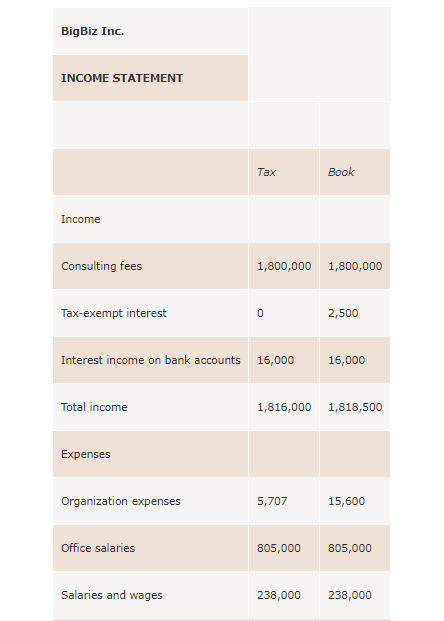

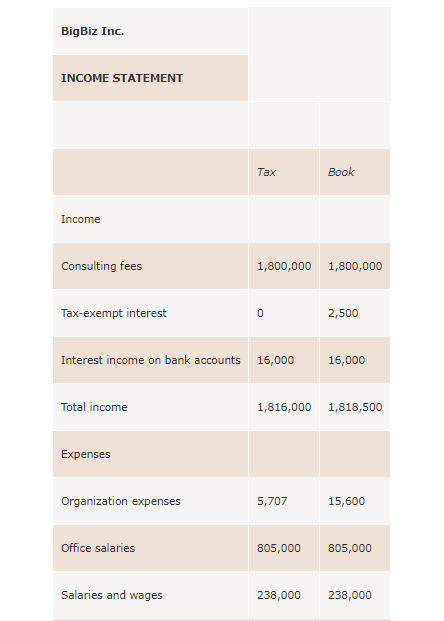

The income statement for the first year of operations of BigBiz, Inc. is shown below.

Note: There were no shareholder distributions during the year.

Note: The deduction for organizational expenses in the year was $5,707.

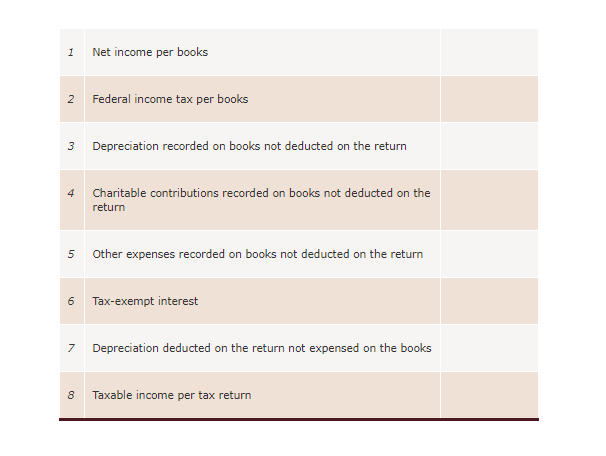

Saber, Inc. is a calendar year, accrual-basis C corporation.

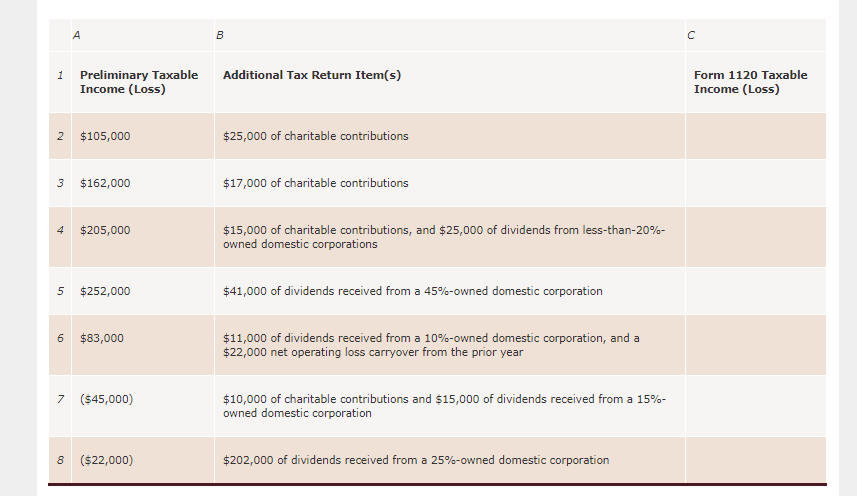

- For each independent situation below, calculate the corporation's taxable income (loss) for its Form 1120, U.S. Corporation Income Tax Return.

- Column A lists preliminary taxable income excluding additional tax return items shown in Column B. Enter the taxable income (loss) in the associated cells in column C on your Excel spreadsheet.

