2022: 1. Land of $800,000 was obtained by issuing a note payable to the seller. 2. Buildings of $890,000 and equipment of $37,900 were purchased using cash. 3. Monthly payments during the year reduced notes payable by $9.788. 4. Issued common stock for $1,300,000. 5. Purchased 13,000 shares of treasury stock for $30 per share. 6. Sold 7,000 shares of treasury stock at $31 per share. 7. Declared and paid a cash dividend of $15,000. Required: Prepare the statement of cash flows for the year ended December 31, 2022, using the Indirect method. (List cash outflows and any decrease in cash as negative amounts.) Answer is complete and correct. GREAT ADVENTURES, INC. Statement of Cash Flows For the Year Ended December 31, 2022 Cash Flows from Operating Activities Net income $ 40,194 Adjustments to reconcile net income to net cash flows from operating activities Depreciation expense 19.500 Increase in accounts receivable (50,300) Increase in accounts payable 30 600 Increase in inventory (10,000) Decrease in other current assets Increase in income tax payable Increase in other current liabilities 4,500 1,700 30,000 $ 66,194 Net cash flow from operating activities Cash Flows from Investing Activities Purchase of equipment Purchase of buildings (37,900) (890,000) (927 900) Net cash flow from investing activities Cash Flows from Financing Activities Issued common stock Payment of dividends Purchased treasury stock Sale of treasury stock Repayment of notes payable 1,300,000 (15,000) (390,000) 217,000 (9,788) Net cash flows from financing activities Net increase in cash 1 102 212 240,506 54,600 295,106 $ Cash at the beginning of the period Cash at the end of the period Note. Noncash Activities Purchase land issuing a note payable $ 800,000 Required information On January 1, Year 1, the general ledger of a company includes the following account balances: Credit Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $24,500 5,900 3,800 57,000 $ 3,900 72,000 15,300 $91,200 $91,200 During Year 1, the following transactions occur: January 2 Purchase rental space for one year in advance, $8,100 ($675/month). January 9 Purchase additional supplies on account, $4,200. January 13 Provide services to customers on account, $26,200. January 17 Receive cash in advance from customers for services to be provided in the future, $4,400. January 20 Pay cash for salaries, $12,200 January 22 Receive cash on accounts receivable, $24,800. January 29 Pay cash on accounts payable, $4,700. 1. Record each of the transactions listed above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Answer is complete and correct. No General Journal Credit Date January 02 Debit 8,100 1 Prepaid Rent Cash 8,100 January 09 4,200 Supplies Accounts Payable 4,200 January 13 26,200 Accounts Receivable Service Revenue 26,200 January 17 4,400 Cash Deferred Revenue 4,400 January 20 12,200 Salaries Expense Cash 12,200 January 22 24,800 Cash Accounts Receivable 24,800 January 29 4,700 Accounts Payable Cash 4,700 Required information On January 1, Year 1, the general ledger of a company includes the following account balances: Credit Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $24,500 5,900 3,800 57,000 $ 3,900 72,000 15,300 $91,200 $91,200 During Year 1, the following transactions occur: January 2 Purchase rental space for one year in advance, $8,100 ($675/month). January 9 Purchase additional supplies on account, $4,200. January 13 Provide services to customers on account, $26,200. January 17 Receive cash in advance from customers for services to be provided in the future, $4,400. January 20 Pay cash for salaries, $12,200. January 22 Receive cash on accounts receivable, $24,800. January 29 Pay cash on accounts payable, $4,700. Rent for the month of January has expired. Supplies remaining at the end of January total $3,500. . By the end of January, $3,725 of services has been provided to customers who paid in advance on January 17 Unpaid salaries at the end of January are $5,310. 2. Record the adjusting entries on January 31 for the above transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Answer is complete and correct. No General Journal Credit Date January 31 Debit 675 Rent Expense Prepaid Rent 675 January 31 4,500 Supplies Expense Supplies 4,500 January 31 Deferred Revenue 3,725 Service Revenue 3,725 January 31 5,310 Salaries Expense Salaries Payable 5,310 Required information On January 1, Year 1, the general ledger of a company includes the following account balances: Credit Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $24,500 5,900 3,800 57,000 $ 3,900 72,000 15,300 $91,200 $91,200 During Year 1, the following transactions occur: January 2 Purchase rental space for one year in advance, $8,100 ($675/month). January 9 Purchase additional supplies on account, $4,200. January 13 Provide services to customers on account, $26,200. January 17 Receive cash in advance from customers for services to be provided in the future, $4,400. January 20 Pay cash for salaries, $12,200. January 22 Receive cash on accounts receivable, $24,800. January 29 Pay cash on accounts payable, $4,700. 3. Prepare an adjusted trial balance as of January 31, Year 1. Adjusted Trial Balance January 31, Year 1 Debit Credit Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Rent Expense Supplies Expense Prepaid Rent Salaries Expense Service Revenue Deferred Revenue Salaries Payable Totals | $ 0 $ Prey 8 of 8