Answered step by step

Verified Expert Solution

Question

1 Approved Answer

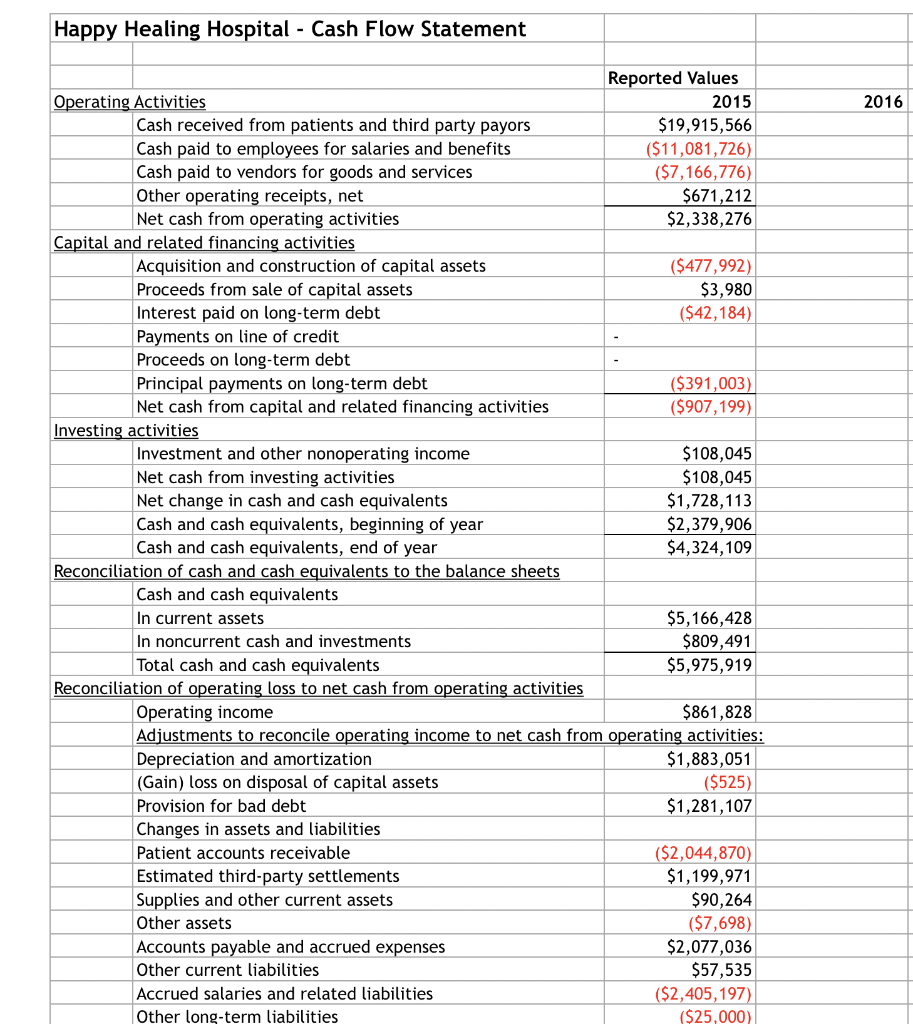

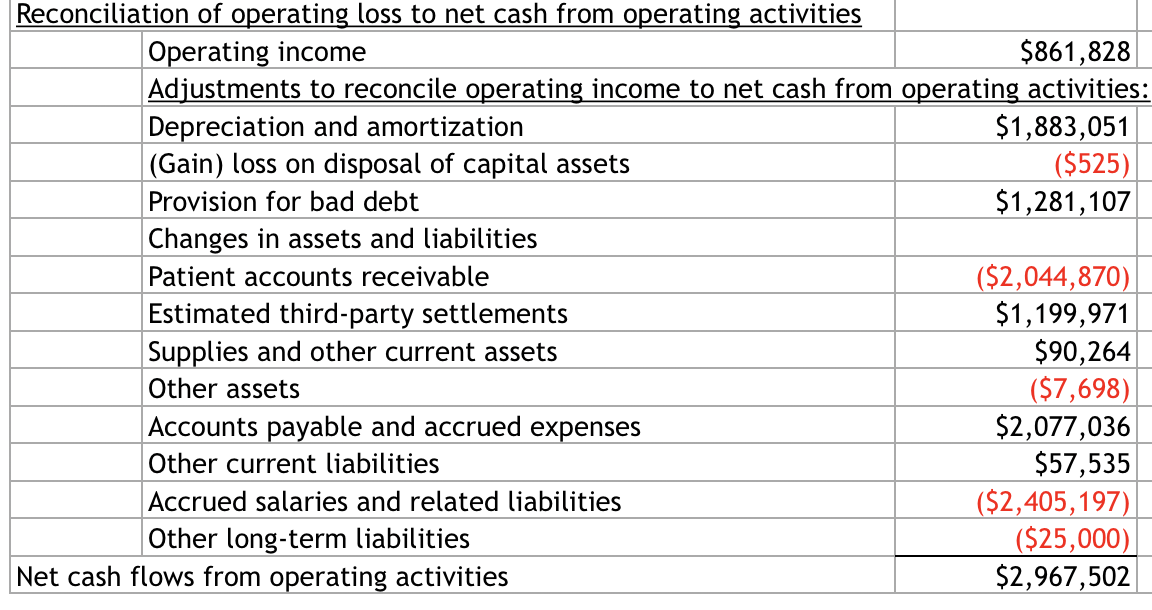

The information for 2016 has been collected from various sources within the healthcare organization and is listed in the attached document. It is not nice

The information for 2016 has been collected from various sources within the healthcare organization and is listed in the attached document. It is not nice and neat. The entries are not lined up very well and maybe a little out of order for your report but the information you need to create this statement is all listed. It is up to you to create the statement and make it presentable.

- add a column next to 2015 and label it 2016 for side-by-side comparison.

- enter the information below in the appropriate cell.

- create formulas to total each section as was done for 2015.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started