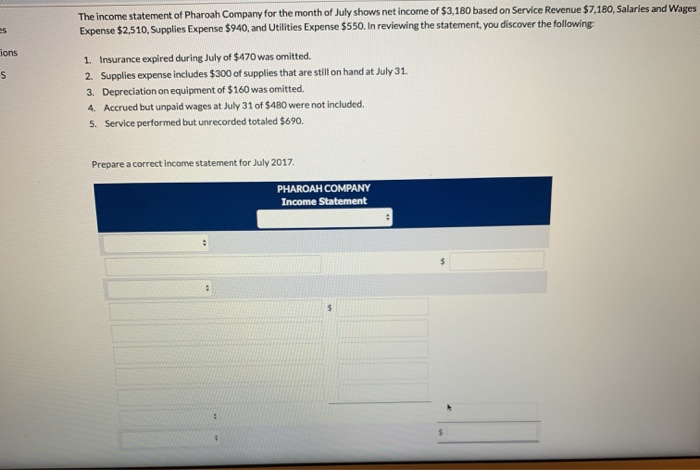

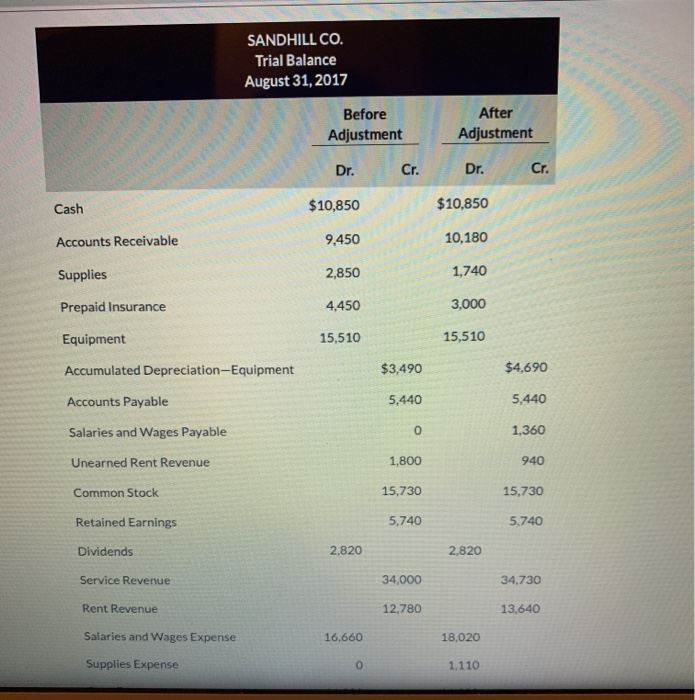

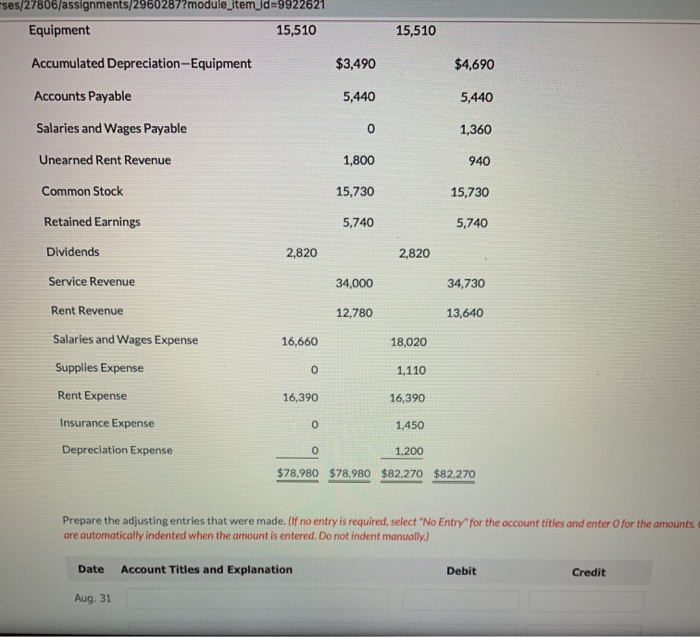

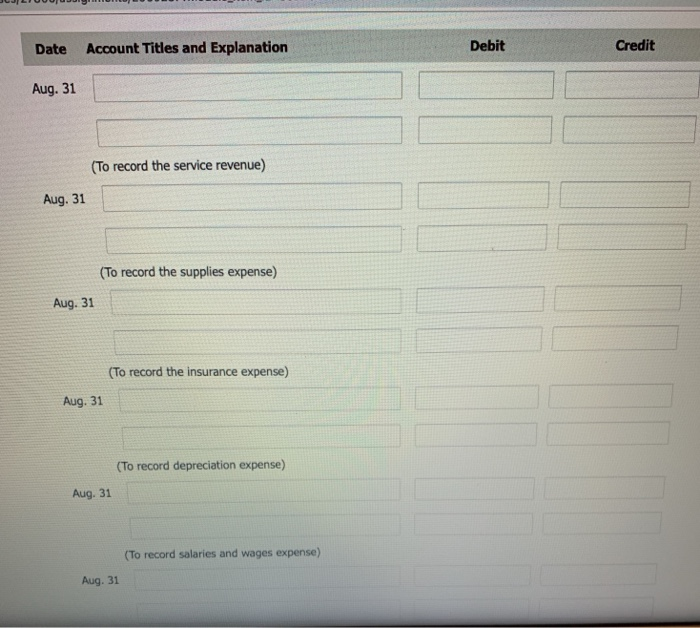

The income statement of Pharoah Company for the month of July shows net income of $3,180 based on Service Revenue $7,180, Salaries and Wages Expense $2,510, Supplies Expense $940, and Utilities Expense $550. In reviewing the statement, you discover the following: ions 1. Insurance expired during July of $470 was omitted. 2 Supplies expense includes $300 of supplies that are still on hand at July 31. 3. Depreciation on equipment of $160 was omitted. 4. Accrued but unpaid wages at July 31 of $480 were not included. 5. Service performed but unrecorded totaled $690. Prepare a correct income statement for July 2017 PHAROAH COMPANY Income Statement SANDHILL CO. Trial Balance August 31, 2017 Before Adjustment After Adjustment Dr. Cr. Dr. Cr. Cash $10,850 $10,850 sh Accounts Receivable 9,450 10,180 Supplies 2,850 1,740 Prepaid Insurance 4,450 3,000 Equipment 15,510 15,510 Accumulated Depreciation-Equipment $3,490 $4,690 Accounts Payable 5,440 5,440 Salaries and Wages Payable 1,360 Unearned Rent Revenue 1,800 940 Common Stock 15,730 15,730 Retained Earnings 