Answered step by step

Verified Expert Solution

Question

1 Approved Answer

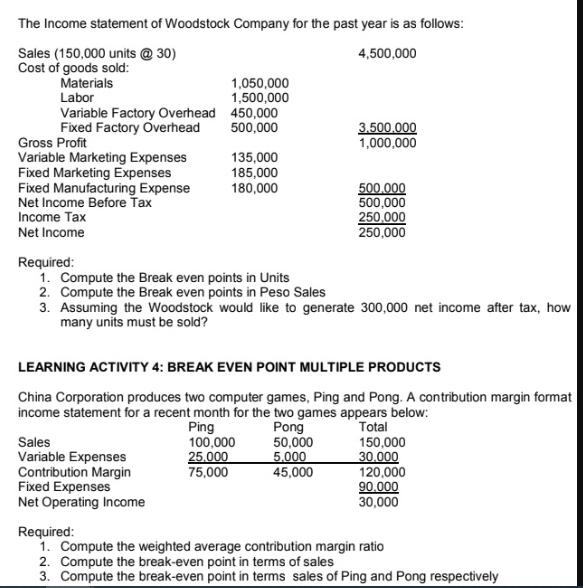

The Income statement of Woodstock Company for the past year is as follows: Sales (150,000 units @30) Cost of goods sold: 4,500,000 Materials Labor

The Income statement of Woodstock Company for the past year is as follows: Sales (150,000 units @30) Cost of goods sold: 4,500,000 Materials Labor 1,050,000 1,500,000 Variable Factory Overhead 450,000 Fixed Factory Overhead 500,000 3.500.000 Gross Profit 1,000,000 Variable Marketing Expenses 135,000 Fixed Marketing Expenses 185,000 Fixed Manufacturing Expense 180,000 500.000 Net Income Before Tax 500,000 Income Tax 250,000 Net Income 250,000 Required: 1. Compute the Break even points in Units 2. Compute the Break even points in Peso Sales 3. Assuming the Woodstock would like to generate 300,000 net income after tax, how many units must be sold? LEARNING ACTIVITY 4: BREAK EVEN POINT MULTIPLE PRODUCTS China Corporation produces two computer games, Ping and Pong. A contribution margin format income statement for a recent month for the two games appears below: Sales Ping 100,000 Variable Expenses 25,000 Contribution Margin 75,000 Fixed Expenses Net Operating Income Required: Pong Total 50,000 150,000 5,000 30.000 45,000 120,000 90.000 30,000 1. Compute the weighted average contribution margin ratio 2. Compute the break-even point in terms of sales 3. Compute the break-even point in terms sales of Ping and Pong respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

BreakEven Analysis for Woodstock Company 1 BreakEven Point in Units Calculation Breakeven point units Fixed Costs Contribution Margin per unit Contrib...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started