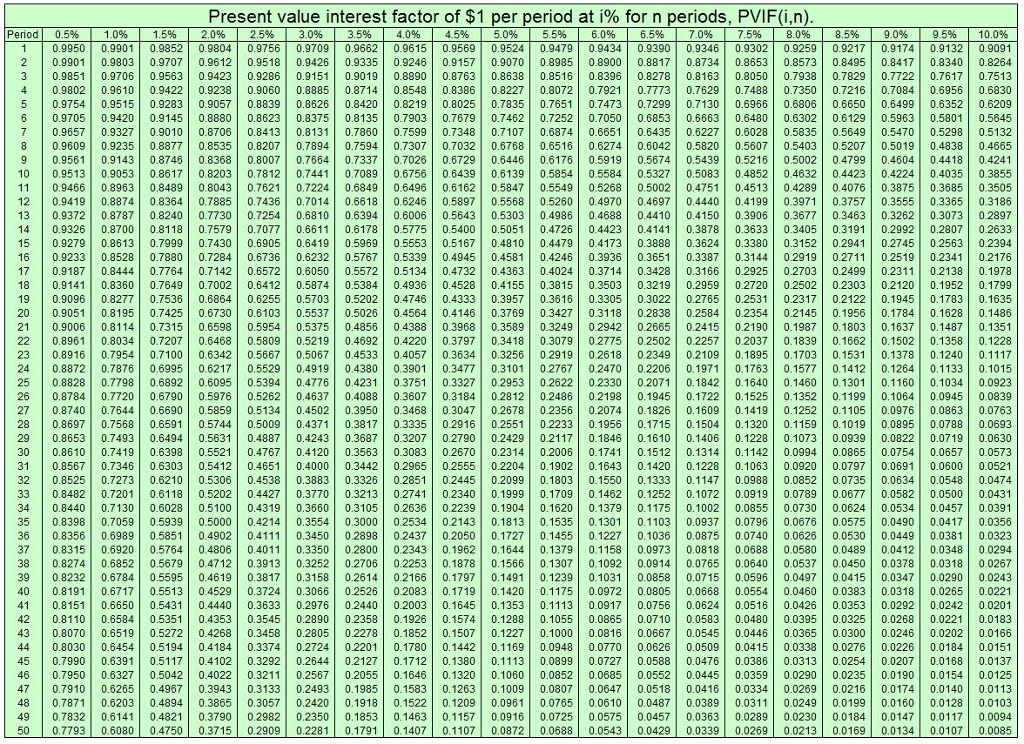

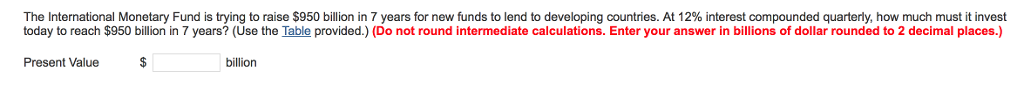

The International Monetary Fund is trying to raise $950 billion in 7 years for new funds to lend to developing countries. At 12% interest compounded quarterly, how much must it invest today to reach $950 billion in 7 years? (Use the Table provided.) (Do not round intermediate calculations. Enter your answer in billions of dollar rounded to 2 decimal places.) Present Value $ billion

The International Monetary Fund is trying to raise $950 billion in 7 years for new funds to lend to developing countries. At 12% interest compounded quarterly, how much must it invest today to reach $950 billion in 7 years? (Use the Table provided.) (Do not round intermediate calculations. Enter your answer in billions of dollar rounded to 2 decimal places.) Present Value $ billion

