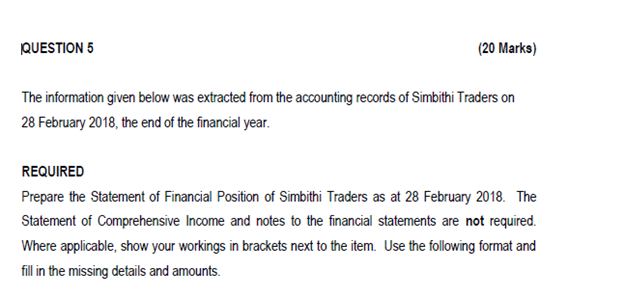

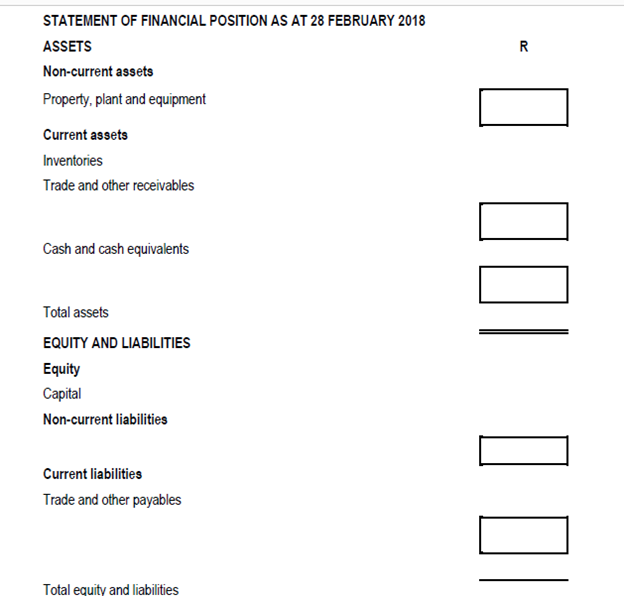

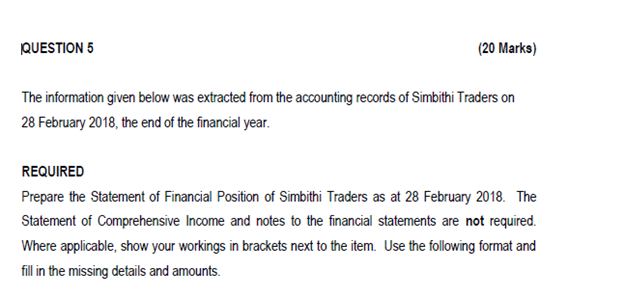

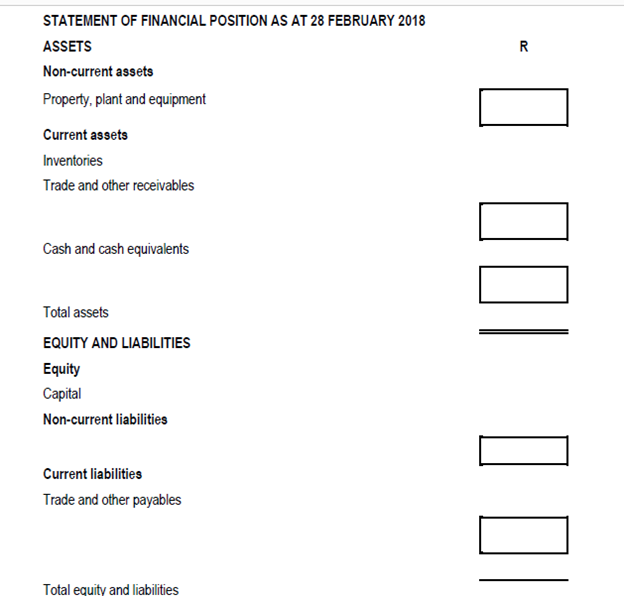

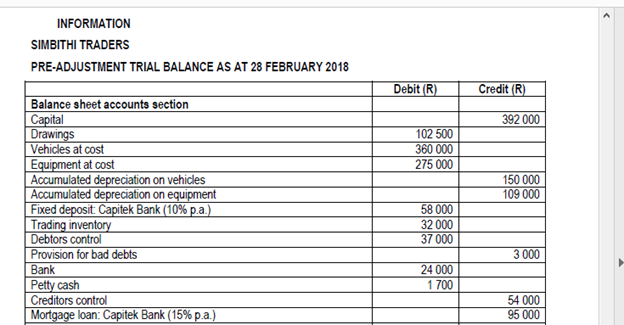

The information given below was extracted from the accounting records of Simbithi Traders on 28 February 2018, the end of the financial year. REQUIRED Prepare the Statement of Financial Position of Simbithi Traders as at 28 February 2018. The Statement of Comprehensive Income and notes to the financial statements are not required. Where applicable, show your workings in brackets next to the item. Use the following format and fill in the missing details and amounts. STATEMENT OF FINANCIAL POSITION AS AT 28 FEBRUARY 2018 ASSETS Non-current assets Property, plant and equipment Current assets Inventories Trade and other receivables Cash and cash equivalents Total assets EQUITY AND LIABILITIES Equity Capital Non-current liabilities Current liabilities Trade and other payables Total equity and liabilities INFORMATION SIMBITHI TRADERS PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2018 1. On 28 February 2018 a cheque for R3 000 was received from Glomail for commission on goods sold for them. The transaction was not recorded. 2. Trading inventory on hand according to stocktaking on 28 February 2018 amounted to R30000. 3. Stationery valued at R500 was taken by the owner for her personal use. No entry had been made for this. 4. Provide for the outstanding interest on fixed deposit. The investment in fixed deposit was made on 01 March 2017 and it matures on 28 February 2020. 5. Provide for outstanding interest on mortgage loan, R3 250. Loan repayments (excluding interest) totalling R24 000 will be made in the next financial year 6. Included in the insurance total is an amount of R600 that was paid for the next financial year. 7. The water and electricity account for February 2018, R2 000, was due to be paid on 04 March 2018. 8. Rent has been paid up to 31 March 2018. 9. The bank statement for February 2018 reflected an amount of R300 for service fees. No entry had been made for this. 10. No entry was made for an account received from Super Wheel to replace the tyres on the motor vehicle, R5 000 . 11. Write off the account of debtor, P. Pan, who was declared insolvent, R2 000 . 12. The provision for bad debts must be decreased by R400. 13. Provide for depreciation as follows: 13.1 On vehicles at 20% per annum on the diminishing balance. 