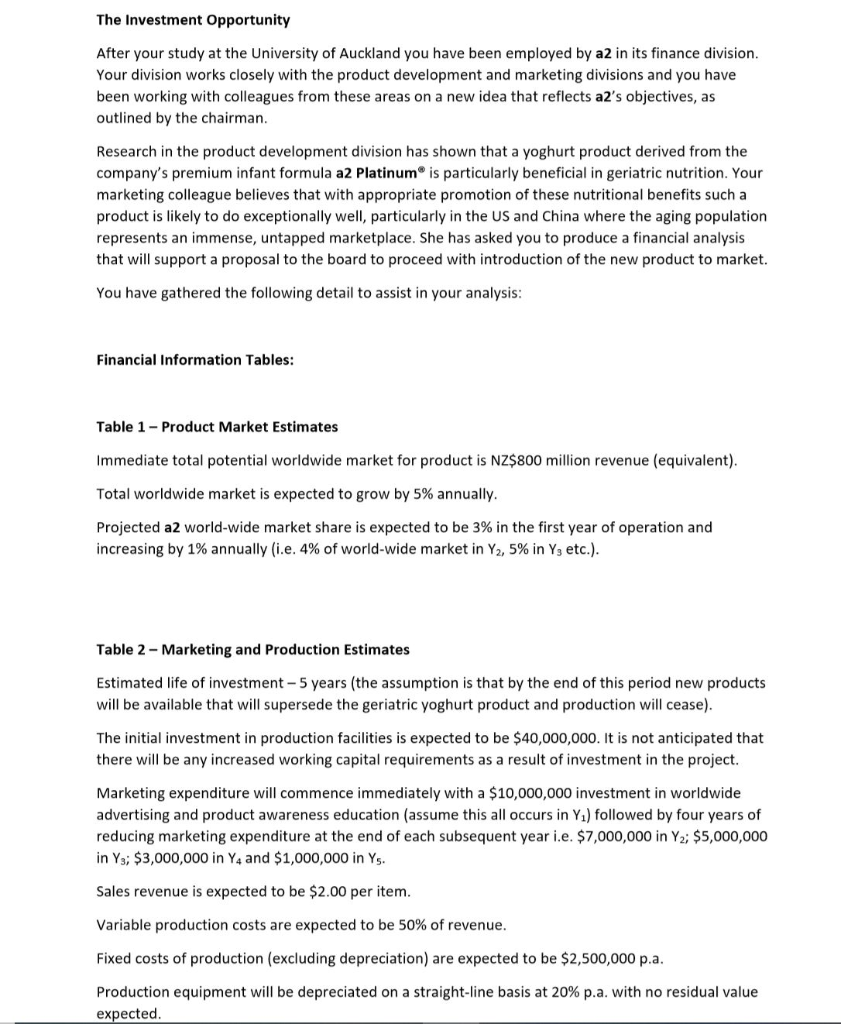

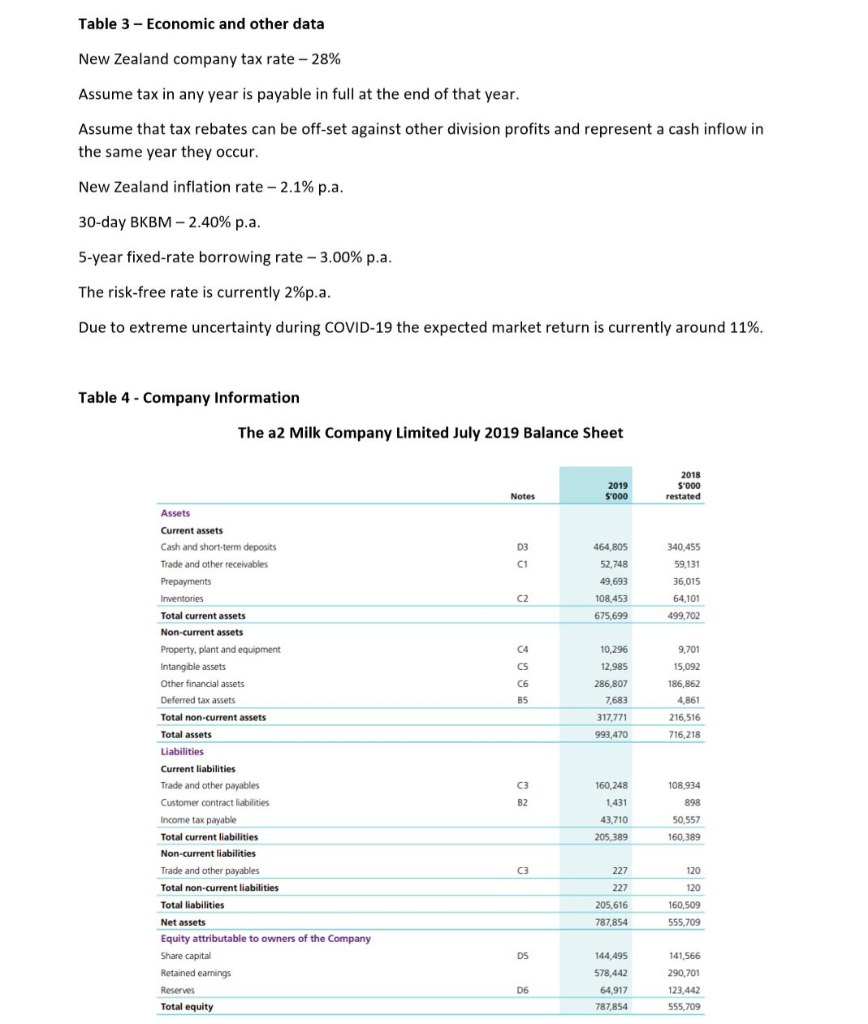

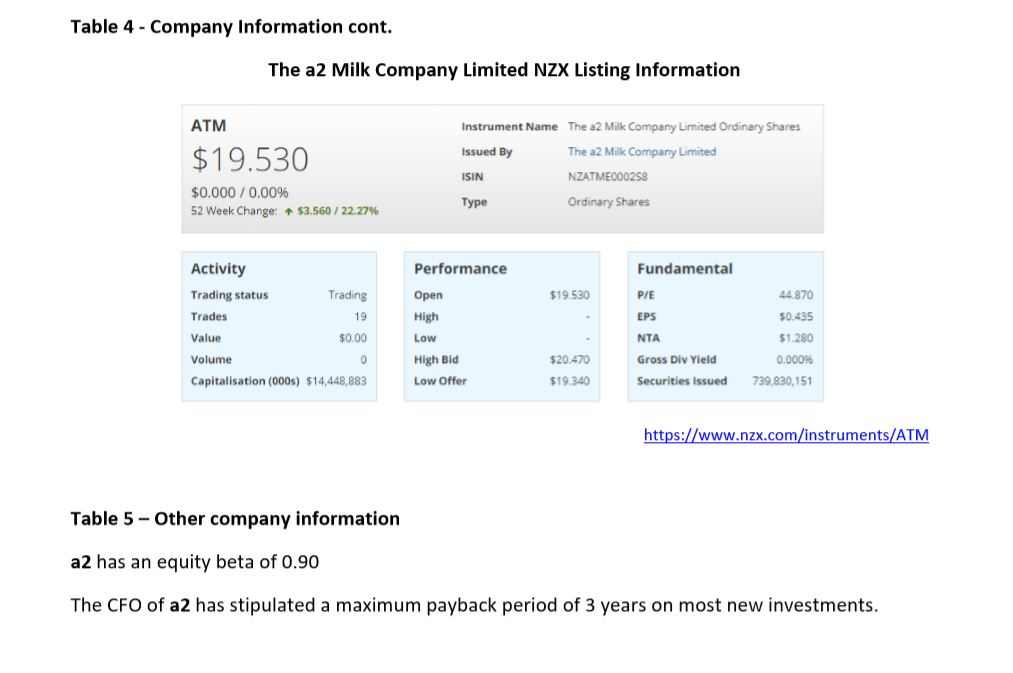

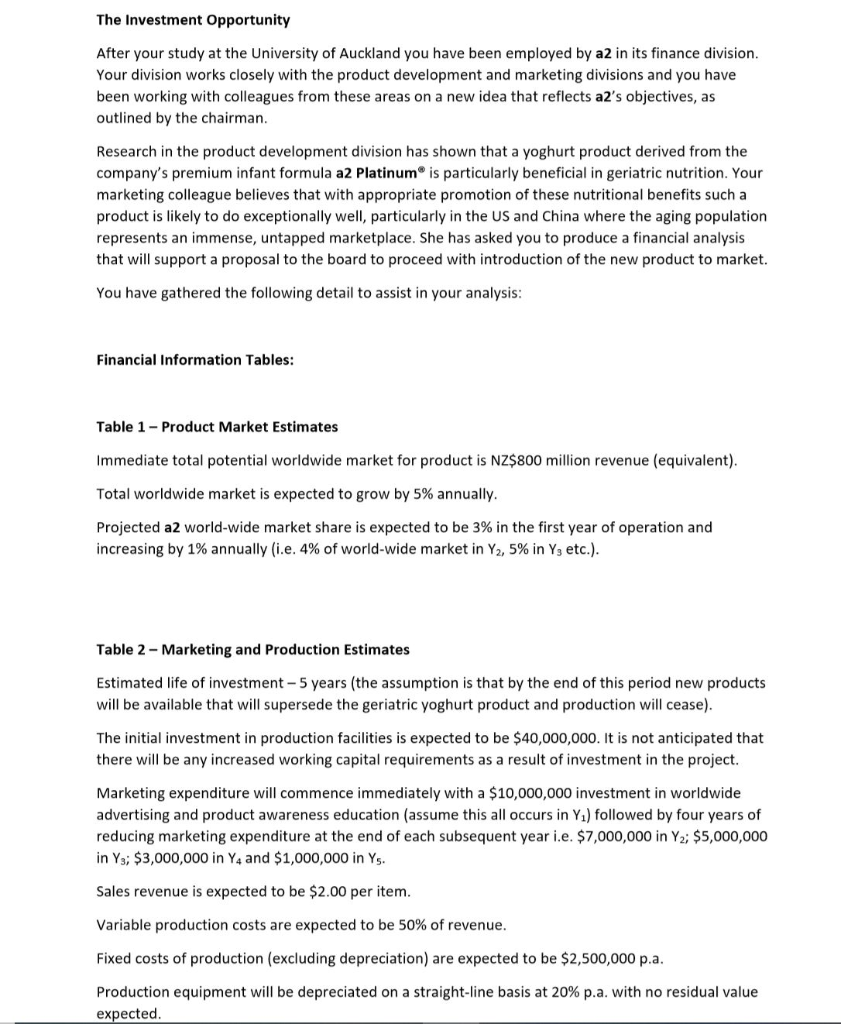

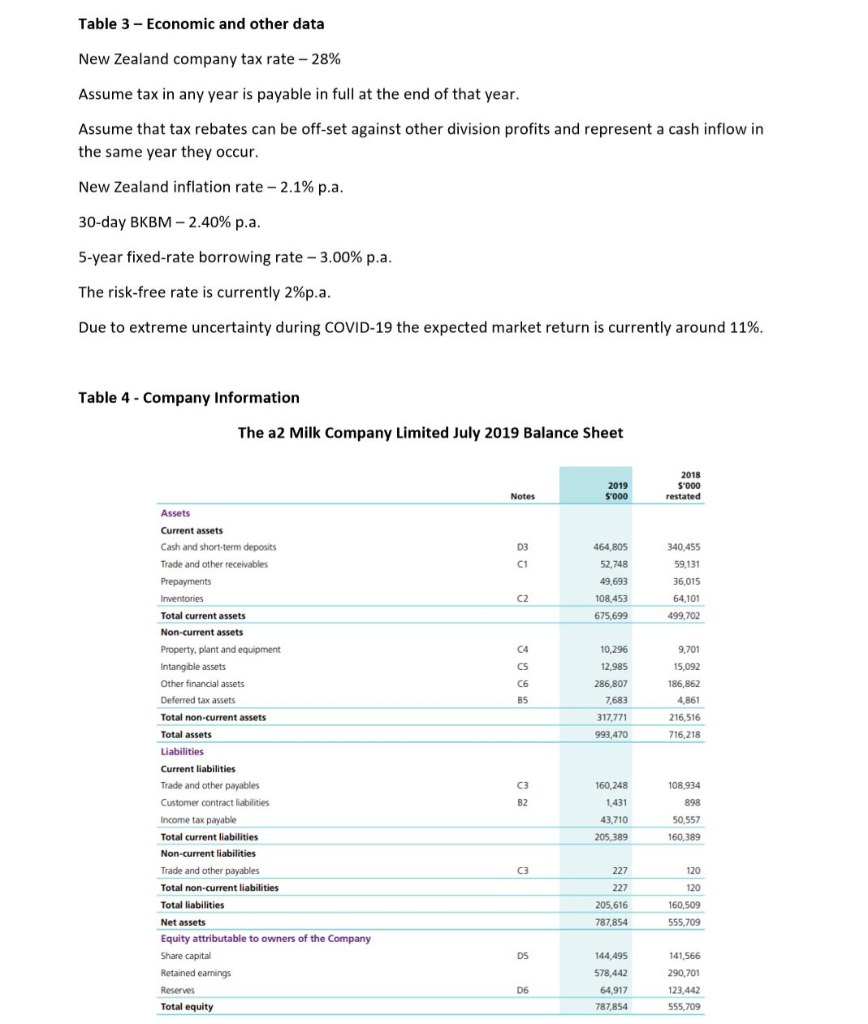

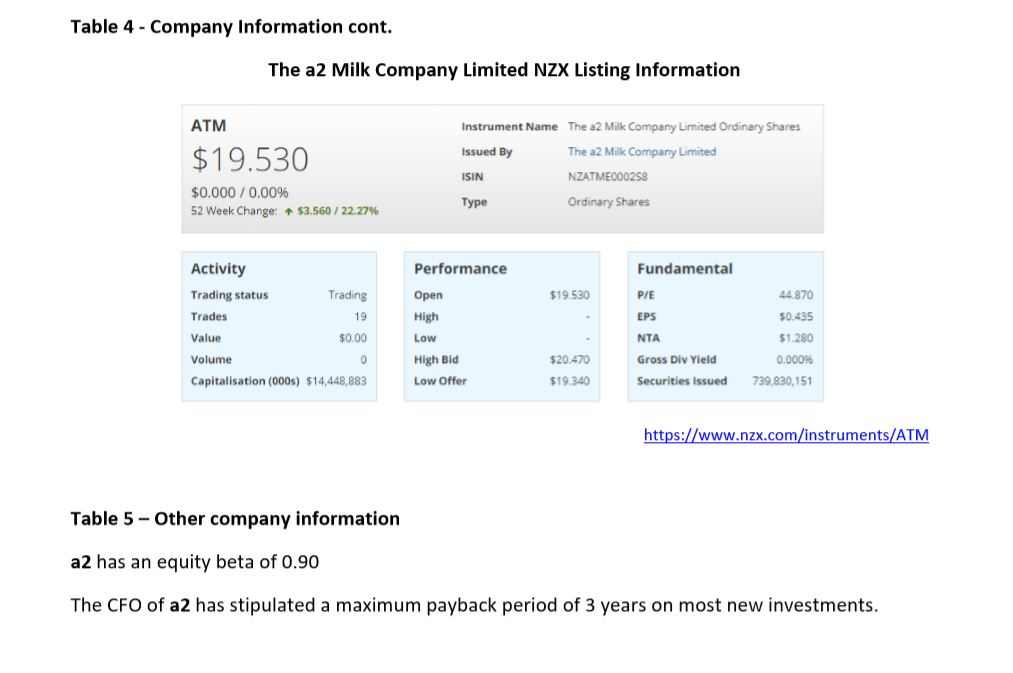

The Investment Opportunity After your study at the University of Auckland you have been employed by a 2 in its finance division. Your division works closely with the product development and marketing divisions and you have been working with colleagues from these areas on a new idea that reflects a2's objectives, as outlined by the chairman Research in the product development division has shown that a yoghurt product derived from the company's premium infant formula a2 Platinum is particularly beneficial in geriatric nutrition. Your marketing colleague believes that with appropriate promotion of these nutritional benefits such a product is likely to do exceptionally well, particularly in the US and China where the aging population represents an immense, untapped marketplace. She