Answered step by step

Verified Expert Solution

Question

1 Approved Answer

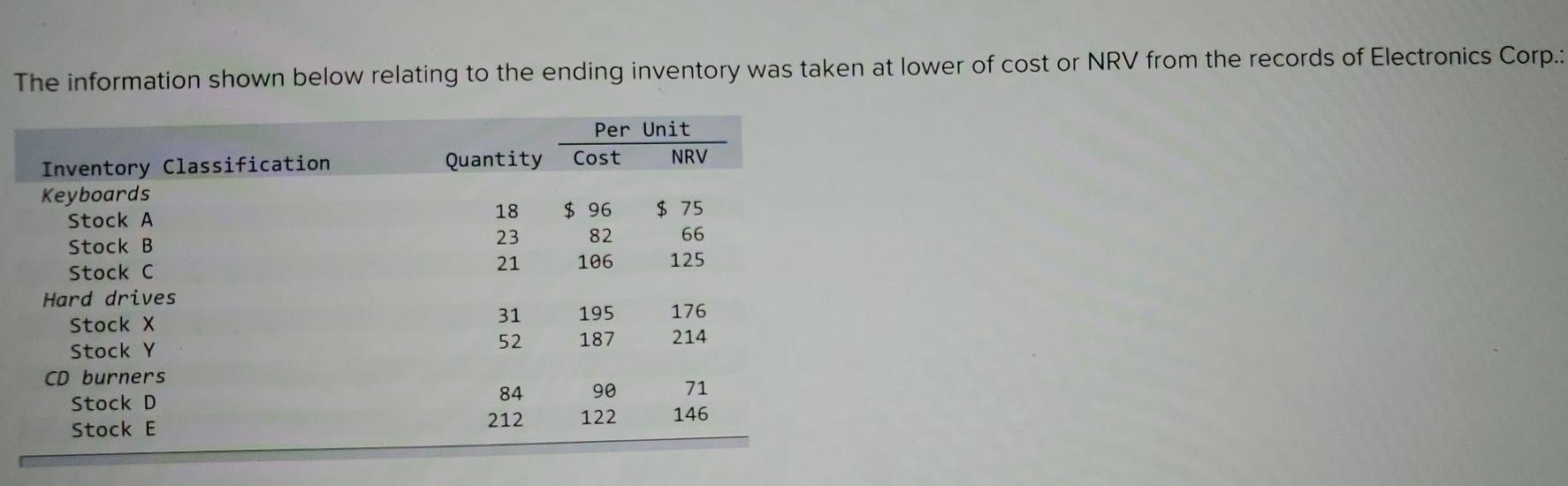

The information shown below relating to the ending inventory was taken at lower of cost or NRV from the records of Electronics Corp.: Per Unit

