Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the info was given like that. please focus on 70-74 Scuderia Ltd follows a strict residual dividend policy. The debt/equity ratio is 0.85 and it

the info was given like that. please focus on 70-74

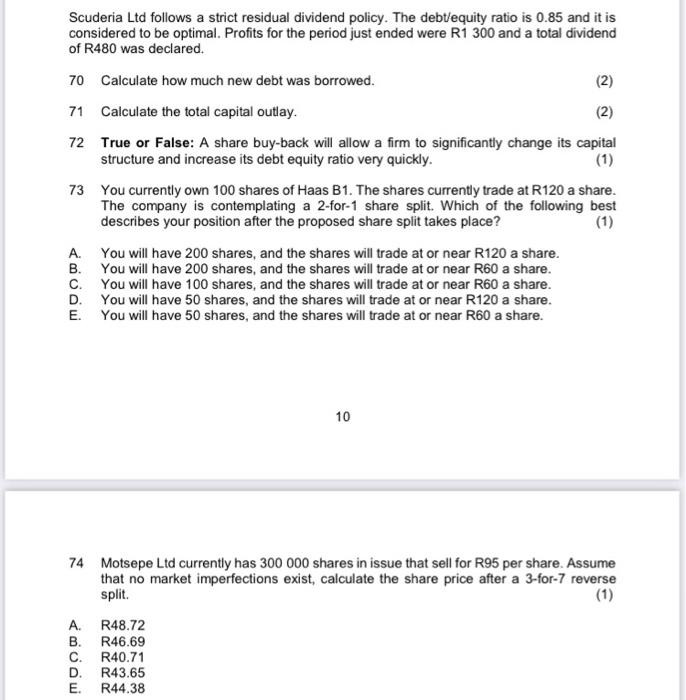

Scuderia Ltd follows a strict residual dividend policy. The debt/equity ratio is 0.85 and it is considered to be optimal. Profits for the period just ended were R1 300 and a total dividend of R480 was declared. 70 Calculate how much new debt was borrowed. (2) 71 Calculate the total capital outlay. (2) 72 True or False: A share buy-back will allow a firm to significantly change its capital structure and increase its debt equity ratio very quickly. (1) 73 You currently own 100 shares of Haas B1. The shares currently trade at R120 a share. The company is contemplating a 2-for-1 share split. Which of the following best describes your position after the proposed share split takes place? (1) A. B. C. You will have 200 shares, and the shares will trade at or near R120 a share. You will have 200 shares, and the shares will trade at or near R60 a share. You will have 100 shares, and the shares will trade at or near R60 a share. You will have 50 shares, and the shares will trade at or near R120 a share. You will have 50 shares, and the shares will trade at or near R60 a share. D. E. 10 74 Motsepe Ltd currently has 300 000 shares in issue that sell for R95 per share. Assume that no market imperfections exist, calculate the share price after a 3-for-7 reverse split. (1) A. R48.72 B. R46.69 C. R40.71 D. R43.65 E. R44.38 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started