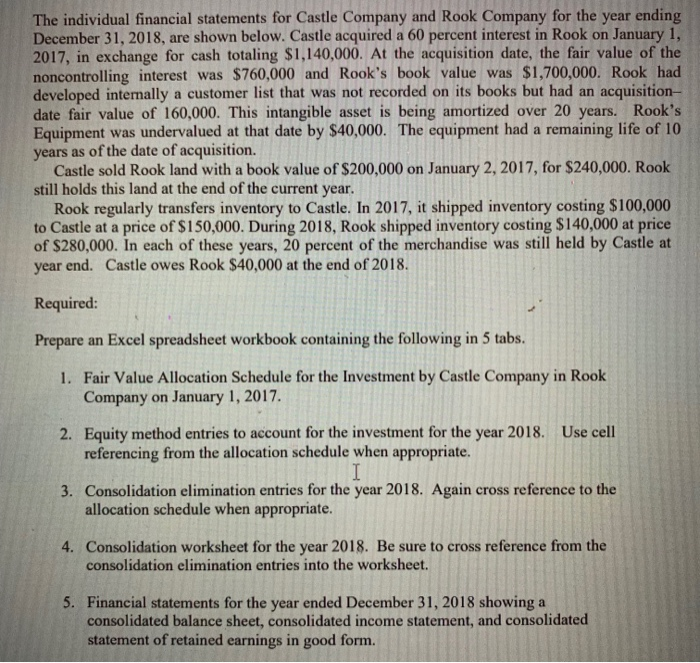

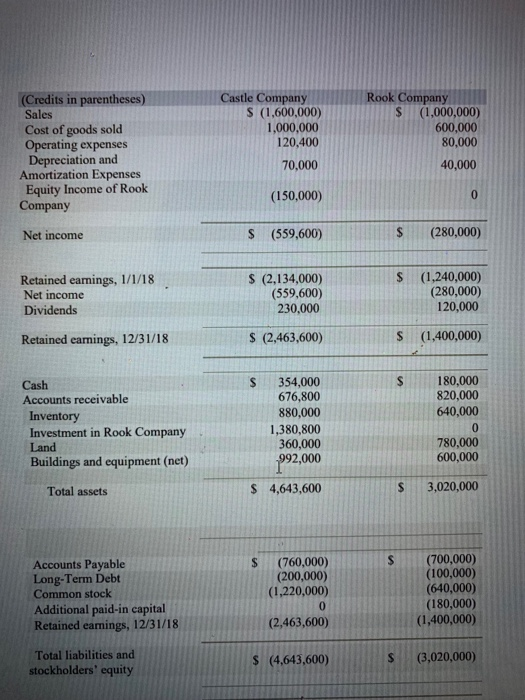

The individual financial statements for Castle Company and Rook Company for the year ending December 31, 2018, are shown below. Castle acquired a 60 percent interest in Rook on January 1, 2017, in exchange for cash totaling $1,140,000. At the acquisition date, the fair value of the noncontrolling interest was $760,000 and Rook's book value was $1,700,000. Rook had developed intenally a customer list that was not recorded on its books but had an acquisition- date fair value of 160,000. This intangible asset is being amortized over 20 years. Rook's Equipment was undervalued at that date by $40,000. The equipment had a remaining life of 10 years as of the date of acquisition. Castle sold Rook land with a book value of $200,000 on January 2, 2017, for $240,000. Rook still holds this land at the end of the current year Rook regularly transfers inventory to Castle. In 2017, it shipped inventory costing $100,000 to Castle at a price of $150,000. During 2018, Rook shipped inventory costing $140,000 at price of $280,000. In each of these years, 20 percent of the merchandise was still held by Castle at Required: Prepare an Excel spreadsheet workbook containing the following in 5 tabs. Fair Value Allocation Schedule for the Investment by Castle Company in Rook Company on January 1, 2017 1. Equity method entries to account for the investment for the year 2018. referencing from the allocation schedule when appropriate. Use cell 2. Consolidation elimination entries for the year 2018. Again cross reference to the allocation schedule when appropriate. 3. Consolidation worksheet for the year 2018. Be sure to cross reference from the consolidation elimination entries into the worksheet. 4. 5. Financial statements for the year ended December 31, 2018 showing a consolidated balance sheet, consolidated income statement, and consolidated statement of retained earnings in good form. Rook CompanyI (Credits in parentheses) Sales Cost of goods sold Operating expenses Depreciation and Amortization Expenses Equity Income of Rook Company Castle Company S (1,000,000) 600,000 80,000 S (1,600,000) 1,000,000 120,400 70,000 40,000 (150.000) (280,000) S (559,600) Net income S (1,240,000) (280,000) 120,000 S (2,134,000) (559,600) 230,000 Retained earnings, 1/1/18 Net income Dividends S (1,400,000) S (2,463,600) Retained earnings, 12/31/18 S180,000 820,000 640,000 S 354,000 676,800 880,000 1,380,800 360,000 92,000 Cash receivable Inventory Investment in Rook Company Land Buildings and equipment (net) 780,000 600,000 S 3,020,000 S 4,643,600 Total assets S(700,000) (100,000) (640,000) (180,000) (1,400,000) S (760,000) (200,000) Accounts Payable Long-Term Debt Common stock Additional paid-in capital Retained eamings, 12/31/18 (1,220,000) 0 (2,463,600) Total liabilities and stockholders' equity S (3,020,000) S (4,643,600)