Answered step by step

Verified Expert Solution

Question

1 Approved Answer

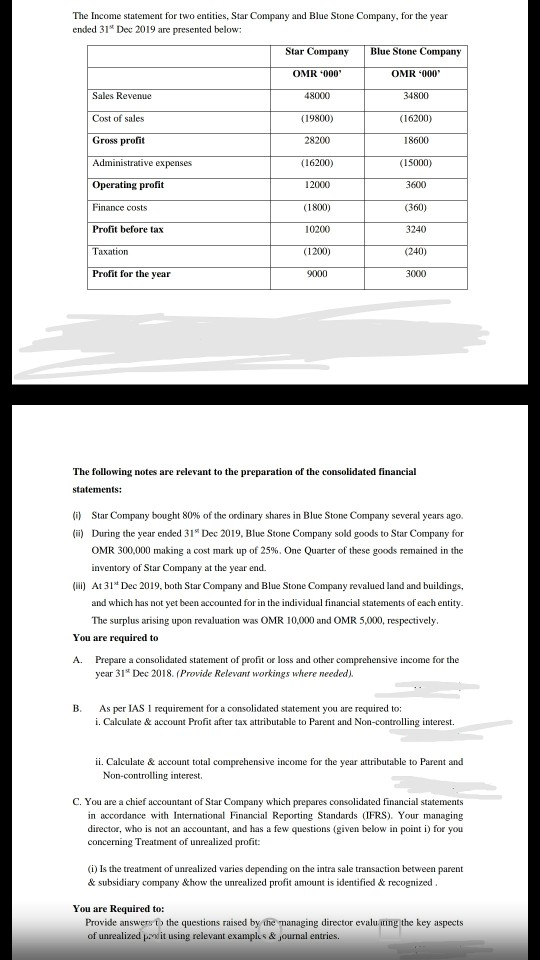

The Income statement for two entities, Star Company and Blue Stone Company, for the year ended 31 Dec 2019 are presented below: Star Company Blue

The Income statement for two entities, Star Company and Blue Stone Company, for the year ended 31 Dec 2019 are presented below: Star Company Blue Stone Company OMR .000 OMR '000 Sales Revenue 48000 34800 Cost of sales (19800) (16200) 28200 18600 Gross profit Administrative expenses Operating profit (16200) (15000) 12000 3600 Finance costs (1800) (360) Profit before tax 10200 3240 Taxation (1200) (240) Profit for the year 9000 3000 The following notes are relevant to the preparation of the consolidated financial statements: (1) Star Company bought 80% of the ordinary shares in Blue Stone Company several years ago. (ii) During the year ended 31" Dec 2019, Blue Stone Company sold goods to Star Company for OMR 300,000 making a cost mark up of 25%. One Quarter of these goods remained in the inventory of Star Company at the year end. (II) At 31 Dec 2019, both Star Company and Blue Stone Company revalued land and buildings, and which has not yet been accounted for in the individual financial statements of each entity. The surplus arising upon revaluation was OMR 10,000 and OMR 5,000, respectively. You are required to A. Prepare a consolidated statement of profit or loss and other comprehensive income for the year 31 Dec 2018. (Provide Relevant workings where needed). B As per IAS 1 requirement for a consolidated statement you are required to: i. Calculate & account Profit after tax attributable to Parent and Non-controlling interest. ii. Calculate & account total comprehensive income for the year attributable to Parent and Non-controlling interest C. You are a chief accountant of Star Company which prepares consolidated financial statements in accordance with International Financial Reporting Standards (IFRS). Your managing director, who is not an accountant, and has a few questions (given below in point i) for you concering Treatment of unrealized profit: 1) Is the treatment of unrealized varies depending on the intra sale transaction between parent & subsidiary company &how the unrealized profit amount is identified & recognized You are Required to: Provide answer the questions raised by the managing director evaluating the key aspects of unrealized powit using relevant examples & ournal entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started