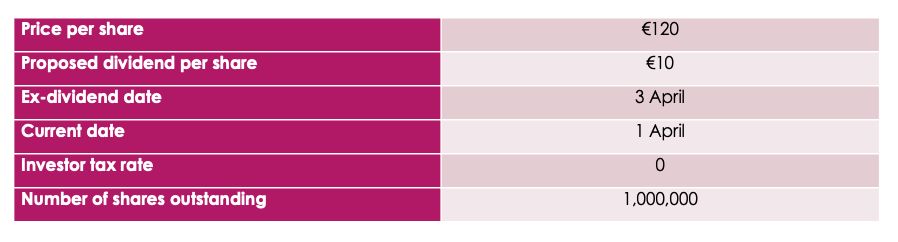

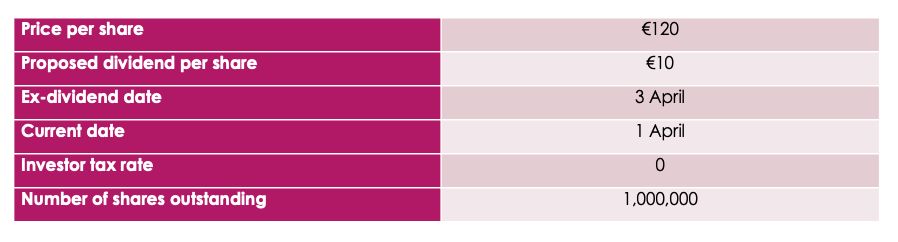

The Irish-based company Neutrono-Neutral is considering paying a cash dividend to its investors. The table below sets out the details of the proposed dividend. Use the information to answer the questions below. What is the total paid in dividends to the firm's shareholders on (or shortly after) the 3 April? What is the expected share price on the 2nd of April? What is the expected share price on the 3rd of April? You should assume there are no transaction costs associated with the dividend payment. Now suppose the firm carries out a share buy-back scheme on the 3rd of April where the firm buys an amount of stock equivalent to the total planned dividend payment. What are the expected share prices on the 2nd and 3rd of April now? How many shares are outstanding after the share buy-back scheme is carried out? Review the logic underpinning Modigliani and Miller's dividend policy irrelevance theorem. Discuss how this logic is affected if the payout is costly in terms of transaction costs and if payouts may represent private information to the firm's investors (signaling models of dividend policy). 120 10 Price per share Proposed dividend per share Ex-dividend date Current date Investor tax rate Number of shares outstanding 3 April 1 April 0 1,000,000 The Irish-based company Neutrono-Neutral is considering paying a cash dividend to its investors. The table below sets out the details of the proposed dividend. Use the information to answer the questions below. What is the total paid in dividends to the firm's shareholders on (or shortly after) the 3 April? What is the expected share price on the 2nd of April? What is the expected share price on the 3rd of April? You should assume there are no transaction costs associated with the dividend payment. Now suppose the firm carries out a share buy-back scheme on the 3rd of April where the firm buys an amount of stock equivalent to the total planned dividend payment. What are the expected share prices on the 2nd and 3rd of April now? How many shares are outstanding after the share buy-back scheme is carried out? Review the logic underpinning Modigliani and Miller's dividend policy irrelevance theorem. Discuss how this logic is affected if the payout is costly in terms of transaction costs and if payouts may represent private information to the firm's investors (signaling models of dividend policy). 120 10 Price per share Proposed dividend per share Ex-dividend date Current date Investor tax rate Number of shares outstanding 3 April 1 April 0 1,000,000