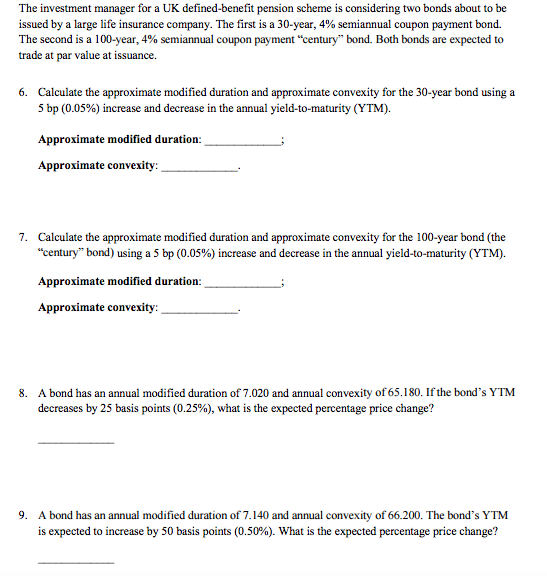

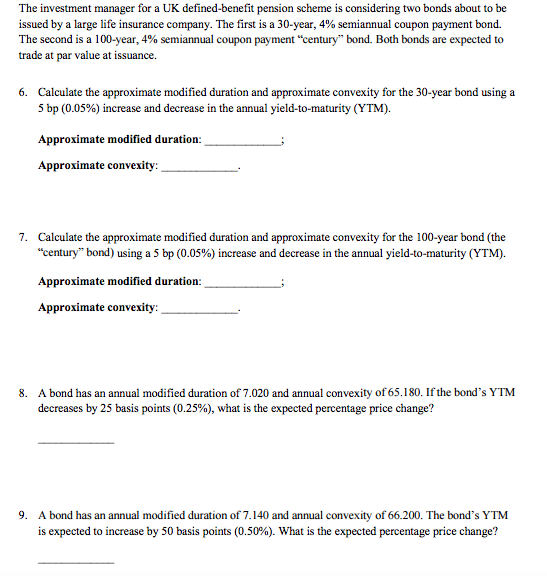

The investment manager for a UK defined-benefit pension scheme is considering two bonds about to be issued by a large life insurance company. The first is a 30-year, 4% semiannual coupon payment bond. The second is a 100-year, 4% semiannual coupon payment "century" bond. Both bonds are expected to trade at par value at issuance. Calculate the approximate modified duration and approximate convexity for the 30-year bond using a 5 bp (0.05%) increase and decrease in the annual yield-to-maturity (YTM). Approximate modified duration: _____; Approximate convexity: _____; Calculate the approximate modified duration and approximate convexity for the 100-year bond (the "century" bond) using a 5 bp (0.05%) increase and decrease in the annual yield-to-maturity (YTM). Approximate modified duration: _____; Approximate convexity: _____; A bond has an annual modified duration of 7.020 and annual convex of 65.180. If the bond's YTM decreases by 25 basis points (0.25%), what is the expected percentage price change? A bond has an annual modified duration of 7.140 and annual convexity of 66.200. The bond's YTM is expected to increase by 50 basis points (0.50%). What is the expected percentage price change? The investment manager for a UK defined-benefit pension scheme is considering two bonds about to be issued by a large life insurance company. The first is a 30-year, 4% semiannual coupon payment bond. The second is a 100-year, 4% semiannual coupon payment "century" bond. Both bonds are expected to trade at par value at issuance. Calculate the approximate modified duration and approximate convexity for the 30-year bond using a 5 bp (0.05%) increase and decrease in the annual yield-to-maturity (YTM). Approximate modified duration: _____; Approximate convexity: _____; Calculate the approximate modified duration and approximate convexity for the 100-year bond (the "century" bond) using a 5 bp (0.05%) increase and decrease in the annual yield-to-maturity (YTM). Approximate modified duration: _____; Approximate convexity: _____; A bond has an annual modified duration of 7.020 and annual convex of 65.180. If the bond's YTM decreases by 25 basis points (0.25%), what is the expected percentage price change? A bond has an annual modified duration of 7.140 and annual convexity of 66.200. The bond's YTM is expected to increase by 50 basis points (0.50%). What is the expected percentage price change