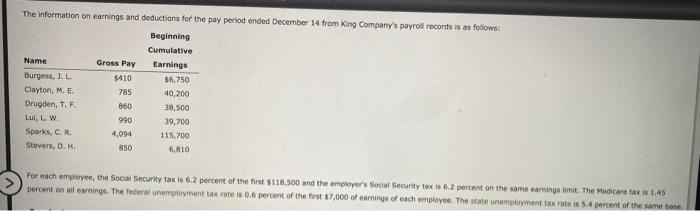

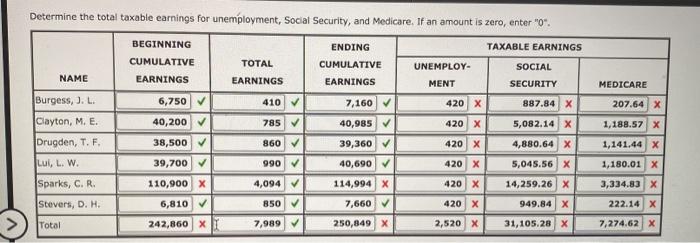

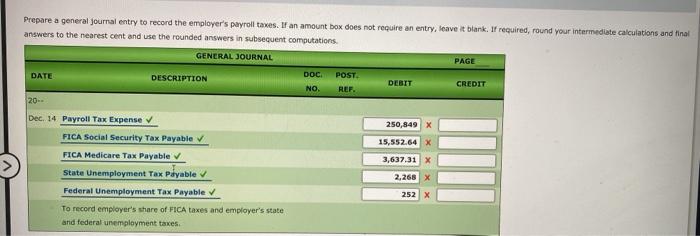

The information on earnings and deductions for the pay period ended December 14 from King Company's payroil records is as follows: Beginning Name Burgess, J.L Clayton, ME Drugden, T. F. Lul, L. W Sparks, C.R Stevens, DH Gross Pay 5410 785 860 990 4,094 Cumulative Earnings $6,750 40,200 38,500 39,700 115,700 6,810 850 For each employee, the Social Security tax is 6.2 percent of the first 5118,500 and the employers Social Security tax is 6.2 percent on the same earnings imit. The Medicare taxis 1.45 percent on all earnings. The federal Unemployment tax rate is 0.6 percent of the first $7,000 of earnings of each employee. The state unemployment tax rate 5.4 percent of the same base Determine the total taxable earnings for unemployment, Social Security, and Medicare. If an amount is zero, enter "0". TAXABLE EARNINGS BEGINNING CUMULATIVE ENDING CUMULATIVE TOTAL UNEMPLOY- NAME EARNINGS EARNINGS SOCIAL SECURITY EARNINGS MENT MEDICARE Burgess, J. L. 6,750 410 420 X 887.84 X 207.64 X Clayton, M. E. 40,200 785 7,160 40,985 39,360 420 X Drugden, T. F. 38,500 860 420 X 1,188.57 x 1,141.44 X 1,180.01 x 3,334.83 X Lul, L. W. 990 420 X 5,082.14 x 4,880.64 x 5,045.56 X 14,259,26 x 949.84 X 31,105.28 X 39,700 110,900 x 6,810 4,094 420 X Sparks, C.R. Stovers, D. H. 40,690 114,994 X 7,660 250,849 X 850 420 X 222.14 X Total 242,860 x 7,989 2,520 X 7,274.62 x Prepare a general Journal entry to record the employer's payroll taxes. If an amount box does not require an entry, leave it blank. If required, round your intermediate calculations and final answers to the nearest cent and use the rounded answers in subsequent computations GENERAL JOURNAL PAGE DOC POST DATE DESCRIPTION DEBIT CREDIT NO. REF 20- 250,849 X 15,552.64 X 3,637.31 X Dec. 14 Payroll Tax Expense FICA Social Security Tax Payable FICA Medicare Tax Payable State Unemployment Tax Payable Federal Unemployment Tax Payable To record employer's share of FICA taxes and employer's state and federal unemployment taxes 2,268 X 252 X