Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The interest rate on U.S. three-month Treasury bills dropped to very low levels at the end of 2008 and remained there for several years. The

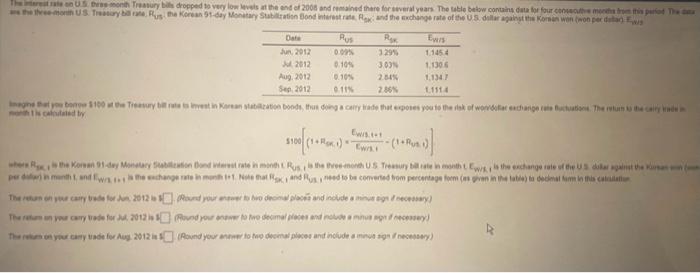

The interest rate on U.S. three-month Treasury bills dropped to very low levels at the end of 2008 and remained there for several years. The table below contains data for four consecutive months from this period. The data are the three-month U.S. Treasury bill rate, Rus: the Korean 91-day Monetary Stabilization Bond interest rate, Rek; and the exchange rate of the U.S. dollar against the Korean won (won per dollar), Ew/s Date Jun, 2012 Jul, 2012 Aug, 2012 Sep, 2012 Rus 0.09% 0.10% 0.10% 0.11% RSK 3.29% 3.03% 2.84% 2.86% Imagine that you borrow $100 at the Treasury bill rate to invest in Korean stabilization bonds, thus doing a carry trade that exposes you to the risk of won/dollar exchange rate fluctuations. The return to the carry trade in month t is calculated by: Ew/s. 1+1 5100/(1+1 $100 (1+RSK, 1)* Ewis, t Ewis 1,145.4 1.130.6 1.134.7 1,111.4 - US. 1)]. (1+Rus. t) where RSKI is the Korean 91-day Monetary Stabilization Bond interest rate in month t, Rus, t is the three-month U.S. Treasury bill rate in month t. Ew/s, t is the exchange rate of the U.S. dollar against the Korean won (won per dollar) in month t, and Ew/s, 1+1 is the exchange rate in month t+1. Note that Rsk, 1 and Rus, I need to be converted from percentage form (as given in the table) to decimal form in this calculation. The return on your carry trade for Jun, 2012 is $ (Round your answer to two decimal places and include a minus sign if necessary.) The return on your carry trade for Jul, 2012 is $ (Round your answer to two decimal places and include a minus sign if necessary.) The return on your carry trade for Aug, 2012 is $(Round your answer to two decimal places and include a minus sign if necessary.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started