Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The information for XZY Inc. in Exhibit 1 is for the base case. Exhibit 2 specifies that the financing will be done in two rounds

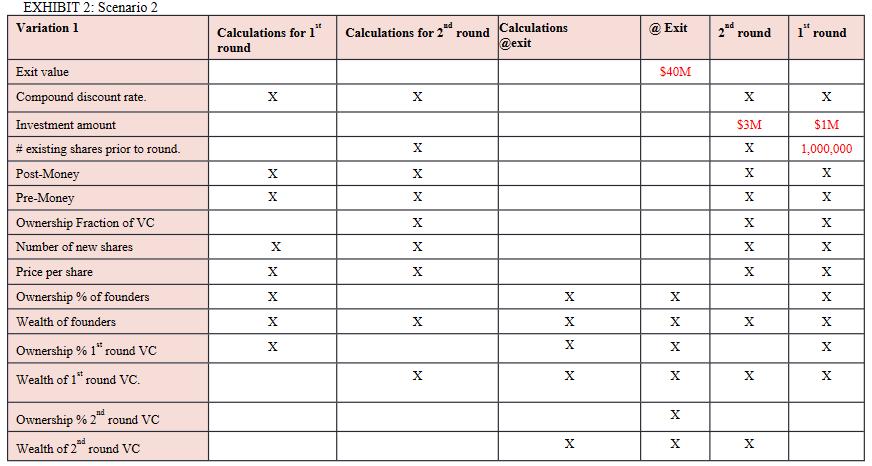

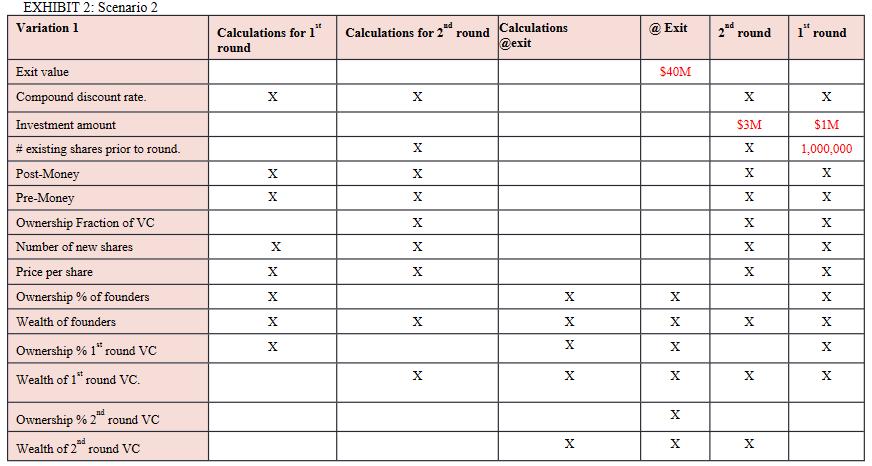

The information for XZY Inc. in Exhibit 1 is for the base case. Exhibit 2 specifies that the financing will be done in two rounds where round one is for $1M and the second round of financing (to happen at end of year 2) is for $3M. The discount rate is 50% for years 1 and 2 but drops to 40% thereafter. "X" means some calculation or a number needs to be filled in that cell. The absence of "X" means no calculation/number is expected. Submit the above exhibits the way they are presented here showing all the calculations in the appropriate column(s) along with a cover page to indicate the names of those in the group and what each individual contributed to the assignment.

Exhibit 2 specifies that the financing will be done in two rounds where round one is for $1M and the second round of financing (to happen at end of year 2) is for $3M. The discount rate is 50% for years 1 and 2 but drops to 40% thereafter. "X" means some calculation or a number needs to be filled in that cell. The absence of "X" means no calculation/number is expected. Submit the above exhibits the way they are presented here showing all the calculations in the appropriate column(s) along with a cover page to indicate the names of those in the group and what each individual contributed to the assignment.

Exhibit 2 specifies that the financing will be done in two rounds where round one is for $1M and the second round of financing (to happen at end of year 2) is for $3M. The discount rate is 50% for years 1 and 2 but drops to 40% thereafter. "X" means some calculation or a number needs to be filled in that cell. The absence of "X" means no calculation/number is expected. Submit the above exhibits the way they are presented here showing all the calculations in the appropriate column(s) along with a cover page to indicate the names of those in the group and what each individual contributed to the assignment.

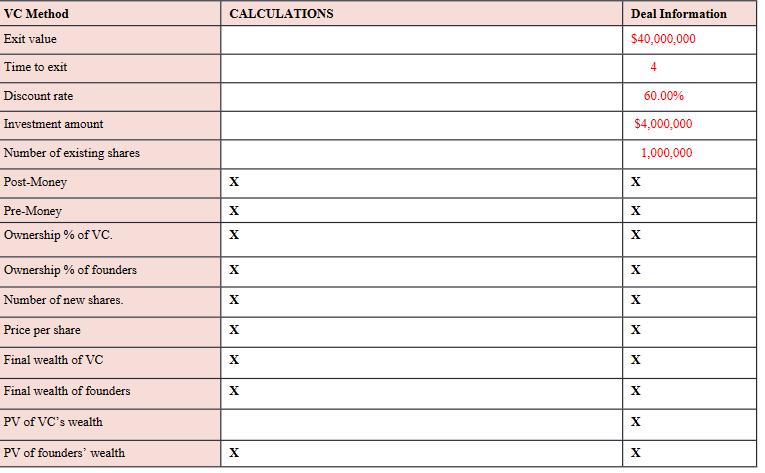

Exhibit 2 specifies that the financing will be done in two rounds where round one is for $1M and the second round of financing (to happen at end of year 2) is for $3M. The discount rate is 50% for years 1 and 2 but drops to 40% thereafter. "X" means some calculation or a number needs to be filled in that cell. The absence of "X" means no calculation/number is expected. Submit the above exhibits the way they are presented here showing all the calculations in the appropriate column(s) along with a cover page to indicate the names of those in the group and what each individual contributed to the assignment. VC Method Exit value Time to exit Discount rate Investment amount Number of existing shares Post-Money Pre-Money Ownership % of VC. Ownership % of founders Number of new shares. Price per share Final wealth of VC Final wealth of founders PV of VC's wealth PV of founders' wealth CALCULATIONS X XX X X X X X X Deal Information $40,000,000 60.00% $4,000,000 1,000,000 X X X X X X X X 4 X

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here is the breakdown of contributions Group Members John Doe Led calculations for Round 1 financing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started