Answered step by step

Verified Expert Solution

Question

1 Approved Answer

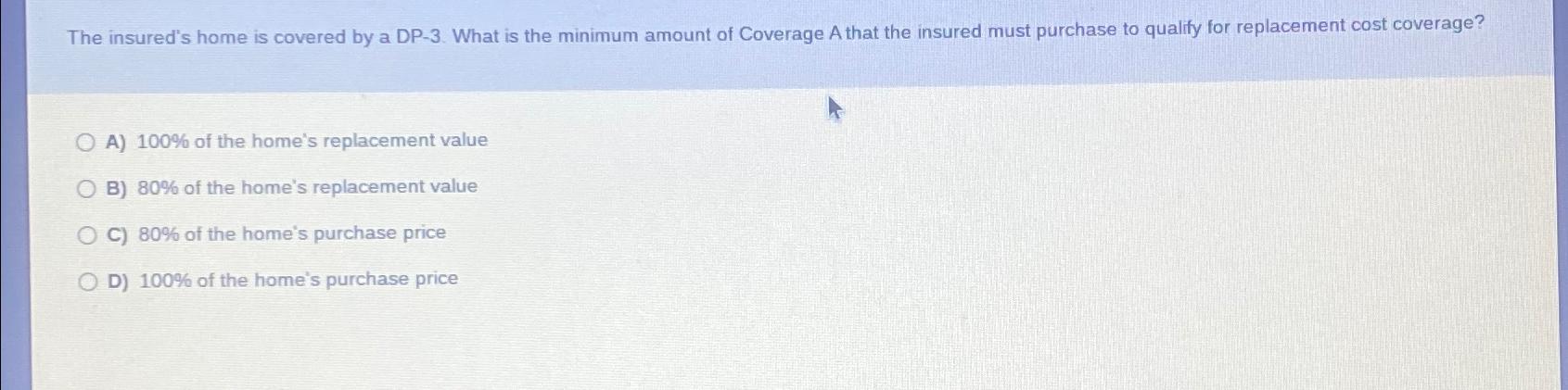

The insured's home is covered by a DP-3. What is the minimum amount of Coverage A that the insured must purchase to qualify for

The insured's home is covered by a DP-3. What is the minimum amount of Coverage A that the insured must purchase to qualify for replacement cost coverage? OA) 100% of the home's replacement value O B) 80% of the home's replacement value C) 80% of the home's purchase price D) 100% of the home's purchase price

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The question youve provided relates to an insurance policy known as DP3 which is a form of homeowners insurance that provides coverage for the dwelling on an open perils basis meaning it covers all perils except those specifically excluded in the policy documents The question asks for the minimum amount of Coverage A often referring to dwelling coverage which the insured must purchase to qualify for replacement cost coverage Replacement cost coverage means the insurance company would pay the cost to replace the damaged part of the home without deduction for depreciation For this type of policy the common industry standard requires that the homeowner ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started