Question

The Iron Bank of Braavos must purchase an asset categorized as a 3-year property class for MACRS depreciation. After-tax MARR for the Iron Bank of

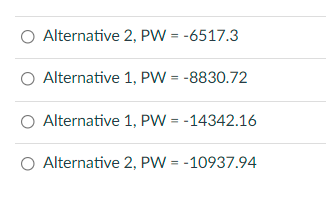

The Iron Bank of Braavos must purchase an asset categorized as a 3-year property class for MACRS depreciation. After-tax MARR for the Iron Bank of Bravos is 25%. Assume a combined federal/state tax rate of 28%. The asset can receive a 40% Bonus Depreciation in year 0 and follows MACRS depreciation afterwards. Three alternatives are available to the Iron Bank of Braavos for this acquisition: Alternative 1: Purchase cost $18K, maintenance cost $4K, salvage value $10K. Alternative 2: Purchase cost $13K, maintenance cost $1K, salvage value $8K. Alternative 3: Purchase cost $16K, maintenance cost $1K, salvage value $4K. Salvage value occurs in year 5. Question: Which brand would you recommend to the Iron Bank of Bravos based on a Present Worth analysis? Hint: 3-year property MACRS depreciation: 0.3333 in year 1, 0.4445 in year 2, 0.1481 in year 3, and 0.0741 in year 4. [P/F,25%,1] = 0.8, [P/F,25%,2] = 0.64, [P/F,25%,3] = 0.512, [P/F,25%,4] = 0.4096, [P/F,25%,5] = 0.3277.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started