has asked you to produce a financial analysis that will support a proposal to the board to proceed with introduction of the new product to market. You have gathered the following detail to assist in your analysis: Financial Information Tables: Table 1 - Product Market Estimates Immediate total potential worldwide market for product is NZ$800 million revenue (equivalent). Total worldwide market is expected to grow by 5% annually. Projected a2 world-wide market share is expected to be 3% in the first year of operation and increasing by 1% annually (i.e. 4% of world-wide market in Y2, 5% in Y; etc.). Table 2 - Marketing and Production Estimates Estimated life of investment -5 years (the assumption is that by the end of this period new products will be available that will supersede the geriatric yoghurt product and production will cease). The initial investment in production facilities is expected to be $40,000,000. It is not anticipated that there will be any increased working capital requirements as a result of investment in the project. Marketing expenditure will commence immediately with a $10,000,000 investment in worldwide advertising and product awareness education (assume this all occurs in Y) followed by four years of reducing marketing expenditure at the end of each subsequent year i.e. $7,000,000 in Yz; $5,000,000 in Ys; $3,000,000 in Y4 and $1,000,000 in Ys. Sales revenue is expected to be $2.00 per item. Variable production costs are expected to be 50% of revenue. Fixed costs of production (excluding depreciation) are expected to be $2,500,000 p.a. Production equipment will be depreciated on a straight-line basis at 20% p.a. with no residual value expected. Table 3 - Economic and other data New Zealand company tax rate -28% Assume tax in any year is payable in full at the end of that year. Assume that tax rebates can be off-set against other division profits and represent a cash inflow in the same year they occur. New Zealand inflation rate - 2.1% p.a. 30-day BKBM - 2.40% p.a. 5-year fixed-rate borrowing rate - 3.00% p.a. The risk-free