Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Income Tax Act, 196/ provides that where a person (referred herein as payer ) is liable to make payment as listed below (other than

The Income Tax Act, 196/ provides that where a person (referred herein as payer ) is liable to make payment as listed below (other than income of non-resident public entertainers) to a non-resident person ( NR payee), he shall deduct withholding tax at the prescribed rate from such payment and (whether such tax has been deducted or not) pay that tax to the Director General of Inland Revenue within one month after such payment has been paid or credited to the NR payee.

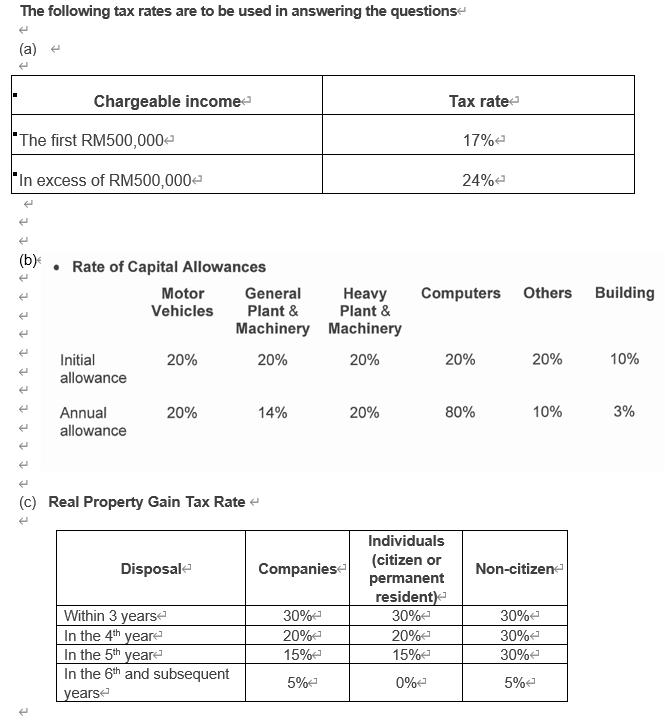

The following tax rates are to be used in answering the questions (a) 4 *The first RM500,000 "In excess of RM500,000 < (b) Rate of Capital Allowances E tt t Chargeable income ( t@tttt Initial allowance Annual allowance Motor Vehicles 20% 20% Disposal General Plant & Machinery 20% (c) Real Property Gain Tax Rate < Within 3 years In the 4th year In the 5th year In the 6th and subsequent years 14% Heavy Plant & Machinery 20% Companies 30% 20% 15% 5% 20% Tax rate 17% 24% Computers Others Individuals (citizen or permanent resident) 30% 20% 15% 0% < 20% 80% 20% 30% 30% 30% 5% 10% Non-citizen Building 10% 3%

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Payers Responsibilities in Withholding Tax a Two Responsibilities of the Payer Deduct Withholding Ta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started