Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The income statement is an important financial statement for all of the following reasons, except O the income statement provides useful information concerning the corporation's

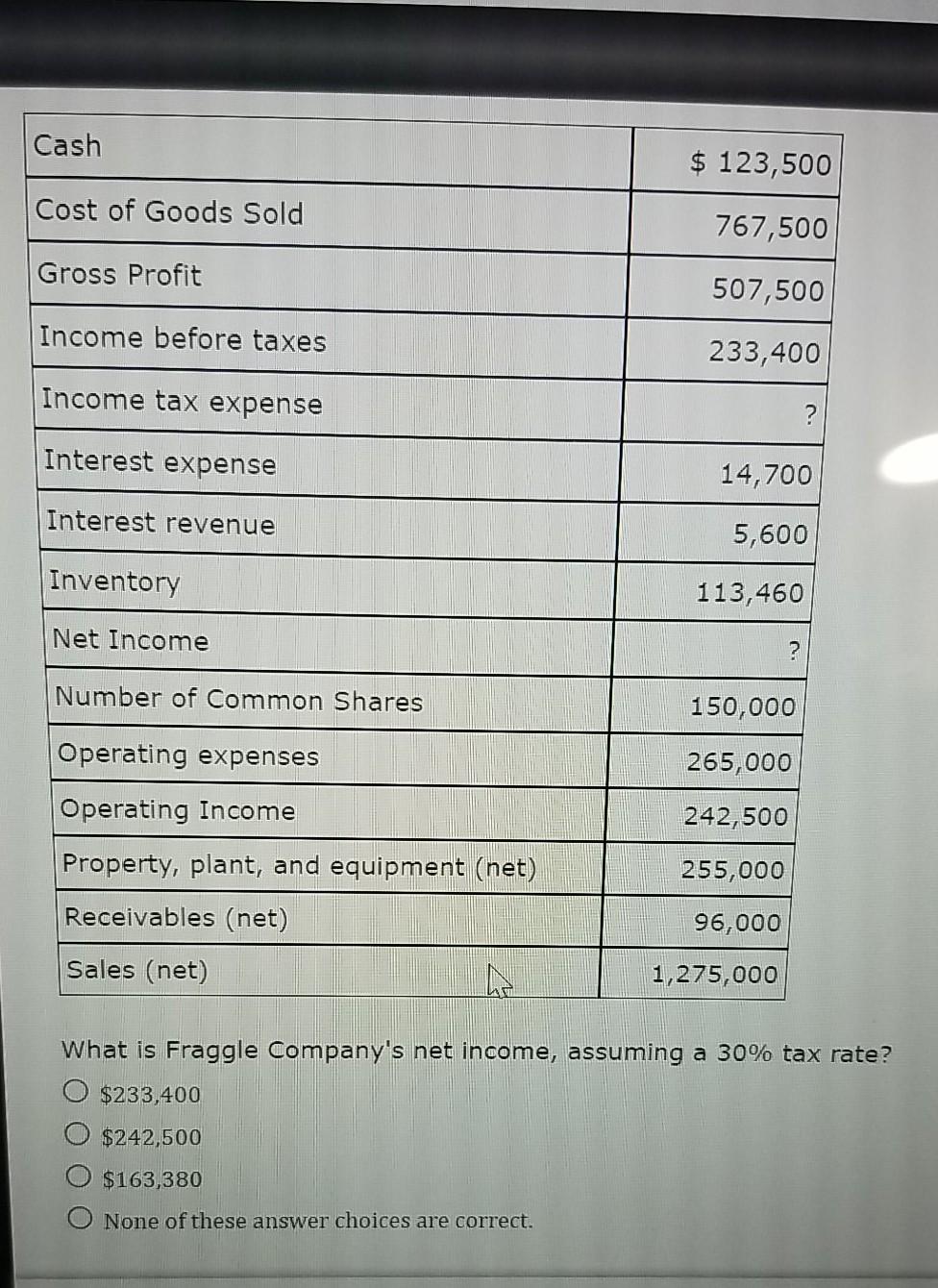

The income statement is an important financial statement for all of the following reasons, except O the income statement provides useful information concerning the corporation's ability to generate sufficient cash flows from operations for use in payment of its operating obligations. the income statement helps shareholders evaluate management's operating effectiveness. O the income statement reports the amount of net cash inflows resulting from operating, financing, and investing activities to users. past income statements can be useful indicators in predicting current and future cash dividend payments as well as future stock prices. In accrual accounting, net income is defined as O Revenues - Expenses Revenues - Expenses + Gains + Losses O increase in net assets from nonowner transactions Revenues - Expenses + Gains - Losses In general, revenue is recognized O upon completion of the production process. O when goods are sold or services are rendered. O during the production process. O when cash is received. Revenue is recognized when: O a seller collects cash from a customer. O a company bills the customer for the goods that have been delivered or the services performed O it has been earned and is realized or realizable. O a company has satisfied its performance obligation to the customer. Cash $ 123,500 Cost of Goods Sold 767,500 Gross Profit 507,500 Income before taxes 233,400 Income tax expense ? Interest expense 14,700 Interest revenue 5,600 Inventory 113,460 Net Income ? Number of Common Shares 150,000 Operating expenses 265,000 Operating Income 242,500 255,000 Property, plant, and equipment (net) Receivables (net) 96,000 Sales (net) IN 1,275,000 What is Fraggle Company's net income, assuming a 30% tax rate? O $233,400 $242,500 $163,380 O None of these answer choices are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started