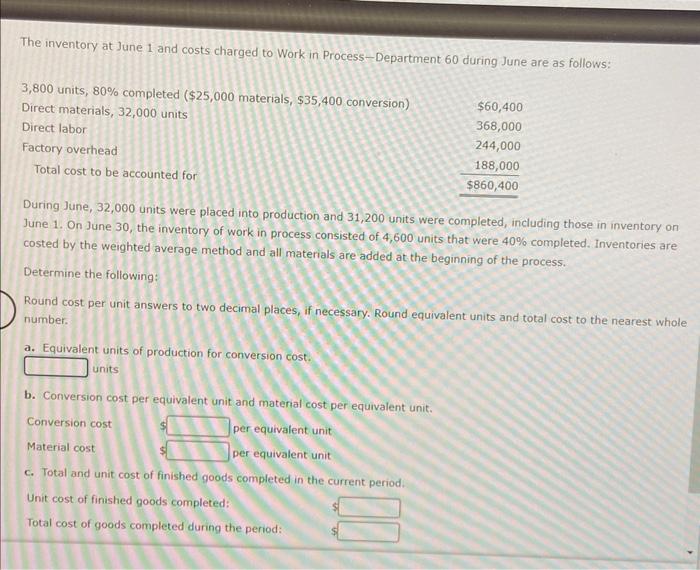

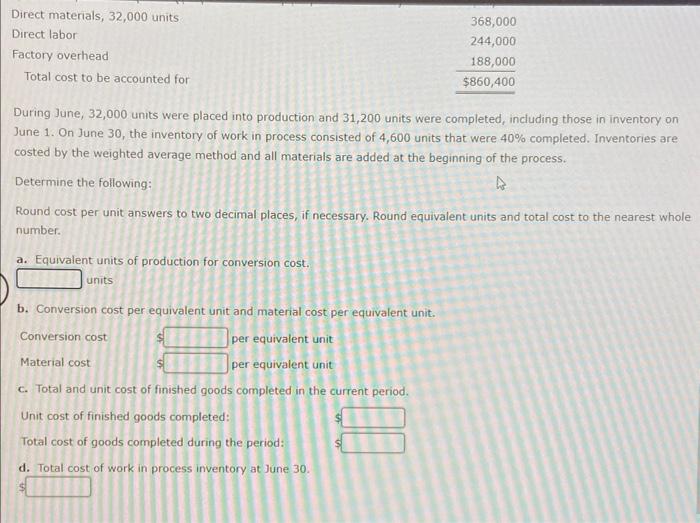

The inventory at June 1 and costs charged to Work in Process-Department 60 during June are as follows: 3,800 units, 80% completed ($25,000 materials, $35,400 conversion) Direct materials, 32,000 units Direct labor Factory overhead Total cost to be accounted for During June, 32,000 units were placed into production and 31,200 units were completed, including those in inventory on June 1. On June 30, the inventory of work in process consisted of 4,600 units that were 40% completed. Inventories are costed by the weighted average method and all materials are added at the beginning of the process. Determine the following: Round cost per unit answers to two decimal places, if necessary. Round equivalent units and total cost to the nearest whole number. a. Equivalent units of production for conversion cost. units $60,400 368,000 244,000 188,000 $860,400 b. Conversion cost per equivalent unit and material cost per equivalent unit. Conversion cost per equivalent unit Material cost per equivalent unit c. Total and unit cost of finished goods completed in the current period. Unit cost of finished goods completed: Total cost of goods completed during the period: Direct materials, 32,000 units Direct labor Factory overhead Total cost to be accounted for During June, 32,000 units were placed into production and 31,200 units were completed, including those in inventory on June 1. On June 30, the inventory of work in process consisted of 4,600 units that were 40% completed. Inventories are costed by the weighted average method and all materials are added at the beginning of the process. Determine the following: Round cost per unit answers to two decimal places, if necessary. Round equivalent units and total cost to the nearest whole number. a. Equivalent units of production for conversion cost. units 368,000 244,000 188,000 $860,400 b. Conversion cost per equivalent unit and material cost per equivalent unit. Conversion cost per equivalent unit Material cost per equivalent unit c. Total and unit cost of finished goods completed in the current period. Unit cost of finished goods completed: Total cost of goods completed during the period: d. Total cost of work in process inventory at June 30