Answered step by step

Verified Expert Solution

Question

1 Approved Answer

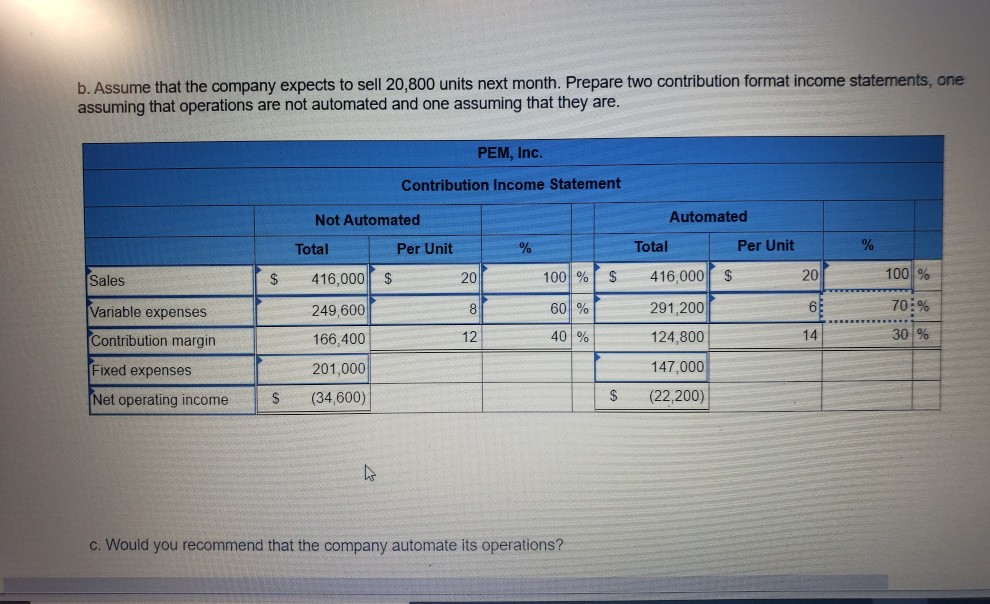

The information in Question 5 B. The spreadsheet, that has the unit available in the verbiage for PEM Onc. Income Statments Non Automated and Automated.

The information in Question 5 B. The spreadsheet, that has the unit available in the verbiage for PEM Onc. Income Statments Non Automated and Automated.

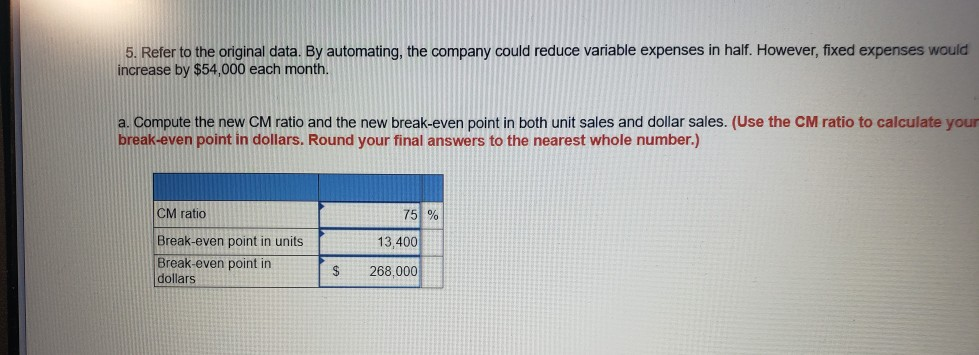

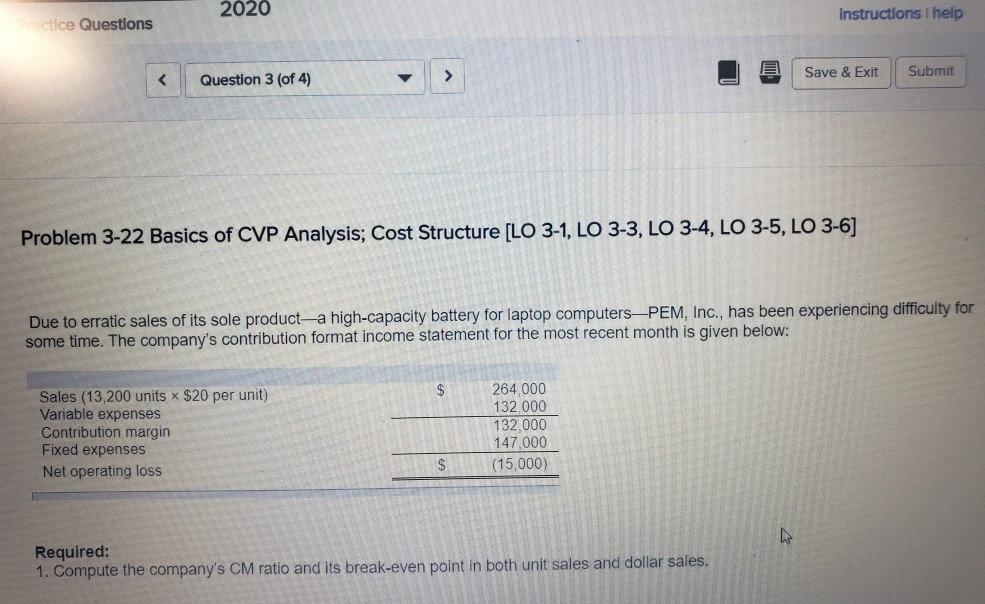

b. Assume that the company expects to sell 20,800 units next month. Prepare two contribution format income statements, one assuming that operations are not automated and one assuming that they are. PEM, Inc. Contribution Income Statement Automated Sales $ Not Automated Total Per Unit 416,000 $ 249,600 8 166,400 201,000 (34,600) % 60% Per Unit $ 6 14 Total 416,000 291,200 124,800 147,000 (22,200) 100 % 70:% 30 % Variable expenses Contribution margin Fixed expenses Net operating income O $ S c. Would you recommend that the company automate its operations? 5. Refer to the original data. By automating, the company could reduce variable expenses in half. However, fixed expenses would increase by $54,000 each month. a. Compute the new CM ratio and the new break-even point in both unit sales and dollar sales. (Use the CM ratio to calculate your break-even point in dollars. Round your final answers to the nearest whole number.) CM ratio Break-even point in units Break-even point in dollars 13,400 $ 268,000 2020 actice Questions Instructions I help Question 3 (of 4) Save & Exit Submit Problem 3-22 Basics of CVP Analysis; Cost Structure [LO 3-1, LO 3-3, LO 3-4, LO 3-5, LO 3-6] Due to erratic sales of its sole product-a high-capacity battery for laptop computersPEM, Inc., has been experiencing difficulty for some time. The company's contribution format income statement for the most recent month is given below: Sales (13,200 units $20 per unit) Variable expenses Contribution margin Fixed expenses Net operating loss 264,000 132,000 132,000 147,000 (15,000) Required: 1. Compute the company's CM ratio and its break-even point in both unit sales and dollar salesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started