Answered step by step

Verified Expert Solution

Question

1 Approved Answer

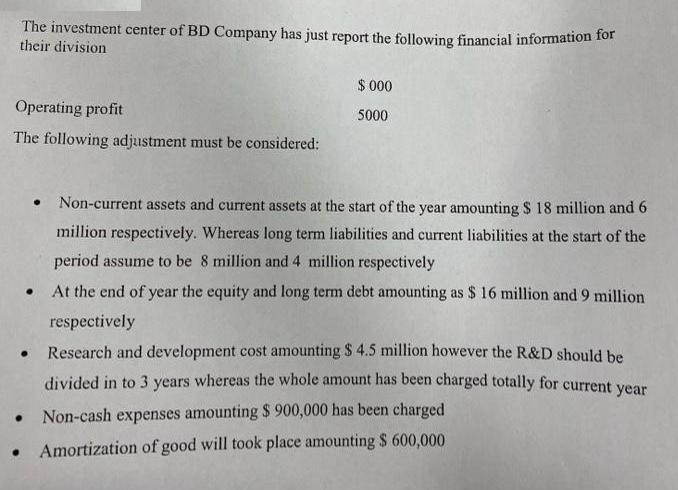

The investment center of BD Company has just report the following financial information for their division Operating profit The following adjustment must be considered:

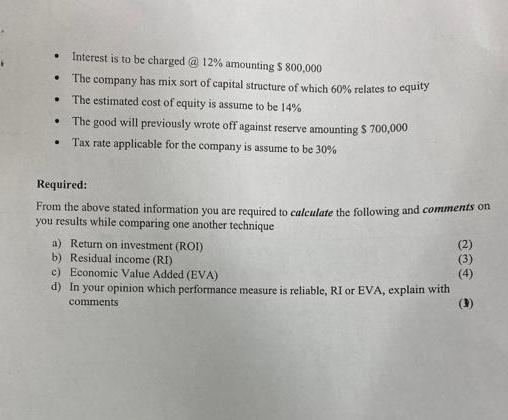

The investment center of BD Company has just report the following financial information for their division Operating profit The following adjustment must be considered: Non-current assets and current assets at the start of the year amounting $ 18 million and 6 million respectively. Whereas long term liabilities and current liabilities at the start of the period assume to be 8 million and 4 million respectively At the end of year the equity and long term debt amounting as $ 16 million and 9 million respectively Research and development cost amounting $ 4.5 million however the R&D should be divided in to 3 years whereas the whole amount has been charged totally for current year Non-cash expenses amounting $ 900,000 has been charged Amortization of good will took place amounting $ 600,000 . $ 000 5000 . . . . . Interest is to be charged @ 12% amounting $ 800,000 The company has mix sort of capital structure of which 60% relates to equity The estimated cost of equity is assume to be 14% The good will previously wrote off against reserve amounting $ 700,000 Tax rate applicable for the company is assume to be 30% Required: From the above stated information you are required to calculate the following and comments on you results while comparing one another technique a) Return on investment (ROI) b) Residual income (RI) c) Economic Value Added (EVA) d) In your opinion which performance measure is reliable, RI or EVA, explain with comments (1) (2) (3)

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a Comment The return on investment ROI is a measure of the profitability of an investment center It is calculated by dividing the operating profit by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started