Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the incorrect ones are c1 and c2 please help answer those 2 4 Consider the following abbreviated financial statements for Weston Enterprises Assets nts WESTON

the incorrect ones are c1 and c2

please help answer those 2

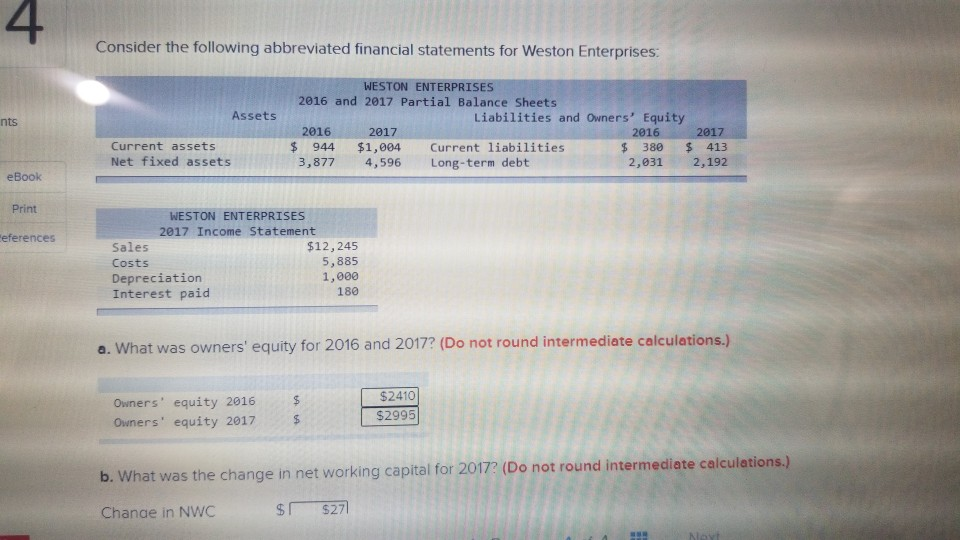

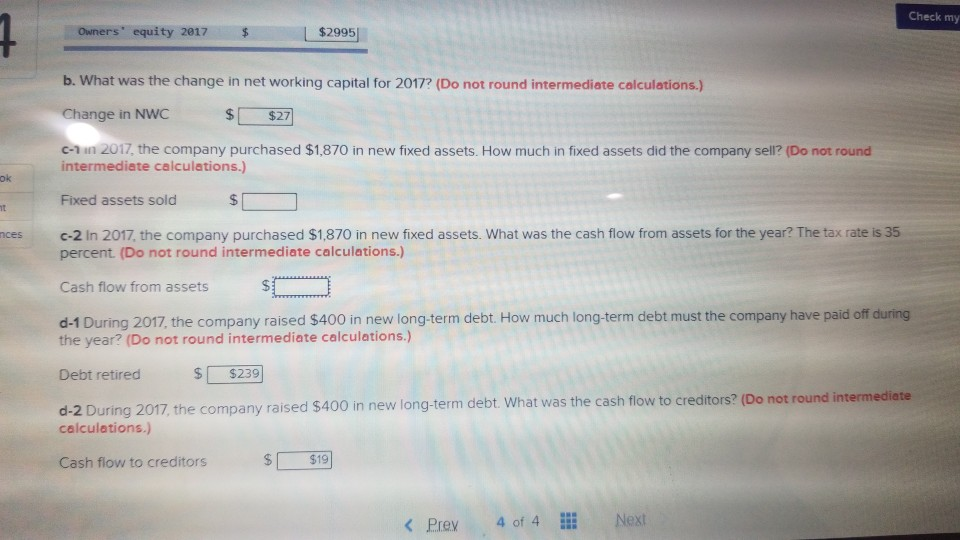

4 Consider the following abbreviated financial statements for Weston Enterprises Assets nts WESTON ENTERPRISES 2016 and 2017 Partial Balance Sheets Liabilities and Owners' Equity 2016 2017 2016 2017 $ 944 $1,004 Current liabilities $ 380 $ 413 3,877 4,596 Long-term debt 2,031 2,192 Current assets Net fixed assets eBook Print eferences WESTON ENTERPRISES 2017 Income Statement Sales $12,245 Costs 5,885 Depreciation 1,000 Interest paid 180 a. What was owners' equity for 2016 and 2017? (Do not round intermediate calculations.) $ Owners' equity 2016 Owners' equity 2017 $2410 $2995 $ b. What was the change in net working capital for 2017? (Do not round intermediate calculations.) Change in NWC $ $277 Nov Check my Owners' equity 2017 $2995 b. What was the change in net working capital for 2017? (Do not round intermediate calculations.) Change in NWC $ $27 C-nin 2017, the company purchased $1,870 in new fixed assets. How much in fixed assets did the company sell? (Do not round intermediate calculations.) ok Fixed assets sold $ ht nces c-2 in 2017, the company purchased $1,870 in new fixed assets. What was the cash flow from assets for the year? The tax rate is 35 percent. (Do not round intermediate calculations.) Cash flow from assets $ d-1 During 2017, the company raised $400 in new long-term debt. How much long-term debt must the company have paid off during the year? (Do not round intermediate calculations.) Debt retired $ $239 d-2 During 2017, the company raised $400 in new long-term debt. What was the cash flow to creditors? (Do not round intermediate calculations.) Cash flow to creditors $ $19 NEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started