Present value interest factor of $1 per period at i% for n periods, PVIF(in) 1 | 0.9950 0.9901| 0.9852| 0.9804| 0.9756 0.9709| 0.9662| 0.9615 | 0.9569 0.9524| 0.9479 | 0.9434| 0.9390| 0.9346| 0.9302| 0.9259 | ?.9217| 0.9174 | 0.9132| 0.9091 2 0.99010.9803 0.9707 0.9612 0.9518 0.9426 0.9335 0.92460.9157 0.9070 0.8985 0.8900 0.8817 0.8734 0.8653 0.8573 0.8495 0.84170.8340 0.8264 3 | 0.9851 | 0.9706| 0.9563| 0.9423| 0.9286 0.9151 | 0.9019| 0.8890| 0.8763 0.8638| 0.8516| 0.8396| 0.8278 | 0.8163| 0.8050| 0.7938 | ?.7829| 0.7722| 0.7617| 0.7513 0.9802 0.9610 0.9422 0.9238 0.90600.8885 0.8714 0.8548 0.8386 0.822T 0.8072 0.7 6 0.70840.6956 0.6830 5 0.9754 0.9515 0.9283 0.9057 0.8839 0.8626 0.84200.8219 0.8025 0.7835 0.76510.7473 0.7299 0.7130 0.6966 0.6806 0.6650 0.6499 0.6352 0.6209 6 0.9705 0.9420 0.91450.8880 0.8623 0.8375 0.81350.79030.7679 0.7462 0.7252 0.7050 0.68530.6663 0.6480 0.6302 0.6129 0.5963 0.5801 0.5645 7 0.9657 0.9327 0.9010 0.8706 0.8413 0.8131 0.7860 0.7599 0.7348 0.7107 0.6874 0.6651 0.6435 0.6227 0.6028 0.5835 0.5649 0.54700.5298 0.5132 8 0.9609 0.9235 0.8877 0.8535 0.8207 0.7894 0.7594 0.7307 0.7032 0.6768 0.6516 0.6274 0.6042 0.5820 0.5607 0.5403 0.5207 0.50190.4838 04665 9 0.9561 0.9143 0.8746 0.8368 0.8007 0.7664 0.7337 0.7026 0.6729 0.6446 0.6176 0.5919 0.5674 0.5439 0.5216 0.5002 0.4799 0.46040.4418 04241 10 0.9513 0.9053 0.8617 0.8203 0,7812 0.7441 0.7089 0.6756 0.6439 0.6139 0.5854 0.5584 0.5327 0.5083 0.4852 0.4632 0.4423 0.4224 0.4035 0.3855 11 0.9466 0.8963 0.8489 0.80430,7621 0.7224 0.6849 0.6496 0.6162 0.5847 0.55490.5268 0.5002 0,4751 0,4513 0.4289 0.4076 0,3875 0.3685 0.3505 12 0.9419 0.8874 0.8364 0.7885 0.7436 0.7014 0.6618 0.6246 0.5897 0.5568 0.5260 0.497O 0.4697 0,4440 0.4199 0.3971 0.3757 0.3555 0.3365 0.3186 13 0.9372 0.8787 0.8240 0.77300.7254 0.6810 0.6394 0.6006 0.5643 0.5303 0.4986 0.4688 0.4410 0.4150 0.3906 0.3677 0.3463 0.3262 0.3073 0.2897 14 0.9326 0.8700 0.8118 0.75790.7077 0.6611 0.6178 0.5775 0.5400 0.5051 0.4726 0.4423 0.4141 0.3878 0.3633 0.3405 0.3191 0.2992 0.2807 0.2633 15 0.9279 0.8613 0.7999 0.74300.6905 0.6419 0.5969 0.5553 0.5167 0.4810 0.4479 0.4173 0.3888 0.36240.3380 0.3152 0.2941 0.2745 0.2563 0.2394 16 0.9233 0.8528 0.7880 0.7284 0.6736 0.6232 0.5767 0.5339 0.4945 0.4581 0.4246 0.3936 0.3651 0.33870.3144 0.2919 0.2711 0.2519 0.2341 0.2176 17 0.9 0.6050 055720.5134 0.4732 0.4363 0.4024 0.3714 0.3428 0.3166 0.2925 0.2703 0.2499 0.23110.2138 0.1978 18 0 2 0.64120.5874 0.53840.4936 0.4528 0.4155 0.3815 0.3503 0.3219 0.2959 0.2720 0.2502 