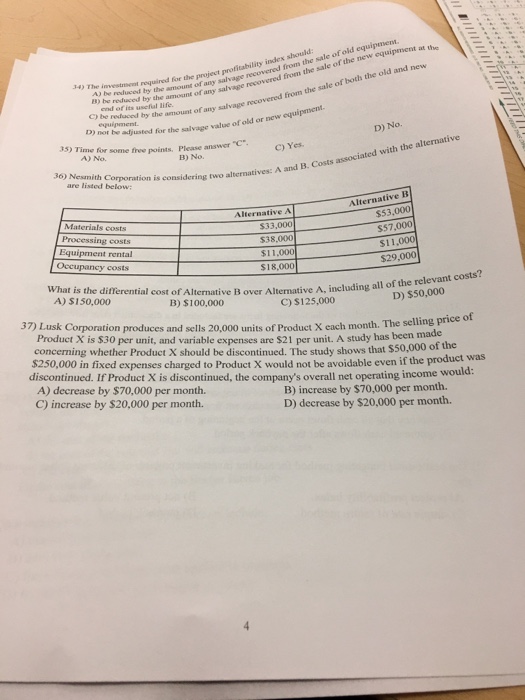

The investment required for the project profitability index should: A) be reduced by the amount of any salvage recovered from the sale of old equipment, B) be reduced by the amount of any salvage recovered from the sale of the new equipment at the end of its useful life C) be reduced by the amount of salvage recovered from the sale of both the old and of old or new equipment. D) not be adjusted for the salvage value of old or new equipment. Time for some free points. Please answer "C". A) No. B) No. C) Yes. D) No. corporation is considering two alternatives: A and B. Costs associated with the alternative are listed below: What is the differential cost of Alternative B over Alternative A, including all of the relevant costs? A) $150,000 B) $100,000 C)$125,000 D) $50,000 Lusk Corporation produces and sells 20,000 units of Product X each month The selling price of Product X is $30 per unit, and variable expenses are $21 per unit. A study has concerning whether Product X should be discontinued. The study shows that $50,000 of the $250,000 in fixed expenses charged to Product X would not be avoidable even if the product was discontinued. If Product X is discontinued, the company's overall net operating income would: A) decrease by $70,000 per month. B) increase by $70,000 per month. C) increase by $20,000 per month. D) decrease by $20,000 per month. The investment required for the project profitability index should: A) be reduced by the amount of any salvage recovered from the sale of old equipment, B) be reduced by the amount of any salvage recovered from the sale of the new equipment at the end of its useful life C) be reduced by the amount of salvage recovered from the sale of both the old and of old or new equipment. D) not be adjusted for the salvage value of old or new equipment. Time for some free points. Please answer "C". A) No. B) No. C) Yes. D) No. corporation is considering two alternatives: A and B. Costs associated with the alternative are listed below: What is the differential cost of Alternative B over Alternative A, including all of the relevant costs? A) $150,000 B) $100,000 C)$125,000 D) $50,000 Lusk Corporation produces and sells 20,000 units of Product X each month The selling price of Product X is $30 per unit, and variable expenses are $21 per unit. A study has concerning whether Product X should be discontinued. The study shows that $50,000 of the $250,000 in fixed expenses charged to Product X would not be avoidable even if the product was discontinued. If Product X is discontinued, the company's overall net operating income would: A) decrease by $70,000 per month. B) increase by $70,000 per month. C) increase by $20,000 per month. D) decrease by $20,000 per month