Question

The information necessary for preparing the 2016 year-end adjusting entries for Vitos Pizza Parlor appears below. Vitos fiscal year-end is December 31. On July 1,

The information necessary for preparing the 2016 year-end adjusting entries for Vitos Pizza Parlor appears below. Vitos fiscal year-end is December 31.

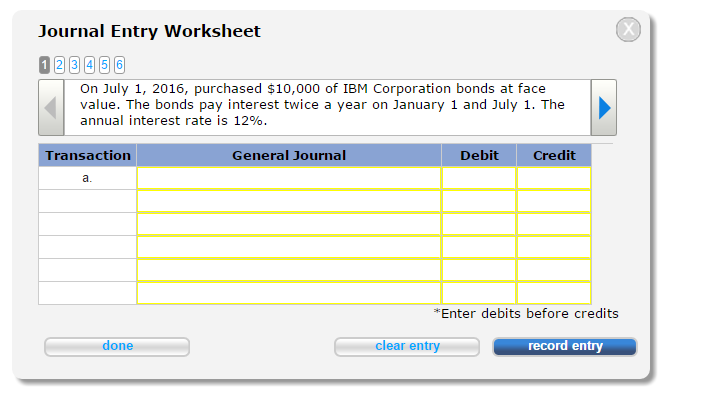

On July 1, 2016, purchased $10,000 of IBM Corporation bonds at face value. The bonds pay interest twice a year on January 1 and July 1. The annual interest rate is 12%.

Vitos depreciable equipment has a cost of $30,000, a five-year life, and no salvage value. The equipment was purchased in 2014. The straight-line depreciation method is used.

On November 1, 2016, the bar area was leased to Jack Donaldson for one year. Vitos received $6,000 representing the first six months rent and credited deferred rent revenue.

On April 1, 2016, the company paid $2,400 for a two-year fire and liability insurance policy and debited insurance expense.

On October 1, 2016, the company borrowed $20,000 from a local bank and signed a note. Principal and interest at 12% will be paid on September 30, 2017.

At year-end, there is a $1,800 debit balance in the supplies (asset) account. Only $700 of supplies remain on hand.

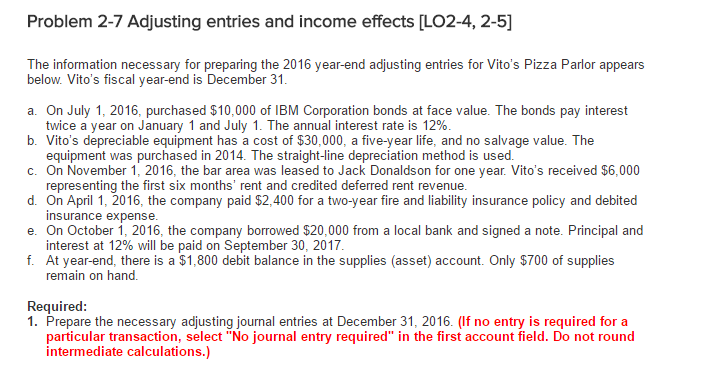

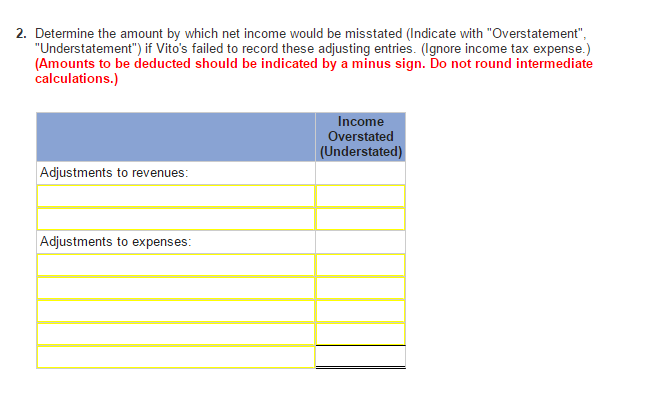

Problem 2-7 Adjusting entries and income effects [LO2-4, 2-5] The information necessary for preparing the 2016 year-end adjusting entries for Vito's Pizza Parlor appears below. Vito's fiscal year-end is December 31 a. On July 1, 2016, purchased $10,000 of IBM Corporation bonds at face value. The bonds pay interest b. Vito's depreciable equipment has a cost of $30,000, a five-year life, and no salvage value. The c. On November 1, 2016, the bar area was leased to Jack Donaldson for one year. Vito's received $6,000 d. On April 1, 2016, the company paid $2,400 for a two-year fire and liability insurance policy and debited e. On October 1, 2016, the company borrowed $20,000 from a local bank and signed a note. Principal and f. At year-end, there is a $1,800 debit balance in the supplies (asset) account. Only $700 of supplies twice a year on January 1 and July 1 . The annual interest rate is 12% equipment was purchased in 2014. The straight-line depreciation method is used representing the first six months' rent and credited deferred rent revenue insurance expense interest at 12% will be paid on September 30, 2017 remain on hand. Required 1. Prepare the necessary adjusting journal entries at December 31, 2016. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started