0.2303 0.2120 0.1952 0.1799 19 0.9096 0.8277 0.7536 0.68640.6255 0.5703 0.5202 0.4746 0.4333 0.3957 0.3616 0.3305 0.3022 0.2765 0.2531 0.2317 0.2122 0.1945 0.1783 0.1635 20 0.90510.8195 0.7425 0.6730 0.6103 0.5537 0.5026 04564 0.4146 0.3769 0.3427 0.3118 0.2838 0.2584 0.2354 0.2145 0.1956 0.1784 0.1628 0.1486 21 0.90060.8114 0.7315 0.6598 0.5954 0.5375 0.4856 0.4388 0.3968 0.3589 0.32490.2942 0.2665 0.2415 0.2190 0.1987 0.1803 0.1637 0.1487 0.1351 7921 0.7773 0.7629 0.7488 0.7350 0.721 9187 0.8444 0.7764 0.7142 0.6572 0.9141 0.8360 0.7649 0.700 995 0.6217 0.5529 0,4919 0,43800.3901 0.3477 0.3101 0.276702470 0.2206 0,19710,1763 0.1577 0.1412 0,1264 0,1133 0.1015 25 0.88280.7798 0.6892 0.6095 0.5394 0,4776 0,4231 0.37510.3327 0.2953 0.2622 0.2330 0.2071 0,1842 0.1640 0.1460 0.1301 0.1160 0.1034 0.0923 2486 0.2198 0.1945 0.1722 0.1525 0.1352 0.1199 0.10640.0945 0.0839 26 0.8784 0.7720 0.6790 0.5976 0.5262 0.4637 0.4088 0.3607 0.3184 0.2812 0.3468 0994 0.0865 0.0754 0.0657 0.0573 0.25550.2204 0.1902 0.1643 0.1420 0.1228 0.1063 0.0920 0.0797 0.0691 0.06000.0521 31 0.8567 0.7346 0.6303 0.5412 0.4651 0.40 445 39 0.82320.6784 0.5595 0.4619 0.3817 0.3158 0.2614 0.2166 0.1797 0.1491 0.12390.1031 0.0858 0.0715 0.0596 0.0497 0.0415 0.0347 0.0290 0.0243 40 0.81910.6717 0.5513 0.4529 0.3724 0.3066 0.2526 0.2083 0.1719 0.1420 0.11750.0972 0.0805 0.0668 0.0554 0.0460 0.0383 0.0318 0.0265 0.0221 41 0.8151 0.6650 0.5431 0.4440 0.3633 0.2976 0.2440 0.2003 0.16450.1353 0.1 42 | 0.8110 0.6584| 0.5351 | 0.4353| 0.3545 0.2890| 0.2358| 0.1926| 0.1574 0.1288| 0.1055 | 0.0865| 0.0710| 0.0583| 0.0480| 0.0395 | ?.0325| 0.0268| 0.0221| 0.0183 113 0.0917 0.0756 0.0624 0.0 667 44 0.8030 0.6454 0.5194 0.4184 0.3374 0.2724 0 058 0.7871 0.6203 0.4894 0.38 0.0487 141

The International Monetary Fund is trying to raise $950 billion in 7 years for new funds to lend to developing countries. At 12% interest compounded quarterly, how much must it invest today to reach $950 billion in 7 years? (Use the Table provided.) (Do not round intermediate calculations. Enter your answer in billions of dollar rounded to 2 decimal places.) Present Value $ billion

The International Monetary Fund is trying to raise $950 billion in 7 years for new funds to lend to developing countries. At 12% interest compounded quarterly, how much must it invest today to reach $950 billion in 7 years? (Use the Table provided.) (Do not round intermediate calculations. Enter your answer in billions of dollar rounded to 2 decimal places.) Present Value $ billion