Question

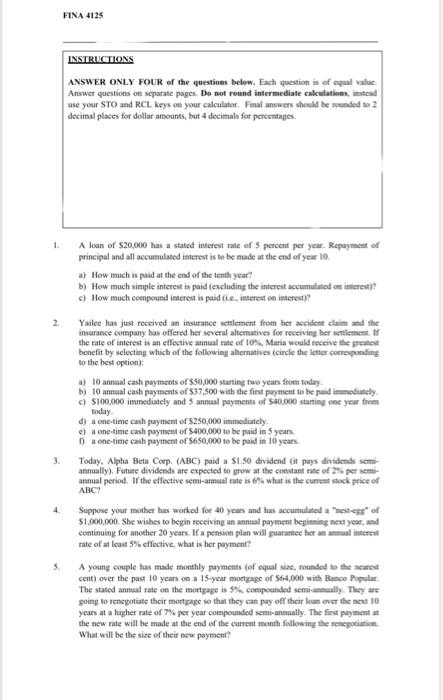

THE INSTRUCTIONS ANSWER ONLY FOUR of the following questions. Each question has the same value. Answer the questions on separate pages. Do not round intermediate

THE INSTRUCTIONS ANSWER ONLY FOUR of the following questions. Each question has the same value. Answer the questions on separate pages. Do not round intermediate calculations, instead use the STO and RCL keys on your calculator. Final answers should be rounded to 2 decimal places for dollar amounts, but to 4 decimal places for percentages.

1. A $ 20,000 loan has a stated interest rate of 5 percent per year. The repayment of the principal and all accrued interest will be made at the end of year 10.

a) How much is paid at the end of the tenth year?

b) How much simple interest is paid (excluding accrued interest on interest)?

c) How much compound interest is paid (that is, interest on interest)?

2. Yailee has just received an insurance settlement for her accident claim and the insurance company has offered her several alternatives for receiving her settlement. If the interest rate is an effective annual rate of 10%, Maria would receive the greatest benefit by selecting which of the following alternatives (circle the letter corresponding to the best option):

a) 10 annual cash payments of S50, 000 starting two years from today

b) 10 annual cash payments of $ 37,500 with the first payment due immediately.

c) S100,000 immediately and 5 annual payments of S40,000 starting one year from today.

d) a one-time cash payment of $ 250,000 immediately.

e) a one-time cash payment of S400,000 to be paid in 5 years.

f) a one-time cash payment of S650,000 to be paid over 10 years.

3. Today, Alpha Beta Corp. (ABC) paid a dividend of $ 1.50 (pays dividends semi-annually). Future dividends are expected to grow at a constant rate of 2% per semi-annual period. If the effective semi-annual rate is 6%, what is the current price of ABC's shares? 3.

4. Suppose her mother has worked for 40 years and has accumulated a "savings reserve" of $ 1,000,000. She wants to start receiving an annual payment starting next year and continue for another 20 years. If a pension plan guarantees you an annual interest rate of at least 5% effective, what is the payment for it?

5. A young couple has made monthly payments (of equal size, rounded to the nearest penny) during the last 10 years on a 15-year mortgage of S64,000 with Banco Popular. The annual rate established on the mortgage is 5%, compounded semi-annually. They will renegotiate their mortgage so they can pay off their loan for the next 10 years at a higher rate of 7% per annum compounded semi-annually. The first payment at the new rate will be made at the end of the current month after the renegotiation. What will be the size of your new payment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started