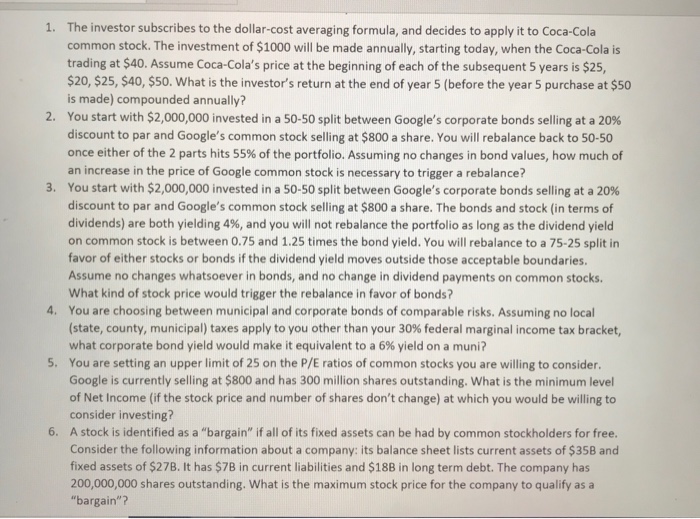

The investor subscribes to the dollar-cost averaging formula, and decides to apply it to Coca-Cola common stock. The investment of $1000 will be made annually, starting today, when the Coca-Cola is trading at $40. Assume Coca-Cola's price at the beginning of each of the subsequent 5 years is $25 $20, $25, $40, $50. What is the investor's return at the end of year 5 (before the year 5 purchase at $50 is made) compounded annually? You start with $2,000,000 invested in a 50-50 split between Google's corporate bonds selling at a 20% discount to par and Google's common stock selling at $800 a share. You will rebalance back to 50-50 once either of the 2 parts hits 55% of the portfolio. Assuming no changes in bond values, how much of n increase in the price of Google common stock is necessary to trigger a rebalance? You start with $2,000,000 invested in a 50-50 split between Google's corporate bonds selling at a 20% discount to par and Google's common stock selling at $800 a share. The bonds and stock (in terms of dividends) are both yielding 4%, and you will not rebalance the portfolio as long as the dividend yield on common stock is between 0.75 and 1.25 times the bond yield. You will rebalance to a 75-25 split in favor of either stocks or bonds if the dividend yield moves outside those acceptable boundaries Assume no changes whatsoever in bonds, and no change in dividend payments on common stocks What kind of stock price would trigger the rebalance in favor of bonds? You are choosing between municipal and corporate bonds of comparable risks. Assuming no local (state, county, municipal) taxes apply to you other than your 30% federal marginal income tax bracket, what corporate bond yield would make it equivalent to a 6% yield on a muni? You are setting an upper limit of 25 on the P/E ratios of common stocks you are willing to consider Google is currently selling at $800 and has 300 million shares outstanding. What is the minimum level of Net Income (if the stock price and number of shares don't change) at which you would be willing to consider investing? A stock is identified as a "bargain" if all of its fixed assets can be had by common stockholders for free Consider the following information about a company: its balance sheet lists current assets of $358 and fixed assets of $27B. It has $7B in current liabilities and $18B in long term debt. The company has 200,000,000 shares outstanding. What is the maximum stock price for the company to qualify as "bargain"? 1. 2. 5. 6