rate is currently 2%p.a. Due to extreme uncertainty during COVID-19 the expected market return is currently around 11%. Table 4 - Company Information The a2 Milk Company Limited July 2019 Balance Sheet 2019 5000 2018 S'000 restated Notes D3 C1 464,805 52,748 49,693 108,453 675,699 340,455 59,131 36,015 64,101 499,702 C2 C4 9,701 C5 10,296 12.985 286,807 7,683 15,092 186,862 C6 B5 4,861 317771 993,470 216,516 716,218 Assets Current assets Cash and short-term deposits Trade and other receivables Prepayments Inventories Total current assets Non-current assets Property, plant and equipment Intangible assets Other financial assets Deferred tax assets Total non-current assets Total assets Liabilities Current liabilities Trade and other payables Customer contract liabilities Income tax payable Total current liabilities Non-current liabilities Trade and other payables Total non-current liabilities Total liabilities Net assets Equity attributable to owners of the Company Share capital Retained earnings Reserves Total equity 160.248 C3 B2 1,431 43,710 205,389 108.934 898 50,557 160,389 03 120 120 227 227 205,616 787,854 160,509 555,709 DS 144,495 141,566 290,701 123,442 555,709 578,442 64,917 787,854 D6 Table 4 - Company Information cont. The a2 Milk Company Limited NZX Listing Information ATM $19.530 Instrument Name The 32 Milk Company Limited Ordinary Shares Issued By The a2 Milk Company Limited ISIN NZATME000258 $0.000 / 0.00% 52 Week Change: +$3.560 / 22.27% Type Ordinary Shares Activity Performance Fundamental Trading $19.530 44.870 Trading status Trades 19 Value $0.00 Open High Low High Bid Low Offer P/E EPS NTA Gross Div Yield Securities Issued $0.435 51.280 0.000% 739.830,151 Volume 0 Capitalisation (000s) $14,448,883 $20.470 $19.340 https://www.nzx.com/instruments/ATM Table 5 - Other company information a2 has an equity beta of 0.90 The CFO of a2 has stipulated a maximum payback period of 3 years on most new investments. Calculate the NPV and IRR of the investment project. (2 marks) Calculate the payback period for the investment project. (2 marks)