Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The inventory of the Flathead Coal Company on June 30 shows 250 tons at $68 per ton. A physical inventory on July 31 shows

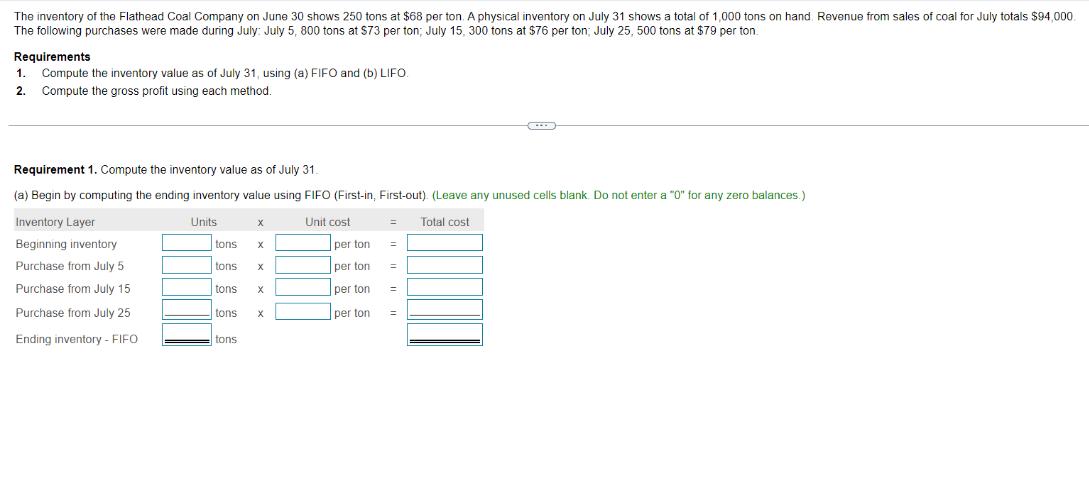

The inventory of the Flathead Coal Company on June 30 shows 250 tons at $68 per ton. A physical inventory on July 31 shows a total of 1,000 tons on hand. Revenue from sales of coal for July totals $94,000. The following purchases were made during July: July 5, 800 tons at $73 per ton; July 15, 300 tons at $76 per ton; July 25, 500 tons at $79 per ton. Requirements 1. Compute the inventory value as of July 31, using (a) FIFO and (b) LIFO. 2. Compute the gross profit using each method. Requirement 1. Compute the inventory value as of July 31. (a) Begin by computing the ending inventory value using FIFO (First-in, First-out). (Leave any unused cells blank. Do not enter a "0" for any zero balances.) Units Inventory Layer Beginning inventory Purchase from July 5 Purchase from July 15 Purchase from July 25 Ending inventory - FIFO X tons tons tons X tons tons X X X Unit cost per ton per ton per ton per ton = = = = Total cost

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

FIFO Method Inventory Layer Units x Unit Cost Total Cost Beginning In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started