Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The investments of Charger Inc. include an investment of trading securities of Raiders Inc. purchased on February 24, 2017, for $560,000. The fair value

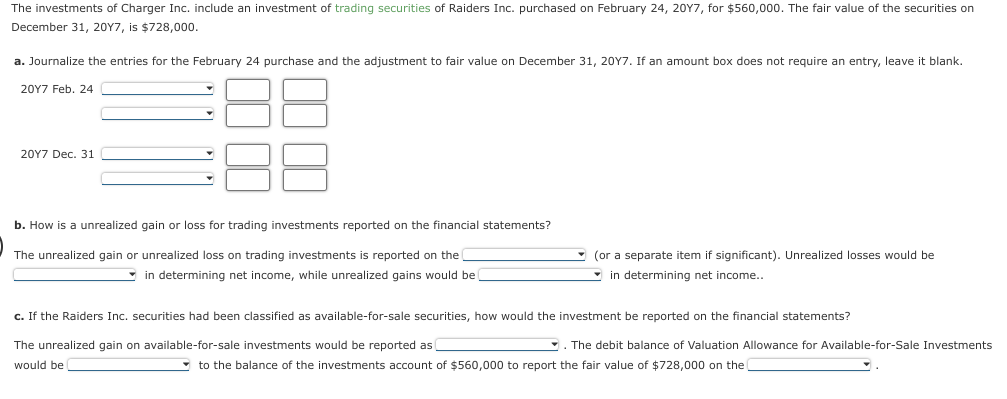

The investments of Charger Inc. include an investment of trading securities of Raiders Inc. purchased on February 24, 2017, for $560,000. The fair value of the securities on December 31, 2017, is $728,000. a. Journalize the entries for the February 24 purchase and the adjustment to fair value on December 31, 2017. If an amount box does not require an entry, leave it blank. 2017 Feb. 24 20Y7 Dec. 31 b. How is a unrealized gain or loss for trading investments reported on the financial statements? The unrealized gain or unrealized loss on trading investments is reported on the in determining net income, while unrealized gains would be (or a separate item if significant). Unrealized losses would be in determining net income.. c. If the Raiders Inc. securities had been classified as available-for-sale securities, how would the investment be reported on the financial statements? The unrealized gain on available-for-sale investments would be reported as . The debit balance of Valuation Allowance for Available-for-Sale Investments would be to the balance of the investments account of $560,000 to report the fair value of $728,000 on the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Journal Entries February 24 20Y7 Trading Securities Raiders Inc 560000 Cash 560000 December 31 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started