Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The inventories disclosure note in the 2024 financial statements for Savers Market included the following ($ in millions): During fiscal 2024, 2023 and 2022, inventory

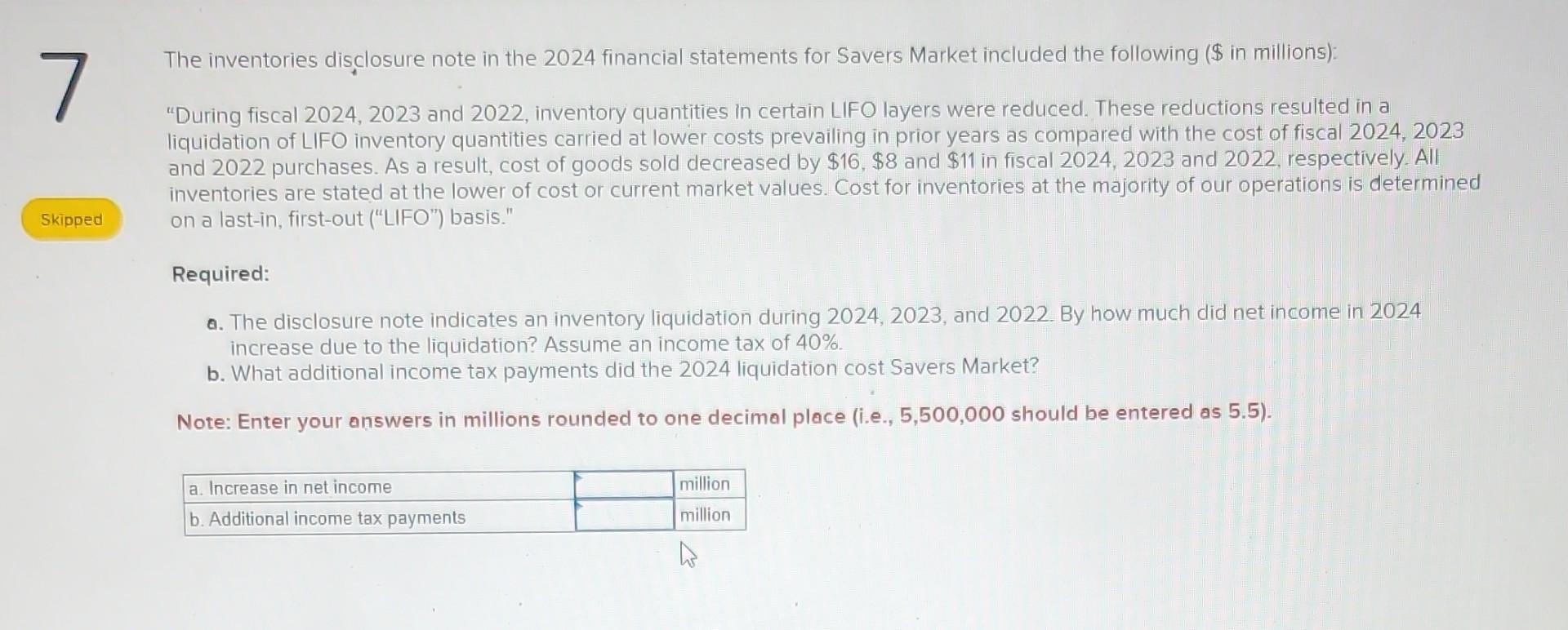

The inventories disclosure note in the 2024 financial statements for Savers Market included the following (\$ in millions): "During fiscal 2024, 2023 and 2022, inventory quantities in certain LIFO layers were reduced. These reductions resulted in a liquidation of LIFO inventory quantities carried at lower costs prevailing in prior years as compared with the cost of fiscal 2024,2023 and 2022 purchases. As a result, cost of goods sold decreased by $16,$8 and $11 in fiscal 2024,2023 and 2022 , respectively. All inventories are stated at the lower of cost or current market values. Cost for inventories at the majority of our operations is determined on a last-in, first-out ("LIFO") basis." Required: 0. The disclosure note indicates an inventory liquidation during 2024,2023 , and 2022 . By how much did net income in 2024 increase due to the liquidation? Assume an income tax of 40%. b. What additional income tax payments did the 2024 liquidation cost Savers Market? Note: Enter your answers in millions rounded to one decimal place (i.e., 5,500,000 should be entered as 5.5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started