Knowsley Ltd offers a mixture of standard rated and exempt supplies. In the quarter ended 31 March 2020 Knowsley Ltd's VAT records show: Input

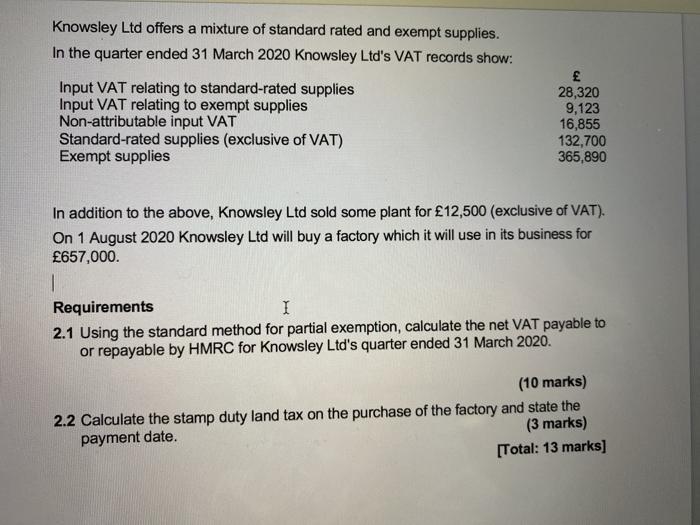

Knowsley Ltd offers a mixture of standard rated and exempt supplies. In the quarter ended 31 March 2020 Knowsley Ltd's VAT records show: Input VAT relating to standard-rated supplies Input VAT relating to exempt supplies Non-attributable input VAT Standard-rated supplies (exclusive of VAT) Exempt supplies 28,320 9,123 16,855 132,700 365,890 In addition to the above, Knowsley Ltd sold some plant for 12,500 (exclusive of VAT). On 1 August 2020 Knowsley Ltd will buy a factory which it will use in its business for 657,000. I Requirements I 2.1 Using the standard method for partial exemption, calculate the net VAT payable to or repayable by HMRC for Knowsley Ltd's quarter ended 31 March 2020. (10 marks) 2.2 Calculate the stamp duty land tax on the purchase of the factory and state the payment date. (3 marks) [Total: 13 marks]

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

21 The net VAT payable to or repayable by HMRC for Knowsley Ltds quarter ended 3132020 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started