The Instructions is the first page and the chart you're supposed to use is the second to answer the first page

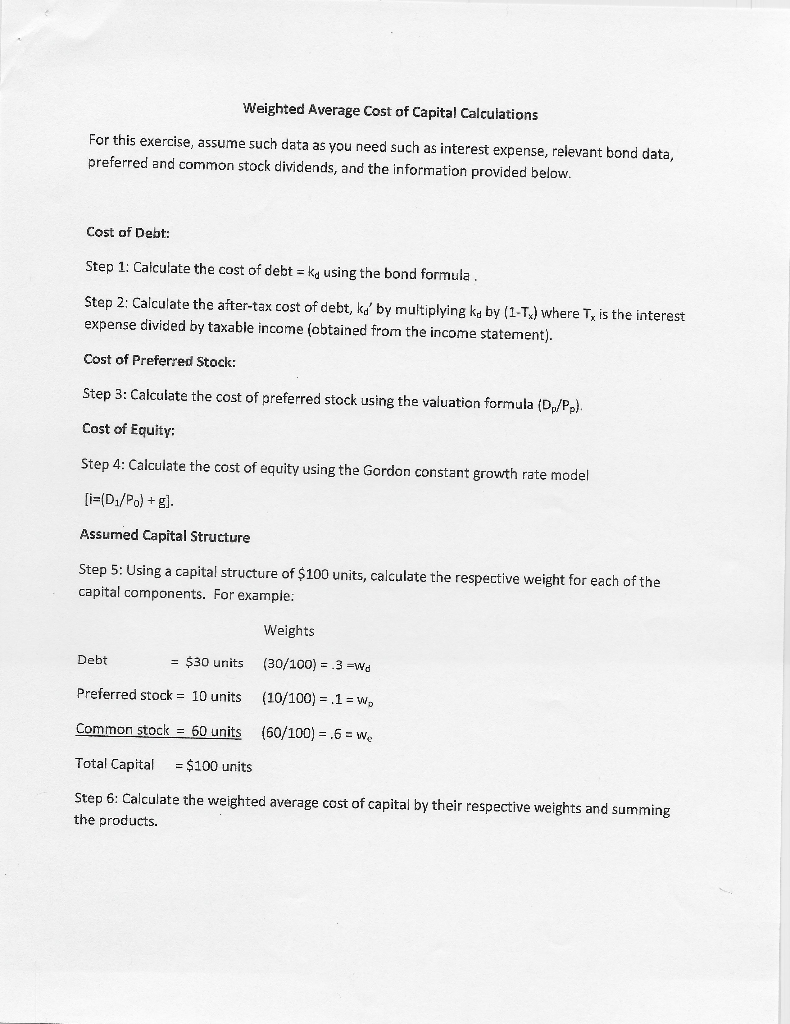

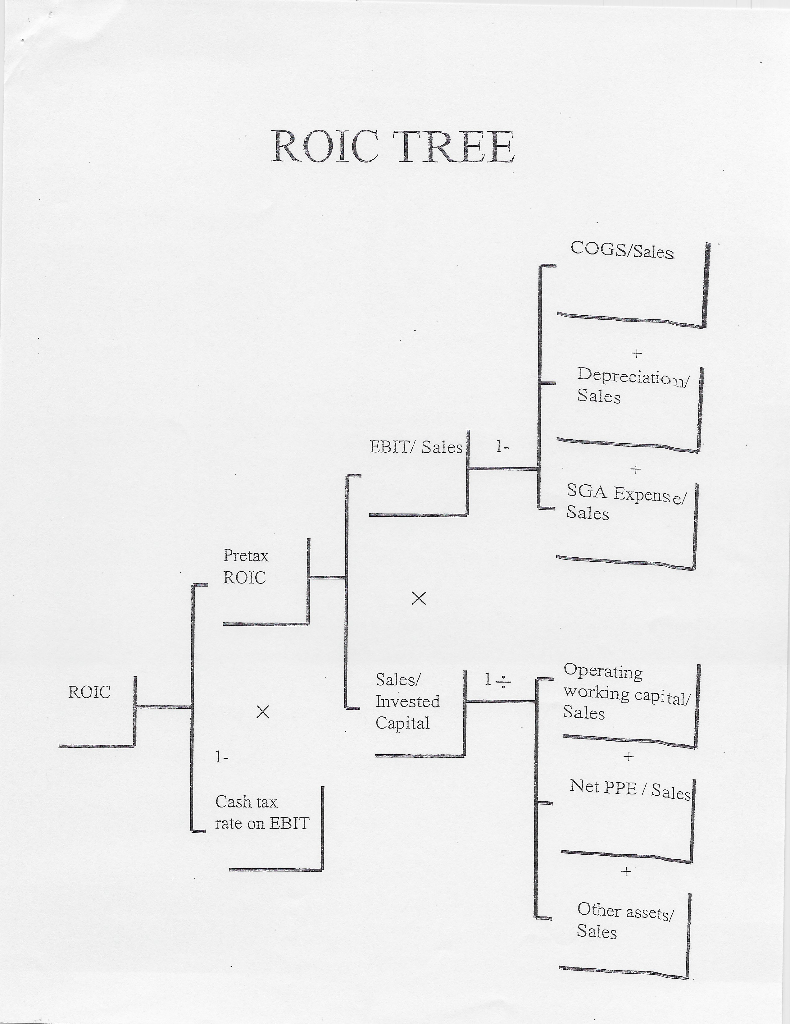

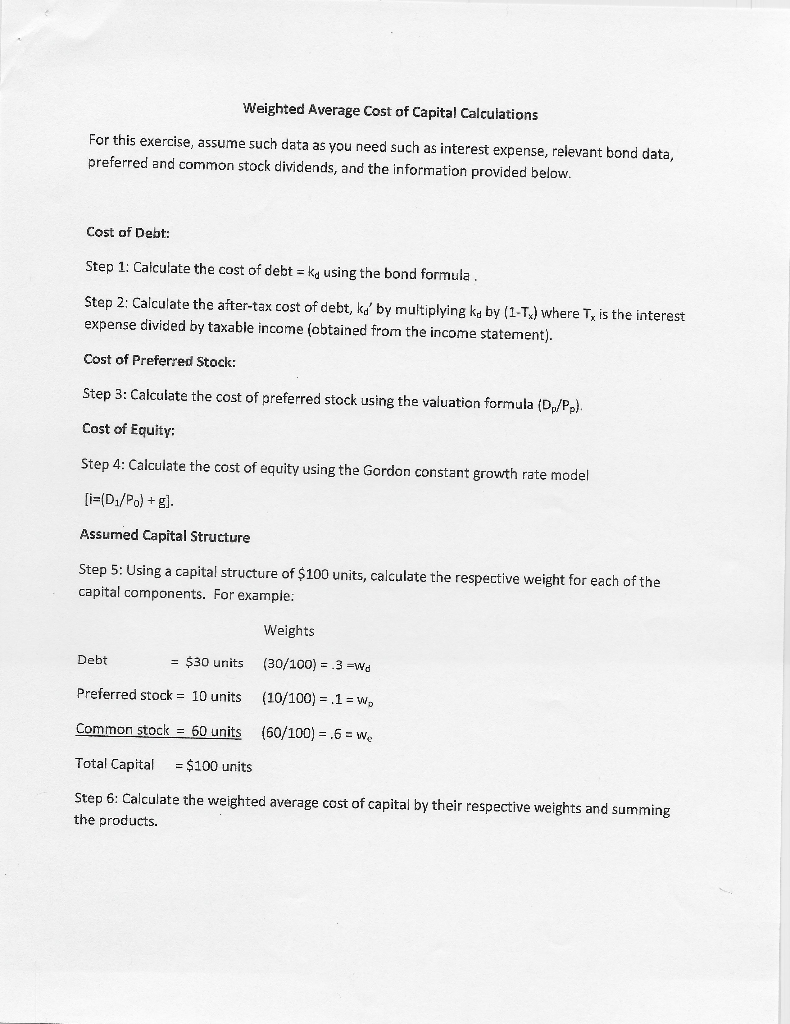

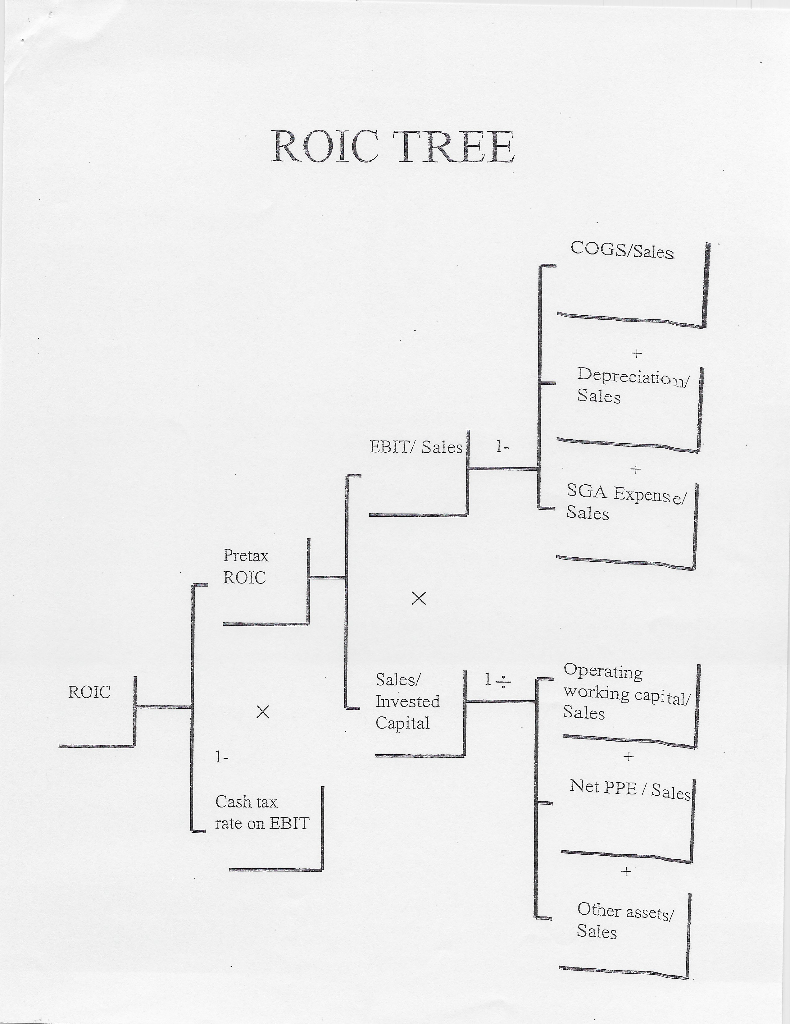

Weighted Average Cost of Capital Calculations For this exercise, assume such data as you need such as interest expense, relevant bond data, preferred and common stock dividends, and the information provided below Cost of Debt: Step 1: Calculate the cost of debt = kd using the bond formula . Step 2: Calculate the after-tax cost of debt, kd' by multiplying koby (1-Tx) where Tx is the interest expense divided by taxable income (obtained from the income statement). Cost of Preferred Stock: Step 3: Calculate the cost of preferred stock using the valuation formula (D/Pp). Cost of Equity: Step 4: Calculate the cost of equity using the Gordon constant growth rate model [i=(D./Po) + 5). Assumed