13.2 On equipment at 15% per annum on cost. 14. The net profit for the year ended 28 February 2018, after taking the above adjustments into account, was R1300. The information given below was extracted from the accounting records of Simbithi Traders on 28 February 2018, the end of the financial year. REQUIRED Prepare the Statement of Financial Position of Simbithi Traders as at 28 February 2018. The Statement of Comprehensive Income and notes to the financial statements are not required. Where applicable, show your workings in brackets next to the item. Use the following format and fill in the missing details and amounts. STATEMENT OF FINANCIAL POSITION AS AT 28 FEBRUARY 2018 ASSETS Non-current assets Property, plant and equipment Current assets Inventories Trade and other receivables Cash and cash equivalents Total assets EQUITY AND LIABILITIES Equity Capital Non-current liabilities Current liabilities Trade and other payables Total equity and liabilities INFORMATION SIMBITHI TRADERS PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2018 1. On 28 February 2018 a cheque for R3 000 was received from Glomail for commission on goods sold for them. The transaction was not recorded. 2. Trading inventory on hand according to stocktaking on 28 February 2018 amounted to R30000. 3. Stationery valued at R500 was taken by the owner for her personal use. No entry had been made for this. 4. Provide for the outstanding interest on fixed deposit. The investment in fixed deposit was made on 01 March 2017 and it matures on 28 February 2020. 5. Provide for outstanding interest on mortgage loan, R3 250. Loan repayments (excluding interest) totalling R24 000 will be made in the next financial year 6. Included in the insurance total is an amount of R600 that was paid for the next financial year. 7. The water and electricity account for February 2018, R2 000, was due to be paid on 04 March 2018. 8. Rent has been paid up to 31 March 2018. 9. The bank statement for February 2018 reflected an amount of R300 for service fees. No entry had been made for this. 10. No entry was made for an account received from Super Wheel to replace the tyres on the motor vehicle, R5 000 . 11. Write off the account of debtor, P. Pan, who was declared insolvent, R2 000 . 12. The provision for bad debts must be decreased by R400. 13. Provide for depreciation as follows: 13.1 On vehicles at 20% per annum on the diminishing balance. 13.2 On equipment at 15% per annum on cost. 14. The net profit for the year ended 28 February 2018, after taking the above adjustments into account, was R1300