Answered step by step

Verified Expert Solution

Question

1 Approved Answer

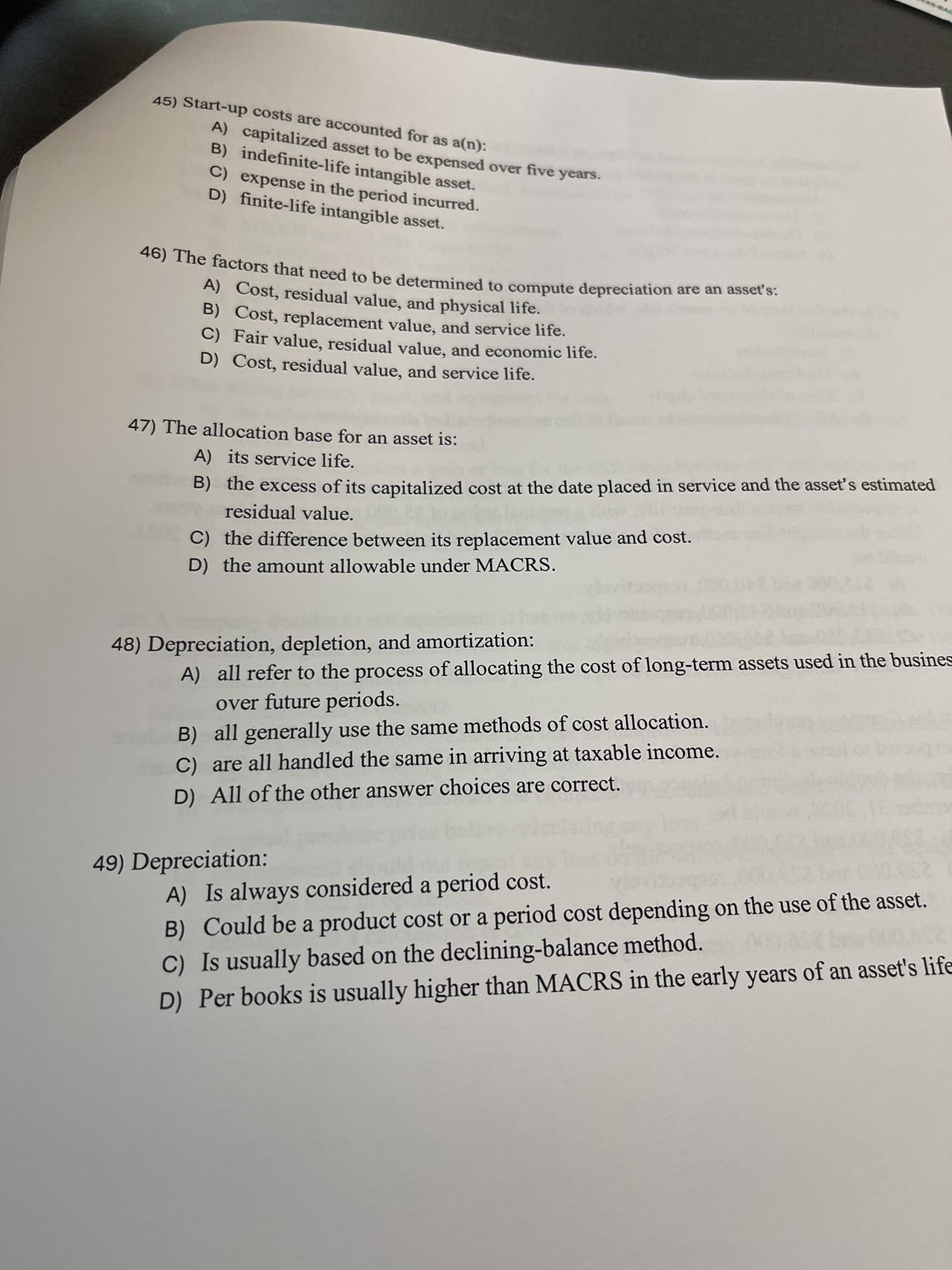

Start - up costs are accounted for as a ( n ) : A ) capitalized asset to be expensed over five years. B )

Startup costs are accounted for as an:

A capitalized asset to be expensed over five years.

B indefinitelife intangible asset.

C expense in the period incurred.

D finitelife intangible asset.

The factors that need to be determined to compute depreciation are an asset's:

A Cost, residual value, and physical life.

B Cost, replacement value, and service life.

C Fair value, residual value, and economic life.

D Cost, residual value, and service life.

The allocation base for an asset is:

A its service life.

B the excess of its capitalized cost at the date placed in service and the asset's estimated

residual value.

C the difference between its replacement value and cost.

D the amount allowable under MACRS.

Depreciation, depletion, and amortization:

A all refer to the process of allocating the cost of longterm assets used in the busines

over future periods.

B all generally use the same methods of cost allocation.

C are all handled the same in arriving at taxable income.

D All of the other answer choices are correct.

Depreciation:

A Is always considered a period cost.

B Could be a product cost or a period cost depending on the use of the asset.

C Is usually based on the decliningbalance method.

D Per books is usually higher than MACRS in the early years of an asset's life

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started