Capital Structure Step 5: Using a capital structure of $100 units, calculate the respective weight for each of the capital components. For example: Weights Debt = $30 units (30/100) = 3 =Wd (10/100) = 1 = W, Preferred stock = 10 units Common stock = 60 units (60/100) = .6 = We Total Capital = $100 units Step 6: Calculate the weighted average cost of capital by their respective weights and summing the products. ROIC TREE COGS/Sales Depreciation Sales EBIT/ Sales in SGA Expenseli Sales Pretax ROIC ROIC Sales/ Invested Capital Operating working capital/l Sales Net PPE / Sales Cash tax rate on EBIT L Other assets/ Sales Weighted Average Cost of Capital Calculations For this exercise, assume such data as you need such as interest expense, relevant bond data, preferred and common stock dividends, and the information provided below Cost of Debt: Step 1: Calculate the cost of debt = kd using the bond formula . Step 2: Calculate the after-tax cost of debt, kd' by multiplying koby (1-Tx) where Tx is the interest expense divided by taxable income (obtained from the income statement). Cost of Preferred Stock: Step 3: Calculate the cost of preferred stock using the valuation formula (D/Pp). Cost of Equity: Step 4: Calculate the cost of equity using the Gordon constant growth rate model [i=(D./Po) + 5). Assumed Capital Structure Step 5: Using a capital structure of $100 units, calculate the respective weight for each of the capital components. For example: Weights Debt = $30 units (30/100) = 3 =Wd (10/100) = 1 = W, Preferred stock = 10 units Common stock = 60 units (60/100) = .6 = We Total Capital = $100 units Step 6: Calculate the weighted average cost of capital by their respective weights and summing the products. ROIC TREE COGS/Sales Depreciation Sales EBIT/ Sales in SGA Expenseli Sales Pretax ROIC ROIC Sales/ Invested Capital Operating working capital/l Sales Net PPE / Sales Cash tax rate on EBIT L Other assets/ Sales