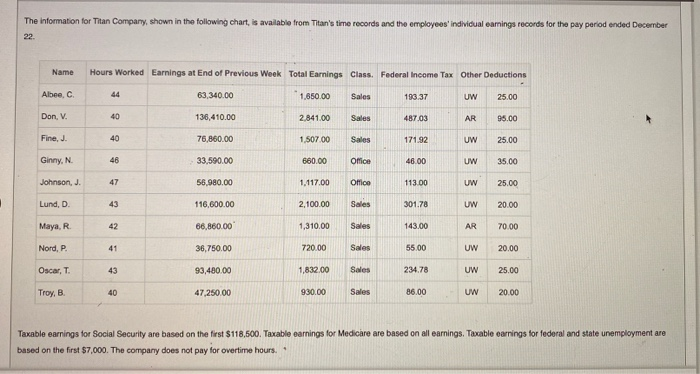

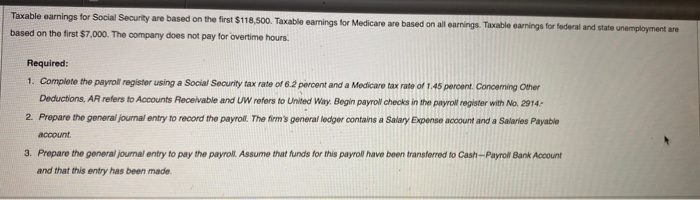

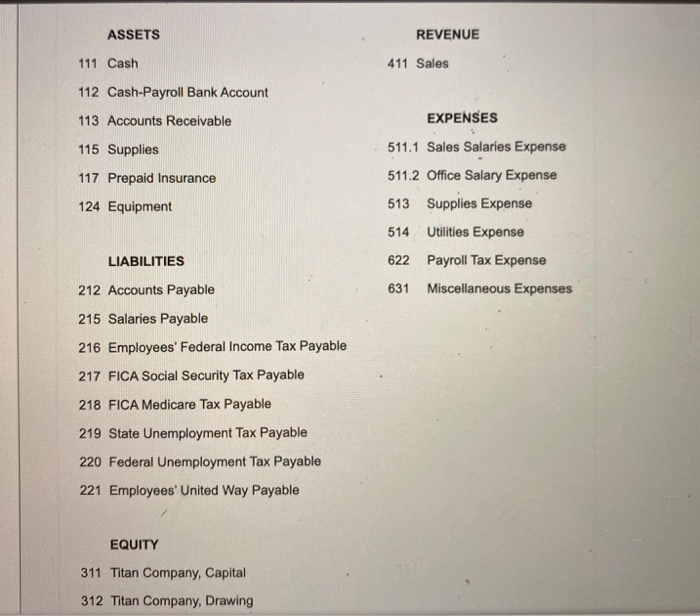

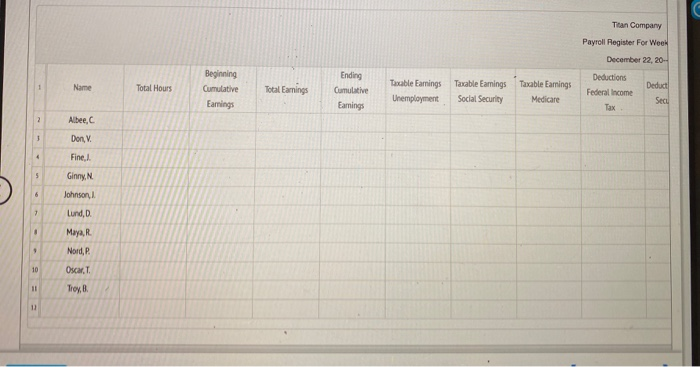

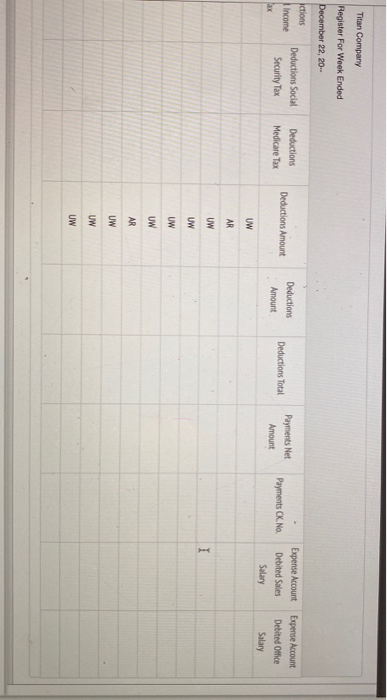

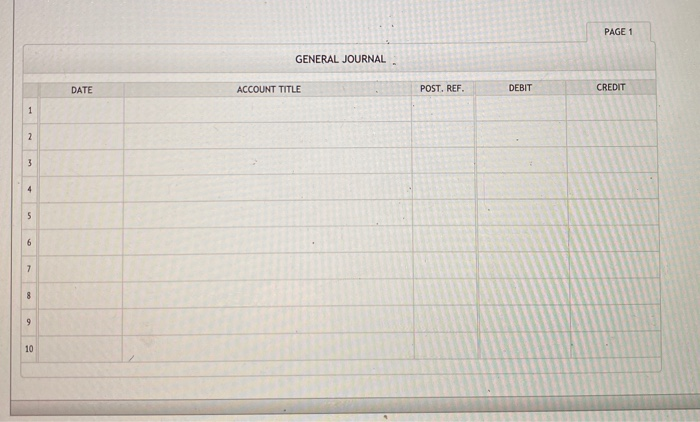

The information for Titan Company, shown in the following chart, is available from Titan's time records and the employees'individual earnings records for the pay period ended December 22. Name Hours Worked Earnings at End of Previous Week Total Earnings Class. Federal Income Tax Other Deductions Albee. C 44 63,340.00 1,650,00 Sales 193.37 UW 25.00 Don, V. 40 136,410.00 2,841.00 Sales 487.03 AR 95.00 Fine, J. 40 76,860.00 1,507.00 Sales 171.92 UW 25.00 Ginny, N. 46 33,590.00 660.00 Office 46.00 UW 35.00 Johnson, J. 47 56.980.00 1.117.00 Office 113.00 UW 25.00 Lund, D. 43 116,600.00 2,100.00 Sales 301.78 UW 20.00 Maya, R. 42 66,860.00 1,310.00 Sales 143.00 AR 70.00 Nord, P. 41 36,750.00 720.00 Sales 55.00 UW 20.00 Oscar, 43 93,480.00 1,832.00 Sales 234.78 UW 25.00 Troy, B. 40 47.250.00 930.00 Sales 86.00 UW 20.00 Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. The company does not pay for overtime hours. Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Tuwable earnings for federal and state unemployment are based on the first $7,000. The company does not pay for overtime hours. Required: 1. Complete the payroll register using a Social Security tax rate of 6.2 percent and a Medicare tax rate of 1.45 percent. Concerning Other Deductions, AR refers to Accounts Receivable and UW refers to United Way. Begin payroll checks in the payroll register with No. 2914 2. Prepare the general journal entry to record the payroll. The firm's general ledger contains a Salary Expenso account and a Salarios Payable account 3. Prepare the general journal entry to pay the payroll Assume that funds for this payroll have been transferred to Cash-Payroll Bank Account and that this entry has been made ASSETS REVENUE 111 Cash 411 Sales 112 Cash-Payroll Bank Account 113 Accounts Receivable EXPENSES 115 Supplies 117 Prepaid Insurance 511.1 Sales Salaries Expense 511.2 Office Salary Expense 513 Supplies