Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the intangibles assets reported by IPO company at December 31, 2016 follow. patent#1 $80,000 less accumulated amortization 16,000 $64,000 patent TAKING IT FURTHER The majority

the intangibles assets reported by IPO company at December 31, 2016 follow.

patent#1 $80,000 less accumulated amortization 16,000 $64,000

patent

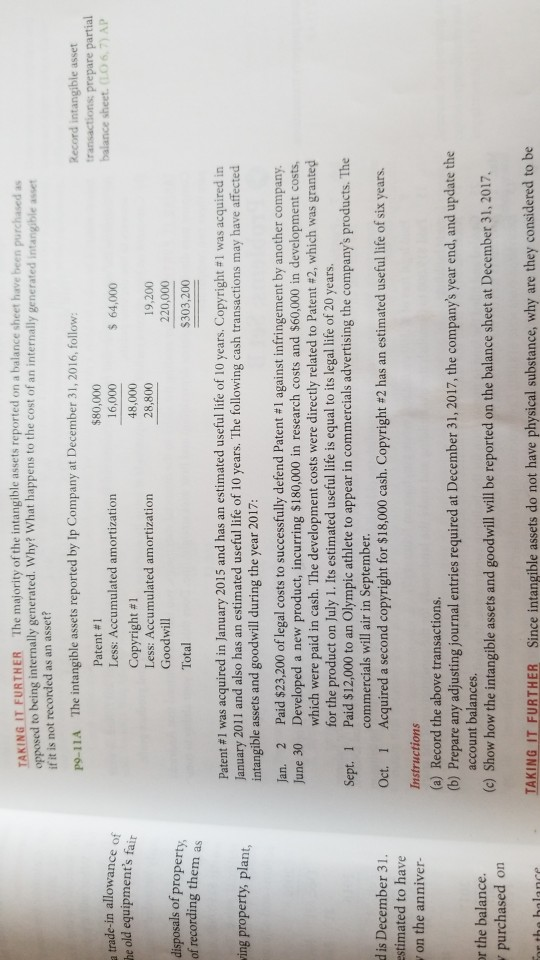

TAKING IT FURTHER The majority of the intangible assets reported on a balance sheet have been purchased as opposed to being internally generated. Why? What happens to the cost of an internally generated intangible asser if it is not recorded as an asset? The intangible assets reported by Ip Company at December 31, 2016, follow: Record intangible asset po-11A $80,000 Patent #1 Less: Accumulated amortization balance sheet. (LO 6,7) AP a trade-in allowance he old equipments fair 64,000 Copyright #1 Less: Accumulated amortization Goodwill 48,000 28,800 19,200 of property of recording them as Total $303,200 Patent #1 was acquired in January 2015 and has an estimated useful life of 10 years. Copyright #1 was aca red in January 2011 and also has an estimated useful life of 10 years. The following cash transactions may have affected intangible assets and goodwill during the year 2017: Jan. 2 Paid $23,200 oflegal costs to successfully defend Patent #1 against infringement by another company June 30 Developed a new product, incurring $180,000 in research costs and $60,000 in development costs, ving property, plant, which were paid in cash. The development costs were directly related to Patent #2, which was granted for the product on July 1. Its estimated useful life is equal to its legal life of 20 years. Paid $12,000 to an Olympic athlete to appear in commercials advertising the company's products. The Sept. 1 commercials will air in September Acquired a second copyright for $18,000 cash. Copyright #2 has an estimated useful life of six years. d is December 31 estimated to have on the anniver Oct. 1 (a) Record the above transactions b) Prepare any adjusting journal entries required at December 31, 2017, the company's year end, and update the account balances. (c) Show how the intangible assets and goodwill will be reported on the balance sheet at December 31, 2017. r the balance. y purchased on or tha bolanc AKING IT FURTHER Since intangible assets do not have physical substance, why are they considered to be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started