Question

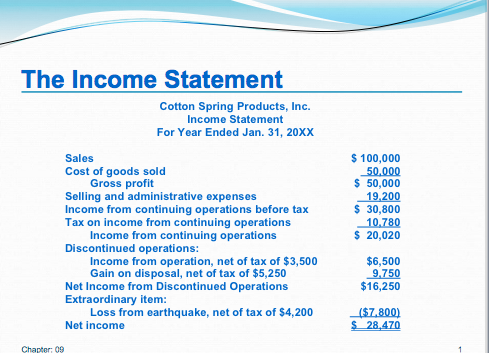

The Income Statement of Cotton Inc is in a file below: 1. In your words, explain each key income line in The Income Statement. 2.

The Income Statement of Cotton Inc is in a file below:

1. In your words, explain each key income line in The Income Statement.

2. Assuming no deferred taxes, and no tax effects in Other Comprehensive Income, what is the amount of Cotton's total tax expense for 20XX?

3. What is Cotton's effective (average) tax rate for 20XX?

4.. If you were forecasting Cotton's future income, what tax rate would you use and why?

5. If you were forecasting Cotton's future income, which income line would you use as a base and why?

I need to compare my answers to see if my thought-process is right before I submit this

The Income Statement Cotton Spring Products, Inc. Income Statement For Year Ended Jan. 31, 20XX $100,000 50,000 S 50,000 19,200 S 30,800 10,780 S 20,020 Sales Cost of goods sold Gross profit Selling and administrative expenses Income from continuing operations before tax Tax on income from continuing operations Income from continuing operations Discontinued operations: Income from operation, net of tax of $3,500 Gain on disposal, net of tax of $5,250 $6,500 9.750 $16,250 Net Income from Discontinued Operations Extraordinary item 7800) S 28,470 Loss from earthquake, net of tax of $4,200 Net income Chapter: 09Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started