Question

The interest for great X is given by QXd = 6,000 - (1/2)PX - PY + 9PZ + (1/10)M Examination shows that the costs of

The interest for great X is given by

QXd = 6,000 - (1/2)PX - PY + 9PZ + (1/10)M

Examination shows that the costs of related merchandise are given by Py = $6,500 and Pz = $100, while the normal pay of people devouring this item is M = $70,000.

a. Show whether products Y and Z are substitutes or supplements for great X.

Great Y is: (Click to choose) a substitute neither supplement nor substitute a supplement .

Great Z is: (Click to choose) neither supplement nor substitute a substitute a supplement .

b. Is X a second rate or an ordinary decent?

Great X is: (Click to choose) an ordinary decent neither a typical nor a substandard decent a sub-par great .

c. What number of units of good X will be bought when Px = $5,230?

d. Decide the interest capacity and converse interest work for great X. Diagram the interest bend for great X.

Guidance: Enter all qualities as numbers, or if necessary, a decimal adjusted to one decimal spot.

Request work: - PX

Opposite request work: PX = - QXd

Guidance: Use the device gave 'D' to diagram the reverse interest bend from QX = 0 to QX = 6,000 (two focuses absolute).

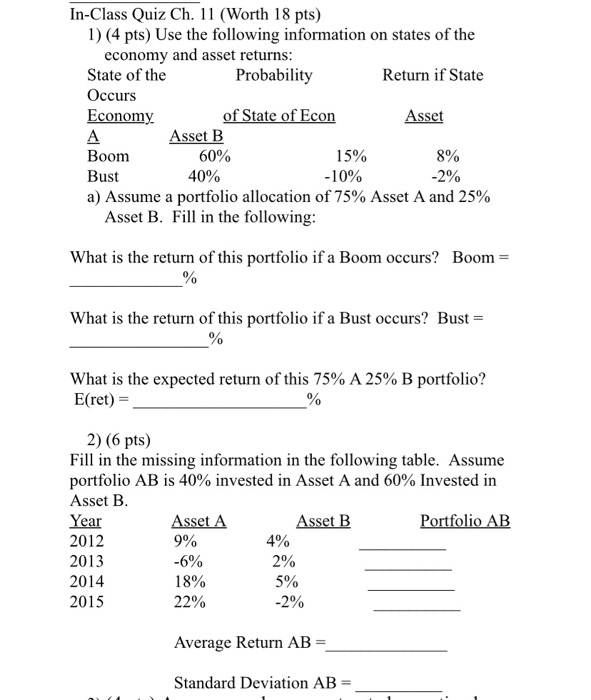

In-Class Quiz Ch. 11 (Worth 18 pts) 1) (4 pts) Use the following information on states of the economy and asset returns: State of the Probability Return if State Occurs Economy of State of Econ A Boom 8% Bust 40% -10% -2% a) Assume a portfolio allocation of 75% Asset A and 25% Asset B. Fill in the following: What is the return of this portfolio if a Boom occurs? Boom = Asset B Year 2012 60% 2013 2014 2015 What is the return of this portfolio if a Bust occurs? Bust = % What is the expected return of this 75% A 25% B portfolio? E(ret) = _% 2) (6 pts) Fill in the missing information in the following table. Assume portfolio AB is 40% invested in Asset A and 60% Invested in Asset B. Asset B Asset A 9% -6% 18% 22% 4% 15% 2% Asset 5% -2% Average Return AB = Standard Deviation AB Portfolio AB

Step by Step Solution

3.22 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions 1 a What is the return of this ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started