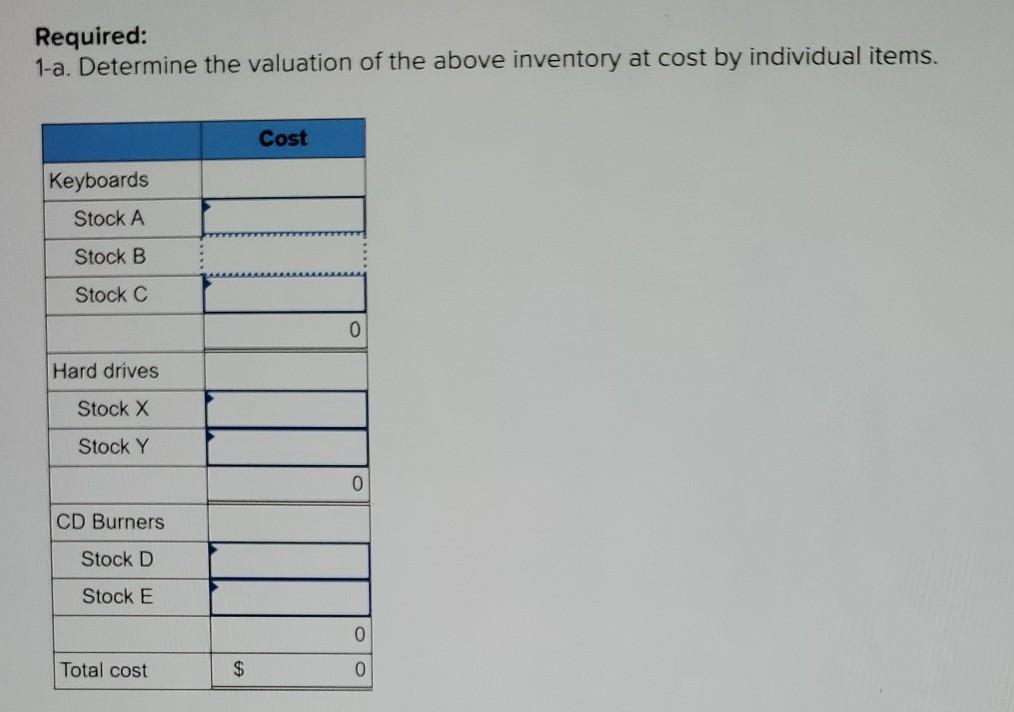

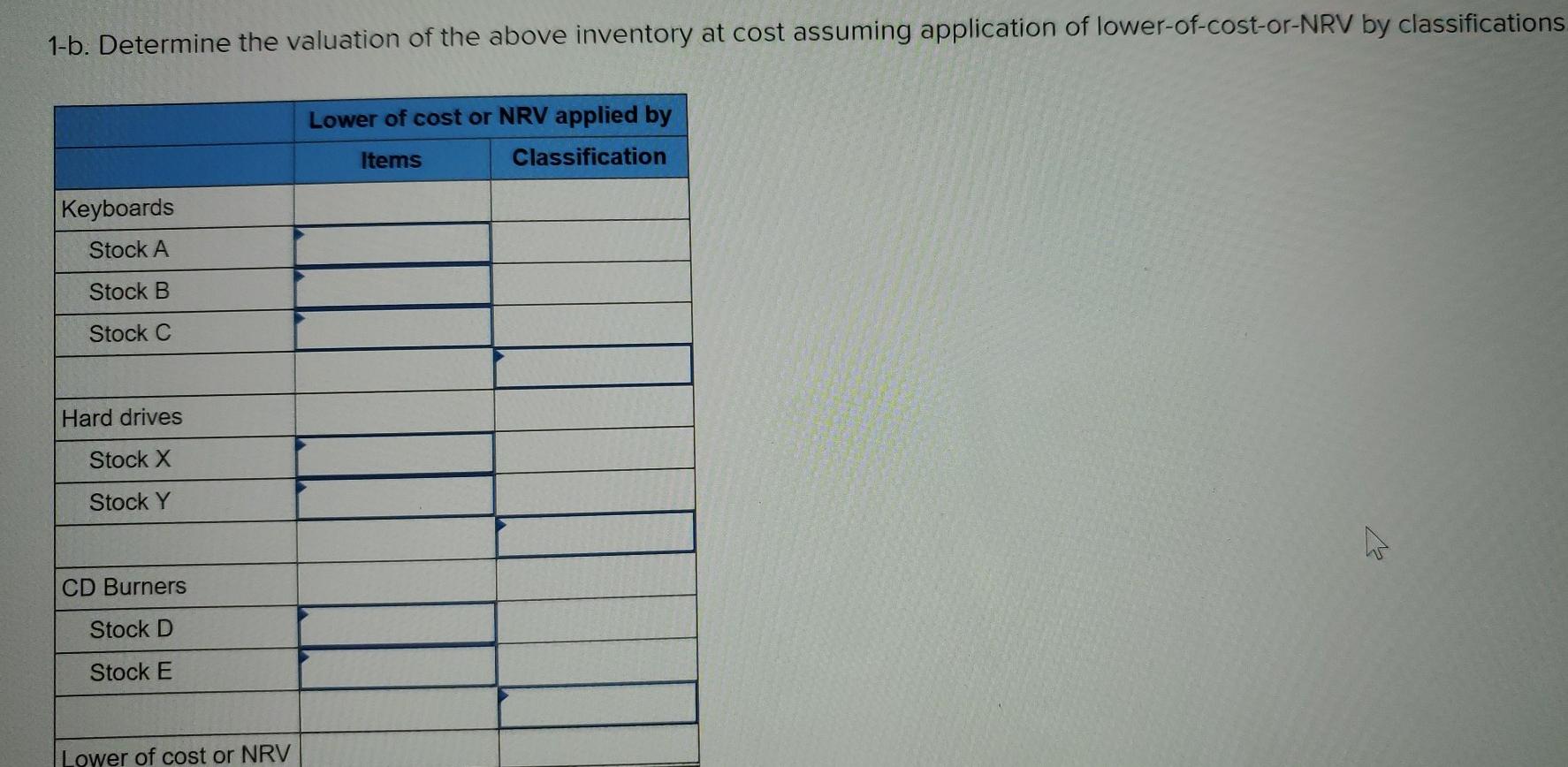

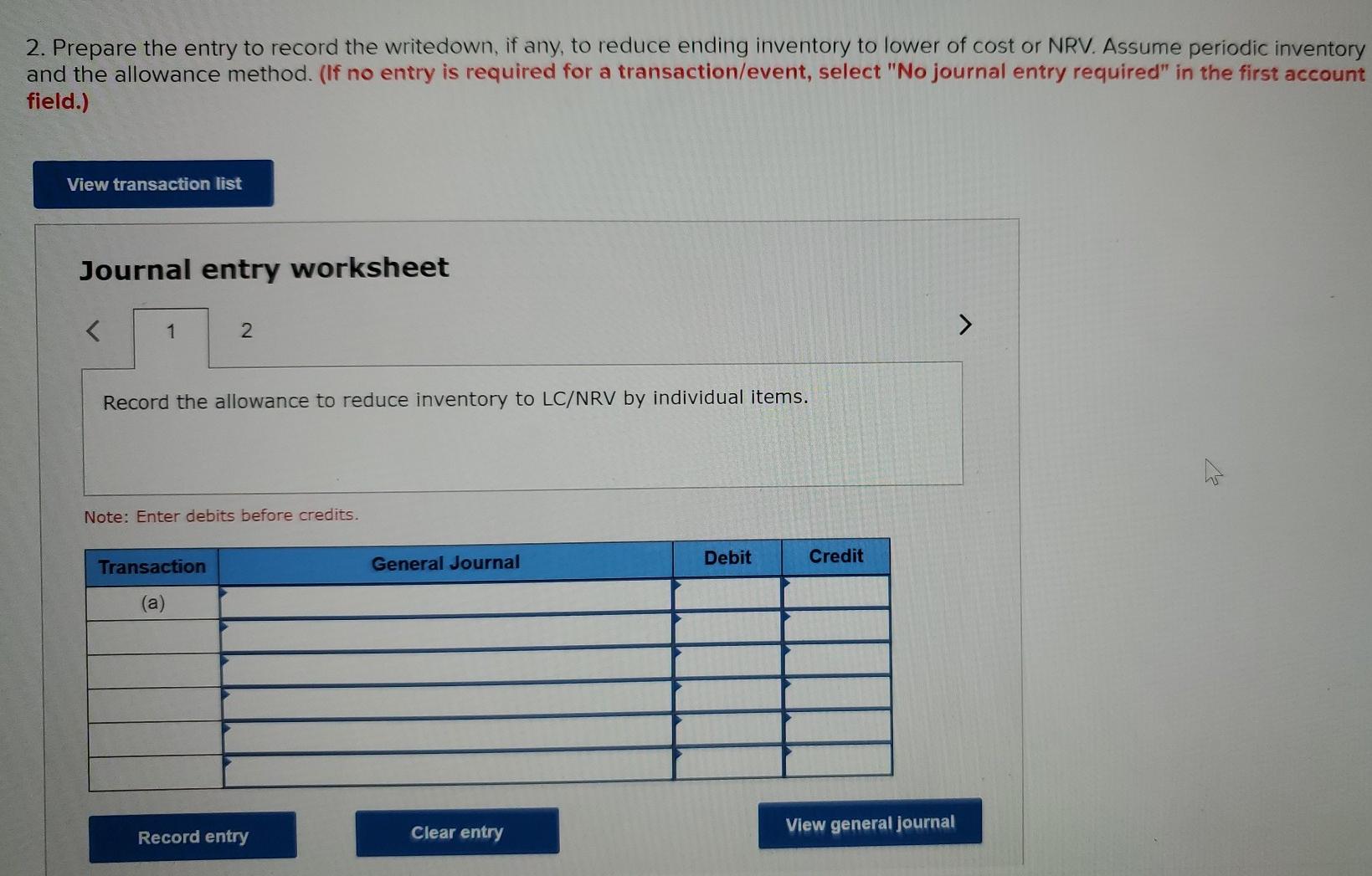

The information shown below relating to the ending inventory was taken at lower of cost or NRV from the records of Electronics Corp.: Per Unit Cost NRV Quantity 18 23 21 $ 96 82 106 $ 75 66 125 Inventory Classification Keyboards Stock A Stock B Stock C Hard drives Stock X Stock Y CD burners Stock D Stock E 31 52 195 187 176 214 84 212 90 122 71 146 Required: 1-a. Determine the valuation of the above inventory at cost by individual items. Cost Keyboards Stock A Stock B Stock C 0 Hard drives Stock X Stock Y 0 CD Burners Stock D Stock E 0 Total cost $ 0 1-b. Determine the valuation of the above inventory at cost assuming application of lower-of-cost-or-NRV by classifications Lower of cost or NRV applied by Items Classification Keyboards Stock A Stock B Stock C Hard drives Stock X Stock Y CD Burners Stock D Stock E Lower of cost or NRV 2. Prepare the entry to record the writedown, if any, to reduce ending inventory to lower of cost or NRV. Assume periodic inventory and the allowance method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 > Record the allowance to reduce inventory to LC/NRV by individual items. Note: Enter debits before credits. Debit Credit Transaction General Journal (a) Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started