Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The inventory method used does make a significant difference in the inventory turnover ratio? Yes or No. Please be specific in regards to where final

The inventory method used does make a significant difference in the inventory turnover ratio? Yes or No.

Please be specific in regards to where final answers are placed within the different charts.

Thank you.

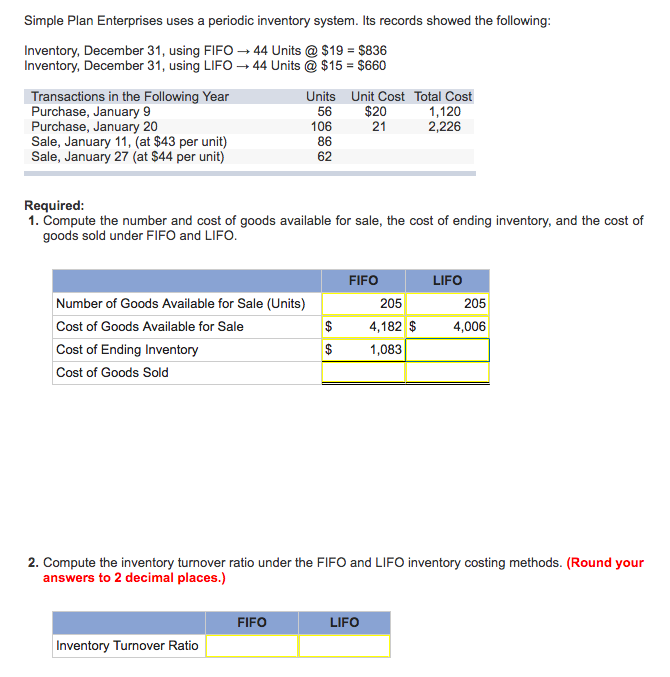

Simple Plan Enterprises uses a periodic inventory system. Its records showed the following: Inventory, December 31, using FIFO 44 Units @$19 $836 Inventory, December 31, using LIFO 44 Units $15 E$660 Units Unit Cost Total Cost Transactions in the Following Year Purchase, January 9 56 $20 1,120 2,226 Purchase, January 20 106 21 Sale, January 11, (at $43 per unit) 86 Sale, January 27 (at $44 per unit) 62 Required: 1. Compute the number and cost of goods available for sale, the cost of ending inventory, and the cost of goods sold under FIFO and LIFO FIFO LIFO Number of Goods Available for Sale (Units) 205 205 4.182 4,006 Cost of Goods Available for Sale 1,083 Cost of Ending Inventory Cost of Goods Sold 2. Compute the inventory turnover ratio under the FlFO and LIFO inventory costing methods. (Round your answers to 2 decimal places.) LIFO FIFO Inventory Turnover RatioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started