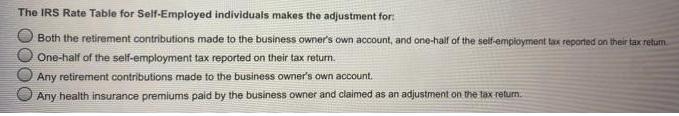

Question: The IRS Rate Table for Self-Employed individuals makes the adjustment for: Both the retirement contributions made to the business owner's own account, and one-half

The IRS Rate Table for Self-Employed individuals makes the adjustment for: Both the retirement contributions made to the business owner's own account, and one-half of the self-employment tax reported on their tax retum. One-half of the self-employment tax reported on their tax return. Any retirement contributions made to the business owner's own account. Any health insurance premiums paid by the business owner and claimed as an adjustment on the tax return. E O000

Step by Step Solution

3.57 Rating (150 Votes )

There are 3 Steps involved in it

ANSWER Nov340 2820 Answer is highlighted in yellow So... View full answer

Get step-by-step solutions from verified subject matter experts