5,740 5.740 Dividends 2,820 2,820 Service Revenue 34,000 34,730 Rent Revenue 12.780 13,640 Salaries and Wages Expense 16,660 18,020 Supplies Expense 1.110 "ses/27806/assignments/2960287?module_item_d=9922621 Equipment 15,510 15,510 Accumulated Depreciation-Equipment $3,490 $4,690 Accounts Payable 5,440 5,440 Salaries and Wages Payable 1,360 Unearned Rent Revenue 1,800 940 Common Stock 15,730 15,730 5,740 Retained Earnings 5,740 Dividends 2,820 2,820 Service Revenue 34,000 34,730 Rent Revenue 12,780 13,640 Salaries and Wages Expense 16,660 18,020 Supplies Expense 1,110 Rent Expense 16,390 16,390 Insurance Expense 1,450 Depreciation Expense 1,200 $78,980 $78,980 $82,270 $82.270 Prepare the adjusting entries that were made. (If no entry is required, select "No Entry for the account titles and enter are automatically indented when the amount is entered. Do not indent manually) for the amounts Date Account Titles and Explanation Debit Credit Aug. 31 Date Account Titles and Explanation Debit Credit Aug. 31 (To record the service revenue) Aug. 31 (To record the supplies expense) Aug. 31 (To record the insurance expense) Aug. 31 (To record depreciation expense) Aug. 31 (To record salaries and wages expense) Aug. 31