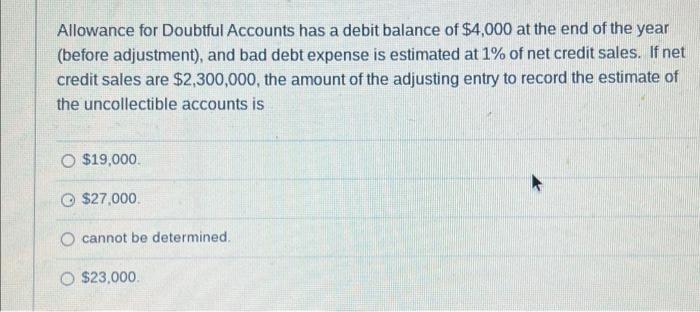

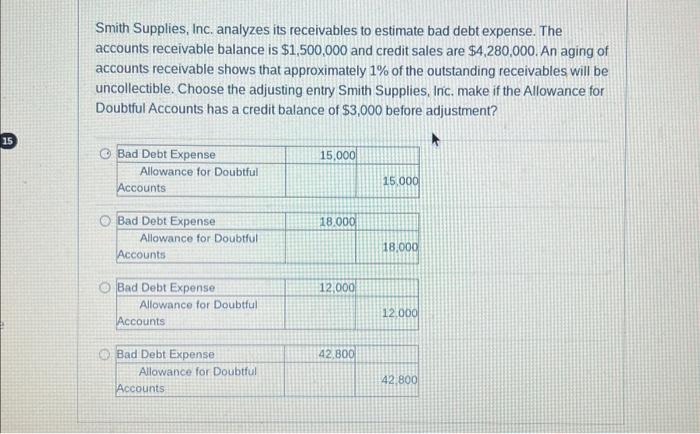

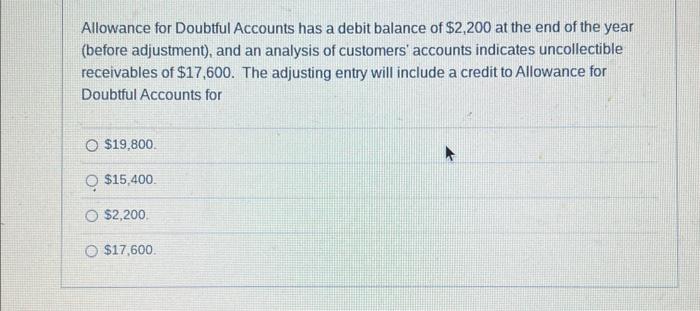

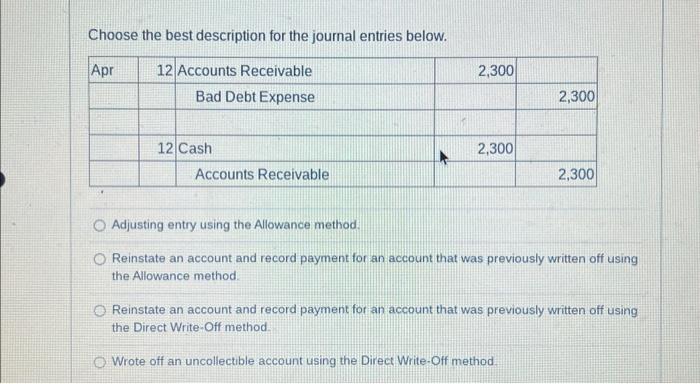

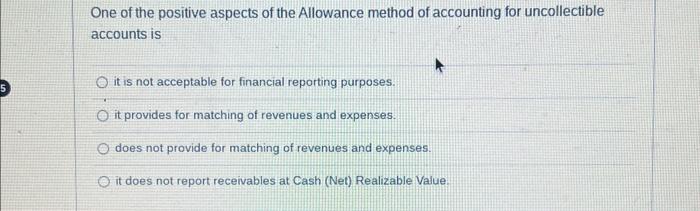

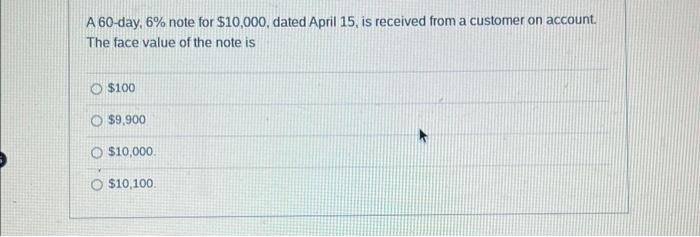

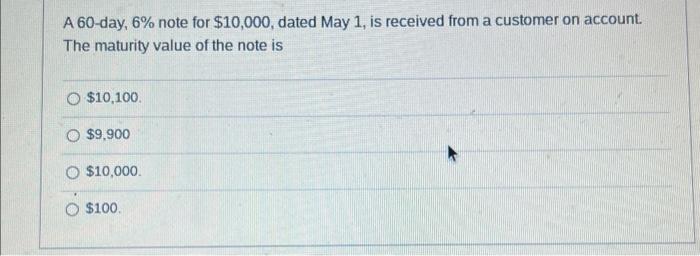

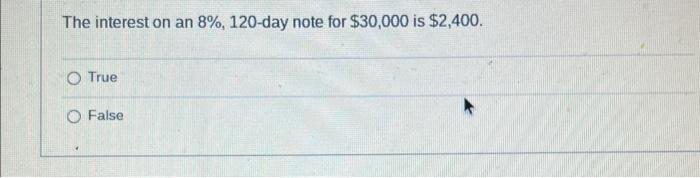

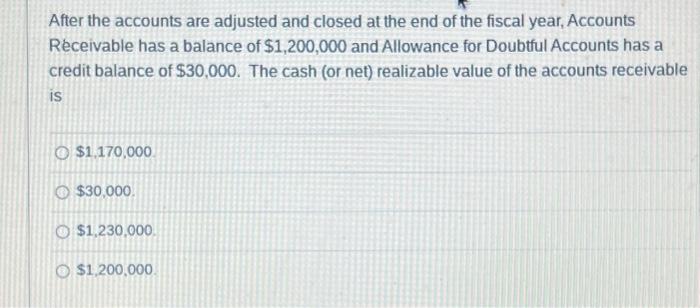

The interest on an 8%,120-day note for $30,000 is $2,400. True False Allowance for Doubtful Accounts has a debit balance of $2,200 at the end of the year (before adjustment), and an analysis of customers' accounts indicates uncollectible receivables of $17,600. The adjusting entry will include a credit to Allowance for Doubtful Accounts for $19,800. $15,400. $2,200. $17,600. Choose the best description for the journal entries below. Adjusting entry using the Allowance method. Reinstate an account and record payment for an account that was previously written off using the Allowance method. Reinstate an account and record payment for an account that was previously written off using the Direct Write-Off method Wrote off an uncollectible account using the Direct Write-Off method. Allowance for Doubtful Accounts has a debit balance of $4,000 at the end of the year (before adjustment), and bad debt expense is estimated at 1% of net credit sales. If net credit sales are $2,300,000, the amount of the adjusting entry to record the estimate of the uncollectible accounts is $19,000 $27,000. cannot be determined. $23,000. One of the positive aspects of the Allowance method of accounting for uncollectible accounts is it is not acceptable for financial reporting purposes. it provides for matching of revenues and expenses. does not provide for matching of revenues and expenses. it does not report receivables at Cash (Net) Realizable Value. Smith Supplies, Inc. analyzes its receivables to estimate bad debt expense. The accounts receivable balance is $1,500,000 and credit sales are $4,280,000. An aging of accounts receivable shows that approximately 1% of the outstanding receivables will be uncollectible. Choose the adjusting entry Smith Supplies, Inc. make if the Allowance for Doubtful Accounts has a credit balance of $3,000 before adjustment? A 60 -day, 6% note for $10,000, dated April 15 , is received from a customer on account. The face value of the note is $100 $9,900 $10,000. $10,100. After the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $1,200,000 and Allowance for Doubtul Accounts has a credit balance of $30,000. The cash (or net) realizable value of the accounts receivable is $1,170,000 $30,000. $1,230,000. $1,200,000