Answered step by step

Verified Expert Solution

Question

1 Approved Answer

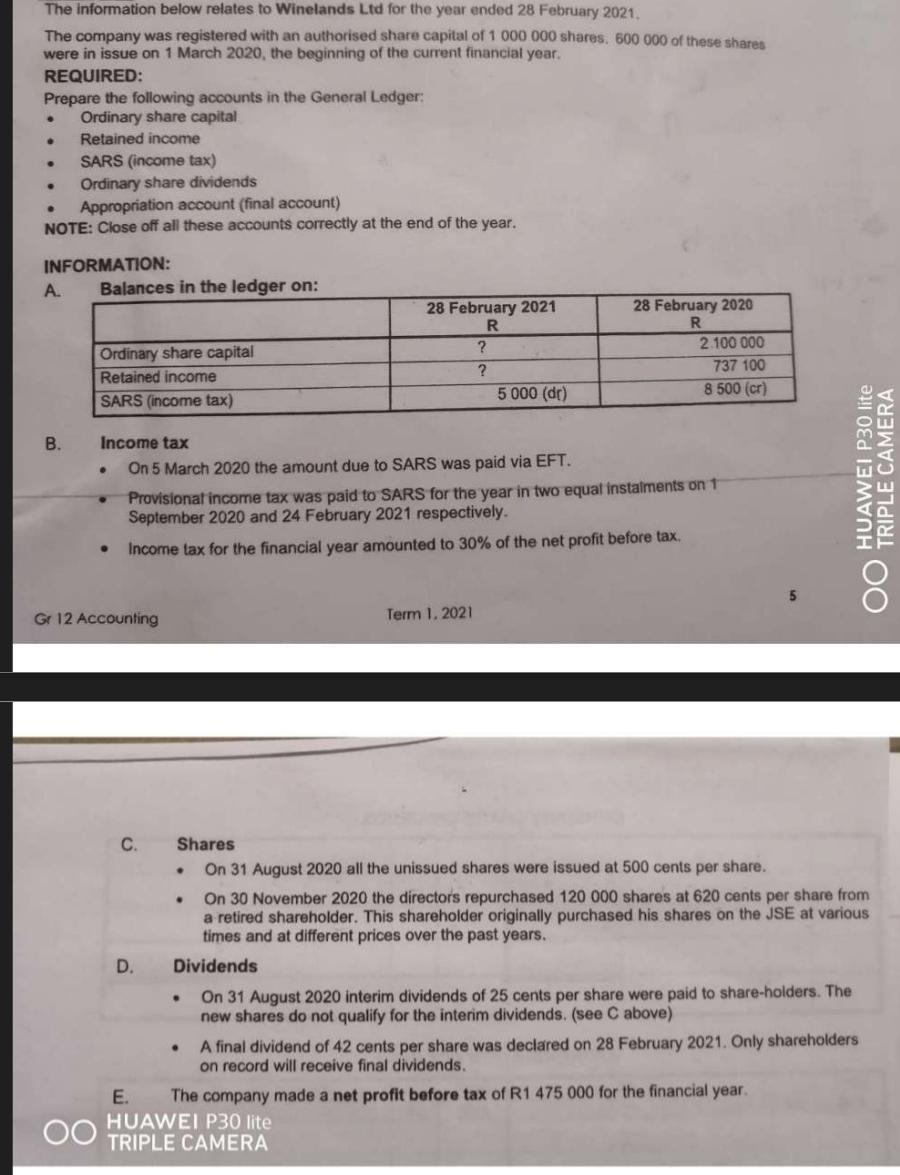

The information below relates to Winelands Ltd for the year ended 28 February 2021. The company was registered with an authorised share capital of

The information below relates to Winelands Ltd for the year ended 28 February 2021. The company was registered with an authorised share capital of 1 000 000 shares. 600 000 of these shares were in issue on 1 March 2020, the beginning of the current financial year. REQUIRED: Prepare the following accounts in the General Ledger: Ordinary share capital Retained income SARS (income tax) Ordinary share dividends Appropriation account (final account) NOTE: Close off all these accounts correctly at the end of the year. INFORMATION: A. Balances in the ledger on: 28 February 2021 R 28 February 2020 R Ordinary share capital Retained income SARS (income tax) B. . ? ? 2.100 000 737 100 5 000 (dr) 8 500 (cr) Income tax On 5 March 2020 the amount due to SARS was paid via EFT. Provisional income tax was paid to SARS for the year in two equal instalments on 1 September 2020 and 24 February 2021 respectively. Income tax for the financial year amounted to 30% of the net profit before tax. Gr 12 Accounting Term 1, 2021 C. Shares D. E. On 31 August 2020 all the unissued shares were issued at 500 cents per share. On 30 November 2020 the directors repurchased 120 000 shares at 620 cents per share from a retired shareholder. This shareholder originally purchased his shares on the JSE at various times and at different prices over the past years. Dividends . On 31 August 2020 interim dividends of 25 cents per share were paid to share-holders. The new shares do not qualify for the interim dividends. (see C above) A final dividend of 42 cents per share was declared on 28 February 2021. Only shareholders on record will receive final dividends. The company made a net profit before tax of R1 475 000 for the financial year. HUAWEI P30 lite TRIPLE CAMERA OO HUAWEI P30 lite TRIPLE CAMERA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started