Expense 124 Equipment 514 Utilities Expense LIABILITIES 622 Payroll Tax Expense 631 Miscellaneous Expenses 212 Accounts Payable 215 Salaries Payable 216 Employees' Federal Income Tax Payable 217 FICA Social Security Tax Payable 218 FICA Medicare Tax Payable 219 State Unemployment Tax Payable 220 Federal Unemployment Tax Payable 221 Employees' United Way Payable EQUITY 311 Titan Company, Capital 312 Titan Company, Drawing Tian Company Payroll Register For Week December 22, 20- 1 Name Total Hours Beginning Cumulative Earnings Total Earnings Ending Cumulative Earnings Taxable Earnings Unemployment Taxable Earnings Social Security Taxable Earnings Medicare Deductions Federal Income Tax Deduct Secu 2 Albee, 1 Don, 4 Fine, 5 Ginny, 6 Johnson, 7 Lund, D Maya, R. Nord, 9 10 Oscar.T. Troy, B. 11 11 Titan Company Register For Woek Ended December 22, 20- ictions Income Deductions Social Security Tax Deductions Medicare Tax Deductions Amount Deductions Amount Deductions Total Payments Net Amount Payments CK. No Expense Account Debited Sales Salary Expense Account Debited Office Salary ay UW AR UW I UW UW UW AR UW UW UW PAGE 1 GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 2 3 4 5 6 7 8 9 10 The information for Titan Company, shown in the following chart, is available from Titan's time records and the employees'individual earnings records for the pay period ended December 22. Name Hours Worked Earnings at End of Previous Week Total Earnings Class. Federal Income Tax Other Deductions Albee. C 44 63,340.00 1,650,00 Sales 193.37 UW 25.00 Don, V. 40 136,410.00 2,841.00 Sales 487.03 AR 95.00 Fine, J. 40 76,860.00 1,507.00 Sales 171.92 UW 25.00 Ginny, N. 46 33,590.00 660.00 Office 46.00 UW 35.00 Johnson, J. 47 56.980.00 1.117.00 Office 113.00 UW 25.00 Lund, D. 43 116,600.00 2,100.00 Sales 301.78 UW 20.00 Maya, R. 42 66,860.00 1,310.00 Sales 143.00 AR 70.00 Nord, P. 41 36,750.00 720.00 Sales 55.00 UW 20.00 Oscar, 43 93,480.00 1,832.00 Sales 234.78 UW 25.00 Troy, B. 40 47.250.00 930.00 Sales 86.00 UW 20.00 Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. The company does not pay for overtime hours. Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Tuwable earnings for federal and state unemployment are based on the first $7,000. The company does not pay for overtime hours. Required: 1. Complete the payroll register using a Social Security tax rate of 6.2 percent and a Medicare tax rate of 1.45 percent. Concerning Other Deductions, AR refers to Accounts Receivable and UW refers to United Way. Begin payroll checks in the payroll register with No. 2914 2. Prepare the general journal entry to record the payroll. The firm's general ledger contains a Salary Expenso account and a Salarios Payable account 3. Prepare the general journal entry to pay the payroll Assume that funds for this payroll have been transferred to Cash-Payroll Bank Account and that this entry has been made ASSETS REVENUE 111 Cash 411 Sales 112 Cash-Payroll Bank Account 113 Accounts Receivable EXPENSES 115 Supplies 117 Prepaid Insurance 511.1 Sales Salaries Expense 511.2 Office Salary Expense 513 Supplies Expense 124 Equipment 514 Utilities Expense LIABILITIES 622 Payroll Tax Expense 631 Miscellaneous Expenses 212 Accounts Payable 215 Salaries Payable 216 Employees' Federal Income Tax Payable 217 FICA Social Security Tax Payable 218 FICA Medicare Tax Payable 219 State Unemployment Tax Payable 220 Federal Unemployment Tax Payable 221 Employees' United Way Payable EQUITY 311 Titan Company, Capital 312 Titan Company, Drawing Tian Company Payroll Register For Week December 22, 20- 1 Name Total Hours Beginning Cumulative Earnings Total Earnings Ending Cumulative Earnings Taxable Earnings Unemployment Taxable Earnings Social Security Taxable Earnings Medicare Deductions Federal Income Tax Deduct Secu 2 Albee, 1 Don, 4 Fine, 5 Ginny, 6 Johnson, 7 Lund, D Maya, R. Nord, 9 10 Oscar.T. Troy, B. 11 11 Titan Company Register For Woek Ended December 22, 20- ictions Income Deductions Social Security Tax Deductions Medicare Tax Deductions Amount Deductions Amount Deductions Total Payments Net Amount Payments CK. No Expense Account Debited Sales Salary Expense Account Debited Office Salary ay UW AR UW I UW UW UW AR UW UW UW PAGE 1 GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 2 3 4 5 6 7 8 9 10