Answered step by step

Verified Expert Solution

Question

1 Approved Answer

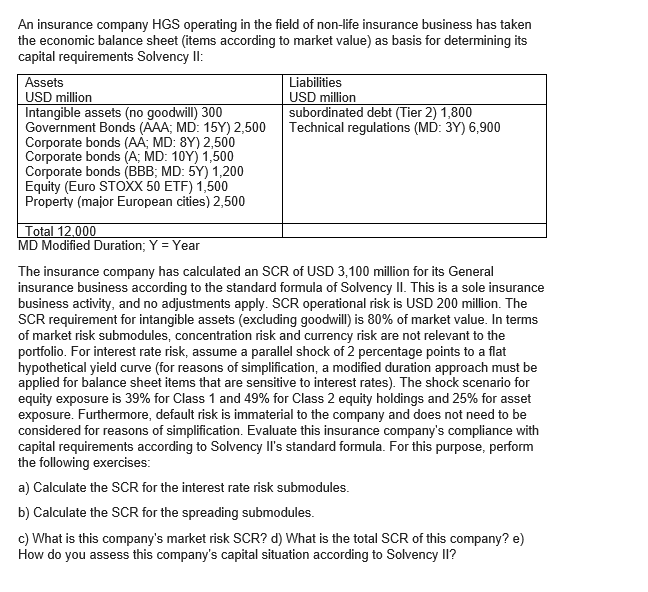

The insurance company has calculated an SCR of USD 3 , 1 0 0 million for its General insurance business according to the standard formula

The insurance company has calculated an SCR of USD million for its General

insurance business according to the standard formula of Solvency II This is a sole insurance

business activity, and no adjustments apply. SCR operational risk is USD million. The

SCR requirement for intangible assets excluding goodwill is of market value. In terms

of market risk submodules, concentration risk and currency risk are not relevant to the

portfolio. For interest rate risk, assume a parallel shock of percentage points to a flat

hypothetical yield curve for reasons of simplification, a modified duration approach must be

applied for balance sheet items that are sensitive to interest rates The shock scenario for

equity exposure is for Class and for Class equity holdings and for asset

exposure. Furthermore, default risk is immaterial to the company and does not need to be

considered for reasons of simplification. Evaluate this insurance company's compliance with

capital requirements according to Solvency II's standard formula. For this purpose, perform

the following exercises:

a Calculate the SCR for the interest rate risk submodules.

b Calculate the SCR for the spreading submodules.

c What is this company's market risk SCR d What is the total SCR of this company? e

How do you assess this company's capital situation according to Solvency II

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started