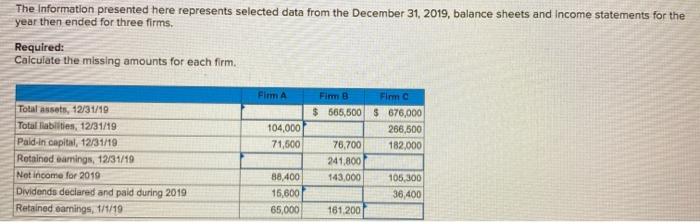

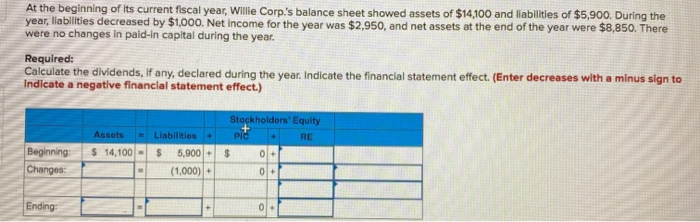

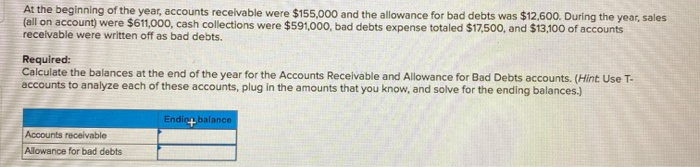

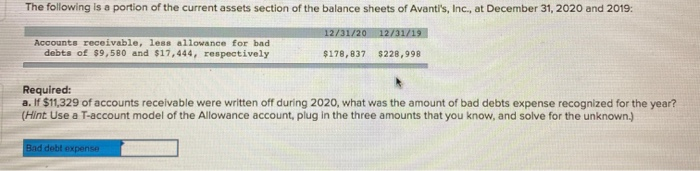

The information presented here represents selected data from the December 31, 2019, balance sheets and income statements for the year then ended for three firms. Required: Calculate the missing amounts for each firm. Firm A 104,000 71,500 Total assets, 12/31/19 Total liabilities, 12/31/19 Pald.in capital, 12/31/19 Retained earnings, 12/31/19 Not income for 2019 Dividends declared and paid during 2019 Retained earnings, 1/1/19 Firm B Firm C $ 565,500 $ 676,000 266,500 76,700 182.000 241,800 143,000 105,300 36,400 161.200 88.400 15,600 65,000 At the beginning of its current fiscal year, Willie Corp's balance sheet showed assets of $14,100 and liabilities of $5,900. During the year, liabilities decreased by $1,000 Net Income for the year was $2,950, and net assets at the end of the year were $8,850. There were no changes in paid-in capital during the year. Required: Calculate the dividends, If any, declared during the year. Indicate the financial statement effect. (Enter decreases with a minus sign to Indicate a negative financial statement effect.) Assets $ 14,100 - Stockholders' Equity PIC RE $ 0 + Liabilities + $ 5,900 + (1,000) + Beginning Changes 0+ Ending: 0+ At the beginning of the year, accounts receivable were $155,000 and the allowance for bad debts was $12,600. During the year, sales (all on account) were $611,000, cash collections were $591,000, bad debts expense totaled $17,500, and $13,100 of accounts receivable were written off as bad debts. Required: Calculate the balances at the end of the year for the Accounts Receivable and Allowance for Bad Debts accounts. (Hint Use T- accounts to analyze each of these accounts, plug in the amounts that you know, and solve for the ending balances.) Endint balance Accounts receivable Allowance for bad debts The following is a portion of the current assets section of the balance sheets of Avanti's, Inc., at December 31, 2020 and 2019: 12/31/20 12/31/19 Accounts receivable, less allowance for bad debts of $9,580 and $17,444, respectively $178,837 $228,998 Required: a. If $11,329 of accounts receivable were written off during 2020, what was the amount of bad debts expense recognized for the year? (Hint Use a T-account model of the Allowance account, plug in the three amounts that you know, and solve for the unknown.) Bad debt expense