- If applicable, show your calculations in the cell next to column C

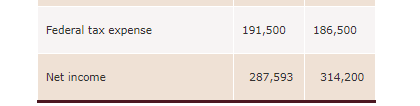

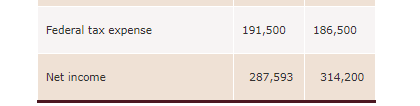

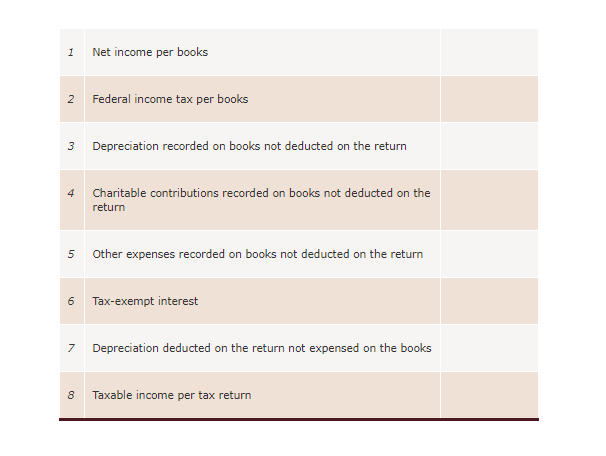

BigBiz Inc. INCOME STATEMENT Tax Book Income Consulting fees 1,800,000 1,800,000 Tax-exempt interest 0 2,500 Interest income on bank accounts 16,000 16,000 Total income 1,816,000 1,818,500 Expenses Organization expenses 5,707 15,600 Office salaries 805,000 805,000 Salaries and wages 238,000 238,000 Rent 76,000 76,000 Utilities 12,200 12,200 Advertising 28,000 28,000 Repairs 3,000 3,000 Taxes 12,000 12,000 Employee benefits 3,000 3,000 Interest 8,000 8,000 Office supplies 9,000 9,000 Depreciation 75,000 30,000 Total expenses 1,274,907 1,239,800 Net income before contributions 541,093 578,700 Charitable contributions 62,000 78,000 Pre-tax income 479,093 500,700 Federal tax expense 191,500 186,500 Net income 287,593 314,200 1 Net income per books 2 Federal income tax per books 3 Depreciation recorded on books not deducted on the return 4 Charitable contributions recorded on books not deducted on the return 5 Other expenses recorded on books not deducted on the return 6 Tax-exempt interest 7 Depreciation deducted on the return not expensed on the books 8 Taxable income per tax return B Additional Tax Return Item(s) 1 Preliminary Taxable Income (Loss) Form 1120 Taxable Income (Loss) 2 $105,000 $25,000 of charitable contributions 3 $162,000 $17,000 of charitable contributions 4 $205,000 $15,000 of charitable contributions, and $25,000 of dividends from less-than-20%- owned domestic corporations 5 $252,000 $41,000 of dividends received from a 45%-owned domestic corporation 6 $83,000 $11,000 of dividends received from a 10%-owned domestic corporation, and a $22,000 net operating loss carryover from the prior year 7 ($45,000) $10,000 of charitable contributions and $15,000 of dividends received from a 15%- owned domestic corporation 8 ($22,000) $202,000 of dividends received from a 25%-owned domestic corporation BigBiz Inc. INCOME STATEMENT Tax Book Income Consulting fees 1,800,000 1,800,000 Tax-exempt interest 0 2,500 Interest income on bank accounts 16,000 16,000 Total income 1,816,000 1,818,500 Expenses Organization expenses 5,707 15,600 Office salaries 805,000 805,000 Salaries and wages 238,000 238,000 Rent 76,000 76,000 Utilities 12,200 12,200 Advertising 28,000 28,000 Repairs 3,000 3,000 Taxes 12,000 12,000 Employee benefits 3,000 3,000 Interest 8,000 8,000 Office supplies 9,000 9,000 Depreciation 75,000 30,000 Total expenses 1,274,907 1,239,800 Net income before contributions 541,093 578,700 Charitable contributions 62,000 78,000 Pre-tax income 479,093 500,700 Federal tax expense 191,500 186,500 Net income 287,593 314,200 1 Net income per books 2 Federal income tax per books 3 Depreciation recorded on books not deducted on the return 4 Charitable contributions recorded on books not deducted on the return 5 Other expenses recorded on books not deducted on the return 6 Tax-exempt interest 7 Depreciation deducted on the return not expensed on the books 8 Taxable income per tax return B Additional Tax Return Item(s) 1 Preliminary Taxable Income (Loss) Form 1120 Taxable Income (Loss) 2 $105,000 $25,000 of charitable contributions 3 $162,000 $17,000 of charitable contributions 4 $205,000 $15,000 of charitable contributions, and $25,000 of dividends from less-than-20%- owned domestic corporations 5 $252,000 $41,000 of dividends received from a 45%-owned domestic corporation 6 $83,000 $11,000 of dividends received from a 10%-owned domestic corporation, and a $22,000 net operating loss carryover from the prior year 7 ($45,000) $10,000 of charitable contributions and $15,000 of dividends received from a 15%- owned domestic corporation 8 ($22,000) $202,000 of dividends received from a 25%-owned domestic corporation