Answered step by step

Verified Expert Solution

Question

1 Approved Answer

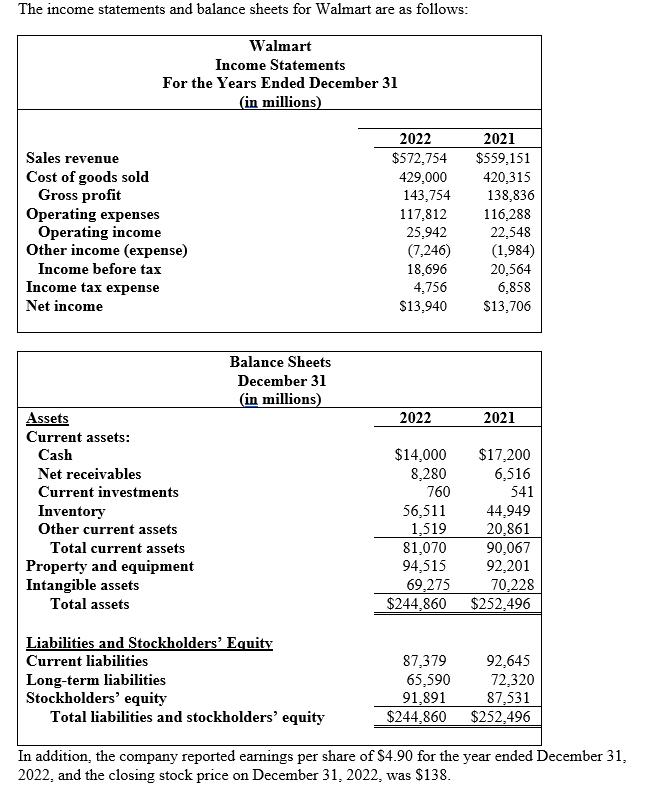

The income statements and balance sheets for Walmart are as follows: Walmart Income Statements For the Years Ended December 31 (in millions) Sales revenue

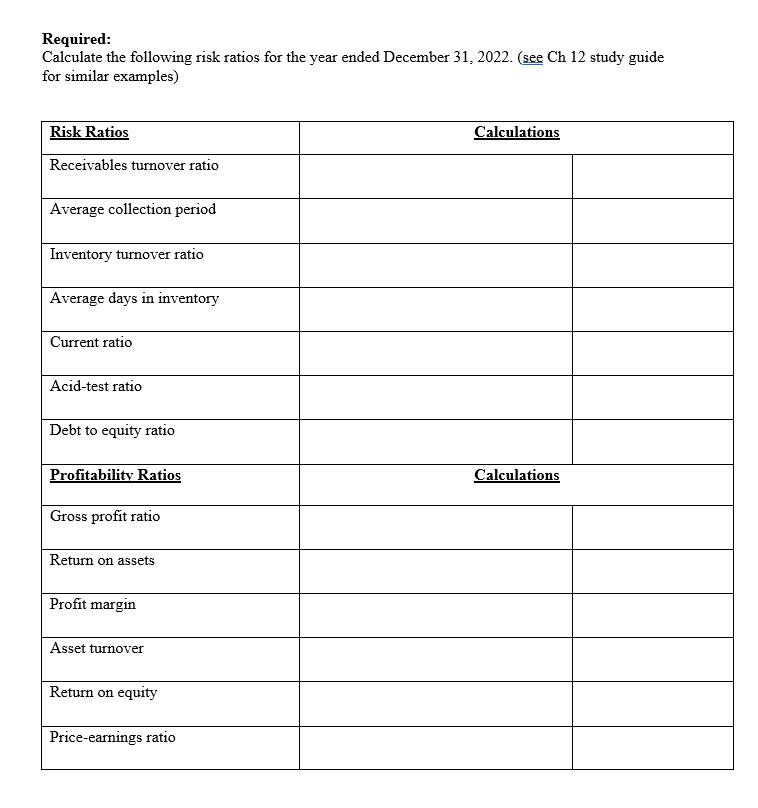

The income statements and balance sheets for Walmart are as follows: Walmart Income Statements For the Years Ended December 31 (in millions) Sales revenue Cost of goods sold Gross profit Operating expenses Operating income Other income (expense) Income before tax Income tax expense Net income Assets Current assets: Cash Net receivables Current investments Inventory Other current assets Total current assets Property and equipment Intangible assets Total assets Balance Sheets December 31 (in millions) Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Stockholders' equity Total liabilities and stockholders' equity 2022 $572,754 429,000 143,754 117,812 25,942 (7,246) 18,696 4,756 $13,940 2022 $14,000 8,280 760 56,511 1,519 81,070 94,515 69,275 $244,860 87,379 65,590 91,891 $244,860 2021 $559,151 420,315 138,836 116,288 22,548 (1,984) 20,564 6,858 $13,706 2021 $17,200 6,516 541 44,949 20,861 90,067 92,201 70,228 $252,496 92,645 72,320 87,531 $252,496 In addition, the company reported earnings per share of $4.90 for the year ended December 31, 2022, and the closing stock price on December 31, 2022, was $138. Required: Calculate the following risk ratios for the year ended December 31, 2022. (see Ch 12 study guide for similar examples) Risk Ratios Receivables turnover ratio Average collection period Inventory turnover ratio Average days in inventory Current ratio Acid-test ratio Debt to equity ratio Profitability Ratios Gross profit ratio Return on assets Profit margin Asset turnover Return on equity Price-earnings ratio Calculations Calculations

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Receivable turnover ratio Average receivable Opening receivable Closing receivable 2 8280 6 516 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started