Answered step by step

Verified Expert Solution

Question

1 Approved Answer

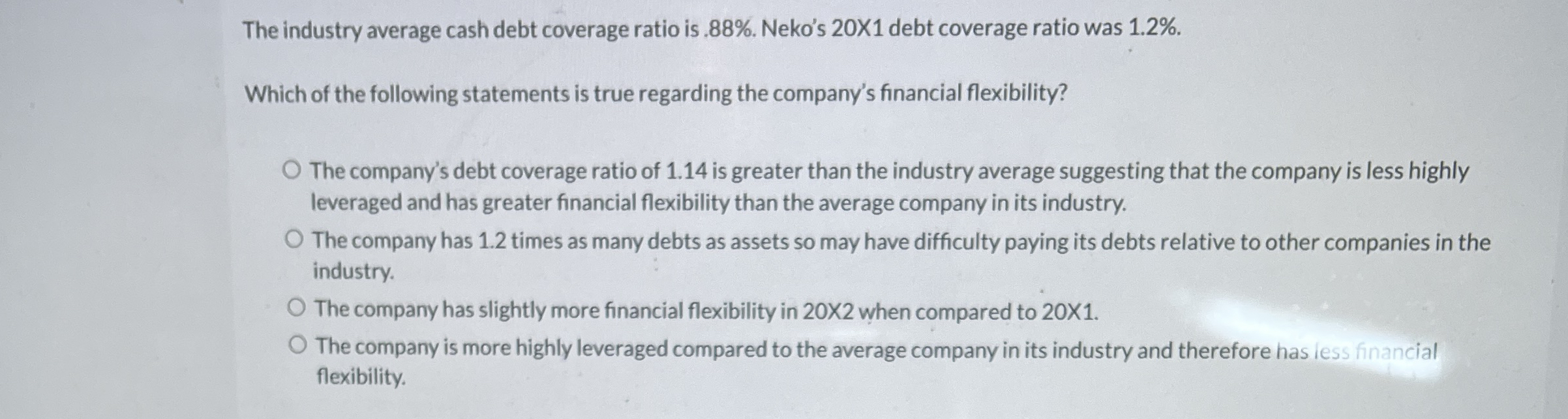

The industry average cash debt coverage ratio is . 8 8 % . Neko's 2 0 X 1 debt coverage ratio was 1 . 2

The industry average cash debt coverage ratio is Neko's X debt coverage ratio was

Which of the following statements is true regarding the company's financial flexibility?

The company's debt coverage ratio of is greater than the industry average suggesting that the company is less highly

leveraged and has greater financial flexibility than the average company in its industry.

The company has times as many debts as assets so may have difficulty paying its debts relative to other companies in the

industry.

The company has slightly more financial flexibility in X when compared to X

The company is more highly leveraged compared to the average company in its industry and therefore has less financial

flexibility.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started