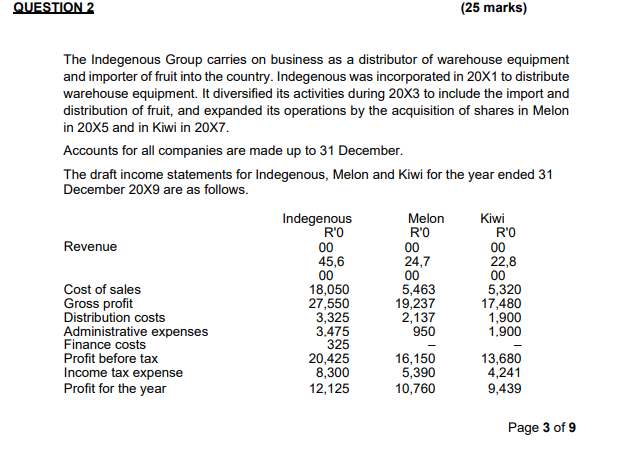

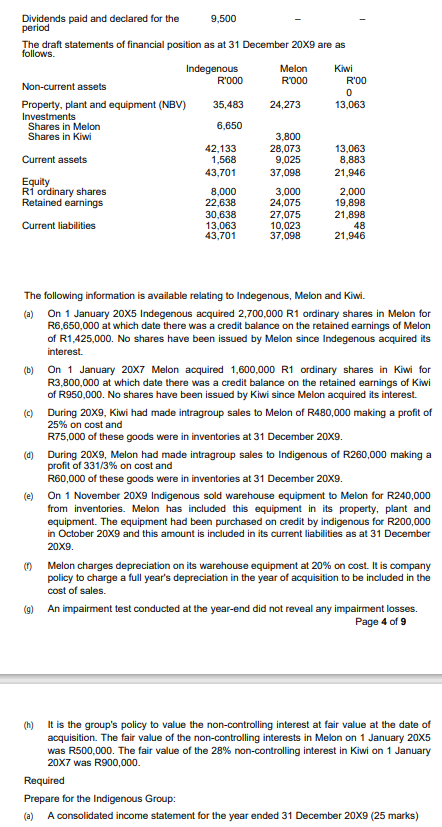

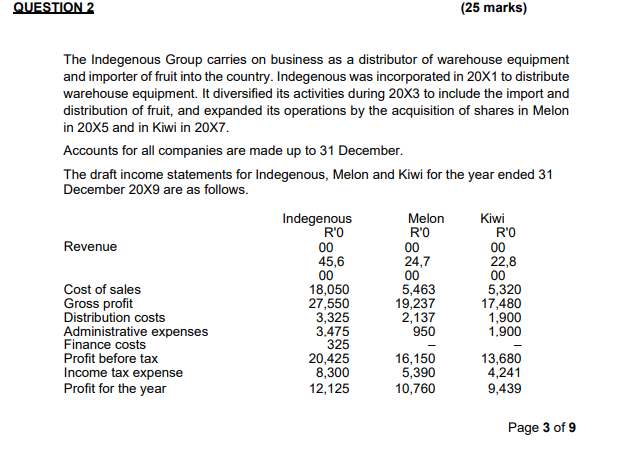

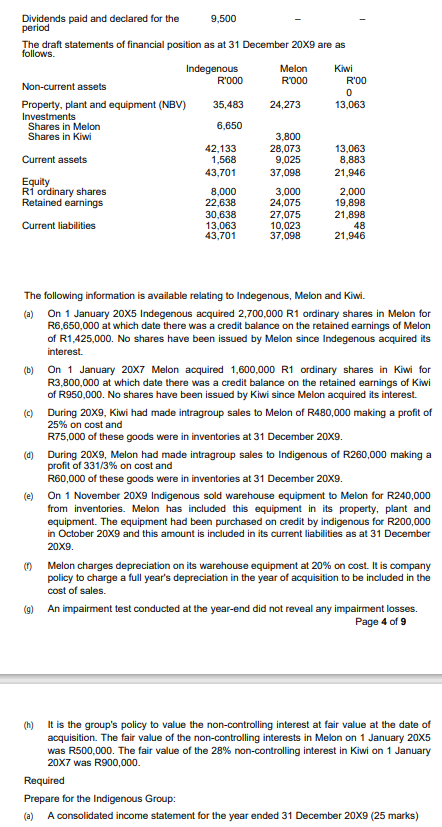

The Indegenous Group carries on business as a distributor of warehouse equipment and importer of fruit into the country. Indegenous was incorporated in 20X1 to distribute warehouse equipment. It diversified its activities during 203 to include the import and distribution of fruit, and expanded its operations by the acquisition of shares in Melon in 205 and in Kiwi in 207. Accounts for all companies are made up to 31 December. The draft income statements for Indegenous, Melon and Kiwi for the year ended 31 December 209 are as follows. Page 3 of 9 Dividends paid and declared for the 9,500 period The draft statements of financial position as at 31 December 209 are as The draft follows. The following information is available relating to Indegenous, Melon and Kiwi. (a) On 1 January 205 Indegenous acquired 2,700,000 R1 ordinary shares in Melon for R6,650,000 at which date there was a credit balance on the retained earnings of Melon of R1,425,000. No shares have been issued by Melon since Indegenous acquired its interest. (b) On 1 January 207 Melon acquired 1,600,000 R1 ordinary shares in Kiwi for R3,800,000 at which date there was a credit balance on the retained earnings of Kiwi of R950,000. No shares have been issued by Kiwi since Melon acquired its interest. (c) During 20X9, Kiwi had made intragroup sales to Melon of R480,000 making a profit of 25% on cost and R75,000 of these goods were in inventories at 31 December 209. (d) During 20X9, Melon had made intragroup sales to Indigenous of R260,000 making a profit of 331/3% on cost and R60,000 of these goods were in inventories at 31 December 209. (e) On 1 November 209 Indigenous sold warehouse equipment to Melon for R240,000 from inventories. Melon has included this equipment in its property, plant and equipment. The equipment had been purchased on credit by indigenous for R200,000 in October 209 and this amount is included in its current liabilities as at 31 December 209. (f) Melon charges depreciation on its warehouse equipment at 20% on cost. It is company policy to charge a full year's depreciation in the year of acquisition to be included in the cost of sales. (g) An impairment test conducted at the year-end did not reveal any impairment losses. Page 4 of 9 (h) It is the group's policy to value the non-controlling interest at fair value at the date of acquisition. The fair value of the non-controlling interests in Melon on 1 January 205 was R500,000. The fair value of the 28% non-controlling interest in Kiwi on 1 January 207 was R900,000. Required Prepare for the Indigenous Group: (a) A consolidated income statement for the year ended 31 December 209 ( 25 marks) The Indegenous Group carries on business as a distributor of warehouse equipment and importer of fruit into the country. Indegenous was incorporated in 20X1 to distribute warehouse equipment. It diversified its activities during 203 to include the import and distribution of fruit, and expanded its operations by the acquisition of shares in Melon in 205 and in Kiwi in 207. Accounts for all companies are made up to 31 December. The draft income statements for Indegenous, Melon and Kiwi for the year ended 31 December 209 are as follows. Page 3 of 9 Dividends paid and declared for the 9,500 period The draft statements of financial position as at 31 December 209 are as The draft follows. The following information is available relating to Indegenous, Melon and Kiwi. (a) On 1 January 205 Indegenous acquired 2,700,000 R1 ordinary shares in Melon for R6,650,000 at which date there was a credit balance on the retained earnings of Melon of R1,425,000. No shares have been issued by Melon since Indegenous acquired its interest. (b) On 1 January 207 Melon acquired 1,600,000 R1 ordinary shares in Kiwi for R3,800,000 at which date there was a credit balance on the retained earnings of Kiwi of R950,000. No shares have been issued by Kiwi since Melon acquired its interest. (c) During 20X9, Kiwi had made intragroup sales to Melon of R480,000 making a profit of 25% on cost and R75,000 of these goods were in inventories at 31 December 209. (d) During 20X9, Melon had made intragroup sales to Indigenous of R260,000 making a profit of 331/3% on cost and R60,000 of these goods were in inventories at 31 December 209. (e) On 1 November 209 Indigenous sold warehouse equipment to Melon for R240,000 from inventories. Melon has included this equipment in its property, plant and equipment. The equipment had been purchased on credit by indigenous for R200,000 in October 209 and this amount is included in its current liabilities as at 31 December 209. (f) Melon charges depreciation on its warehouse equipment at 20% on cost. It is company policy to charge a full year's depreciation in the year of acquisition to be included in the cost of sales. (g) An impairment test conducted at the year-end did not reveal any impairment losses. Page 4 of 9 (h) It is the group's policy to value the non-controlling interest at fair value at the date of acquisition. The fair value of the non-controlling interests in Melon on 1 January 205 was R500,000. The fair value of the 28% non-controlling interest in Kiwi on 1 January 207 was R900,000. Required Prepare for the Indigenous Group: (a) A consolidated income statement for the year ended 31 December 209 ( 25 marks)