Question

The IOP Boogie Clinic began operating on January 1, 2015. It provides a variety of medical services to boogie boarders, surfers, and other beachgoers. The

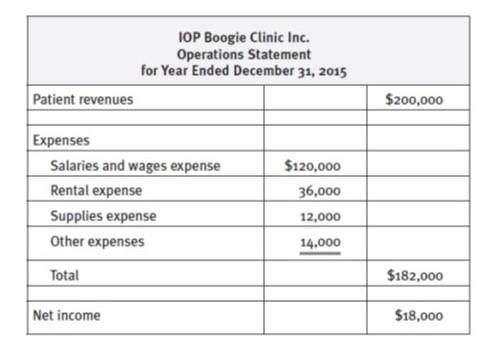

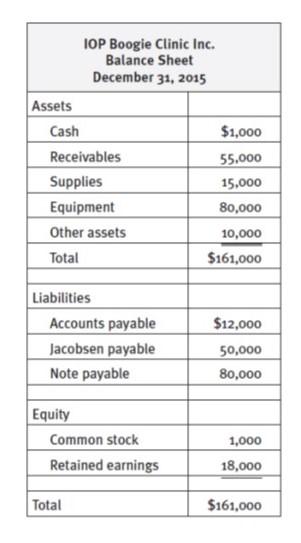

The IOP Boogie Clinic began operating on January 1, 2015. It provides a variety of medical services to boogie boarders, surfers, and other beachgoers. The head physician, Dr. Cheryl Jacobsen, is completely dedicated to providing outstanding medical care at a reasonable price. The competent care, friendly staff, and reasonable cost quickly resulted in a good buzz about the clinic among the beach community. As a result, revenues grew steadily throughout the year. On December 31, 2015, Dr. Jacobsen noticed that the checkbook balance was extremely low. She was dismayed because her mother had loaned the IOP Boogie Clinic $50,000 for operating funds to get the clinic started and she had promised to pay her mother 6 percent interest on the loan. Dr. Jacobsen was reluctant to borrow additional funds from her mother, so on January 4, 2016, she went to the local bank to request a loan. The bank loan officer was friendly and supportive but requested financial statements for the IOP Boogie Clinic before the bank would approve a loan. On January 5, 2016, Dr. Jacobsen asked the office administrator to prepare financial statements for the calendar year 2015. Later that day, the office administrator returned with the financial statements shown here:

On January 6, 2016, Dr. Jacobsen presented the bank loan officer with the financial statements. The loan officer asked several questions about the statements, such as how the supplies amount was determined [supplies purchased in last quarter], how much interest was recorded [none], and so on. Much to Dr. Jacobsens dismay, the loan officer said the statements appeared to omit items required by generally accepted accounting principles, such as depreciation, accruals, and inventory counts. The statements would have to be changed to reflect GAAP. Dr. Jacobsen was quite upset at this rejection. She had not anticipated any problems borrowing money at the bank and was frustrated by the amount of time she was spending on the IOP Boogie Clinic financing matters. On her way back to the clinic, Dr. Jacobsen called her mother to vent about the problem. Her mother told her that her stepfather, Tom, a certified public accountant, would help her out. The stepfathers subsequent review of the accounting records and other supporting information revealed the following:

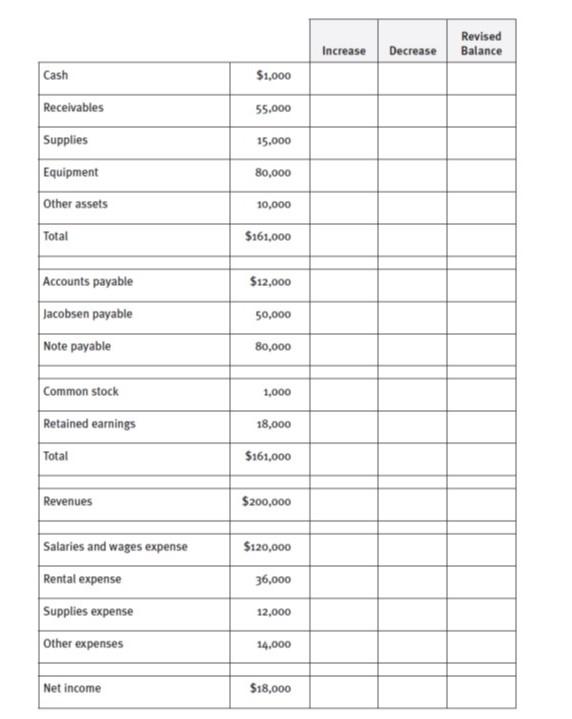

Unpaid salaries and wages at December 31, 2015, totaled $10,000. The equipment, purchased on January 5, 2015, had an estimated useful life of five years and a $20,000 salvage value. Other expenses include $6,000 of prepaid insurance. A physical count of the supplies revealed that only $10,000 was actually on hand. The equipment note payable of $80,000 carried a 6 percent interest rate. Medical services performed for patients during December but not yet billed totaled $10,000.

Assignment and Questions 1. Use the form provided on the next page to prepare a revised set of financial statements that take the new information into account. 2. Is any additional information needed? 3. Why is the IOP Boogie Clinic short of cash? 4. What can Dr. Jacobsen do to improve the situation?

Expert A

IOP Boogie Clinic Inc. Operations Statement \begin{tabular}{|l|r|c|} \hline \multicolumn{2}{|c|}{ for Year Ended December 31, 2015 } \\ \hline Patient revenues & & \multicolumn{1}{|c|}{$200,000} \\ \hline & & \\ \hline Expenses & & \\ \hline Salaries and wages expense & $120,000 & \\ \hline Rental expense & 36,000 & \\ \hline Supplies expense & 12,000 & \\ \hline Other expenses & 14,000 & \\ \hline Total & & $182,000 \\ \hline & & \\ \hline Net income & & $18,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{IOPBoogieClinicInc.BalanceSheetDecember31,2015} \\ \hline Assets & \\ \hline Cash & $1,000 \\ \hline Receivables & $55,000 \\ \hline Supplies & 15,000 \\ \hline Equipment & 80,000 \\ \hline Other assets & 10,000 \\ \hline Total & $161,000 \\ \hline & \\ \hline Liabilities & $161,000 \\ \hline Accounts payable & $12,000 \\ \hline Jacobsen payable & 50,000 \\ \hline Note payable & 80,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started