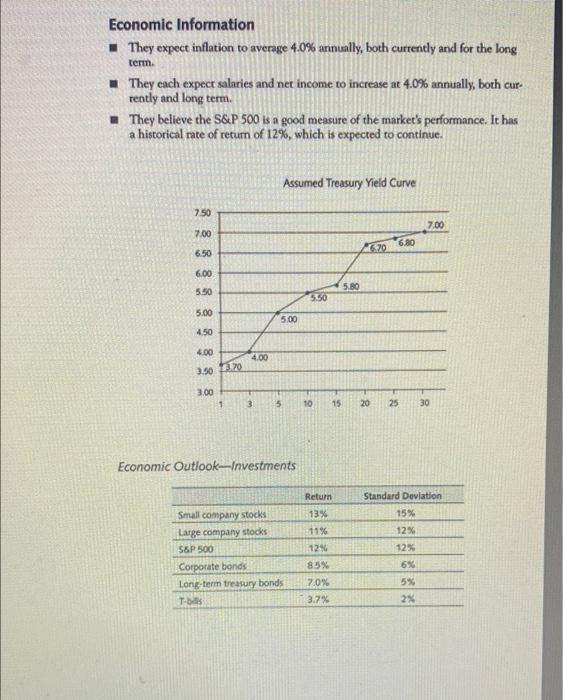

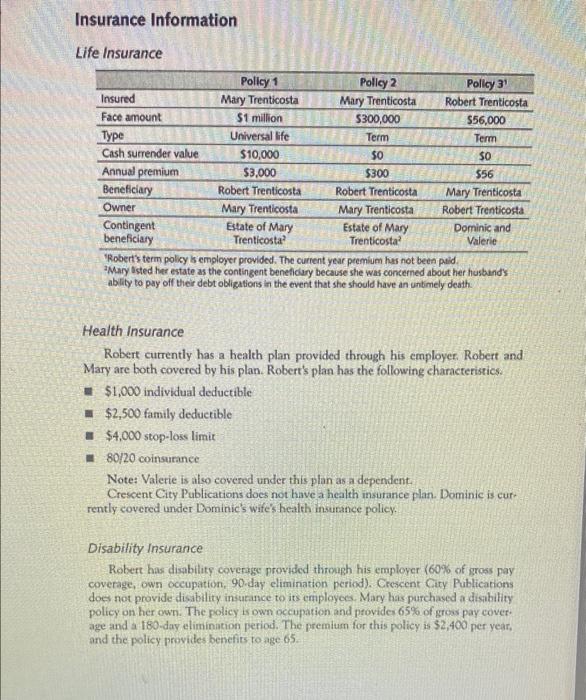

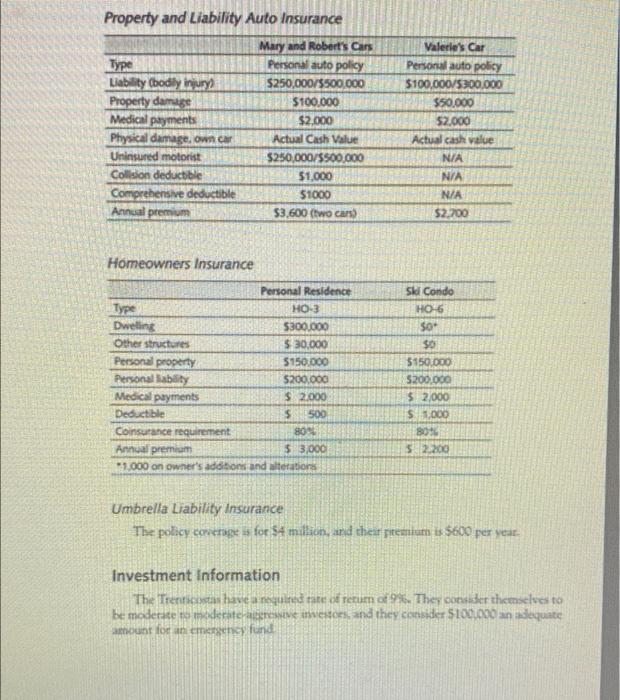

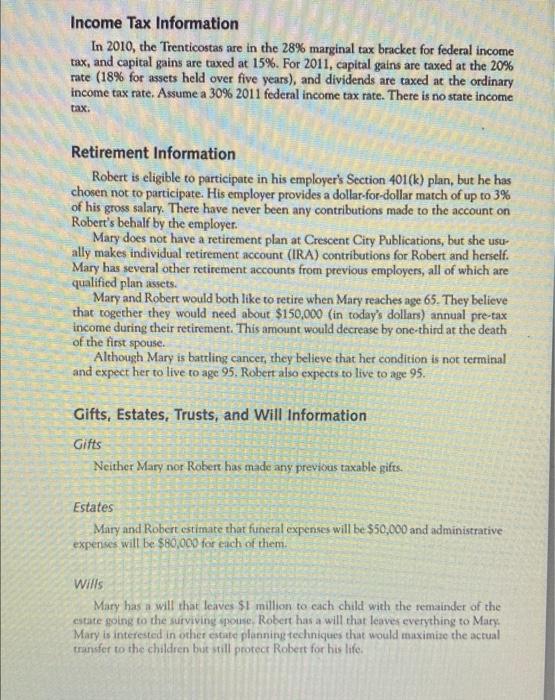

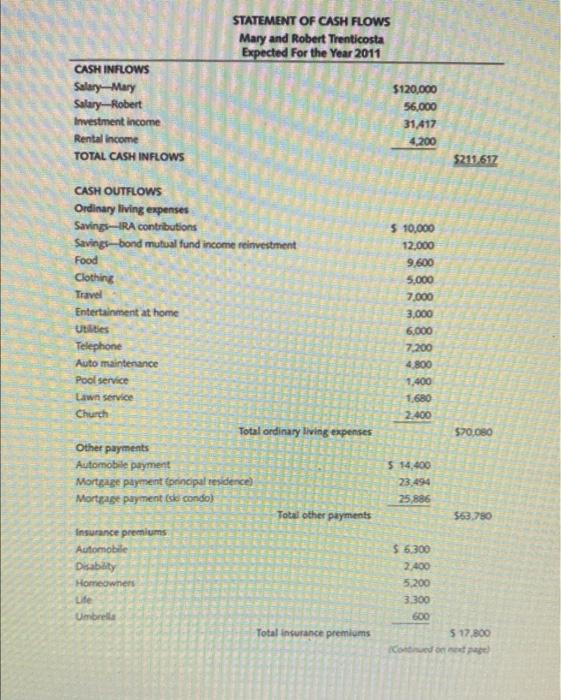

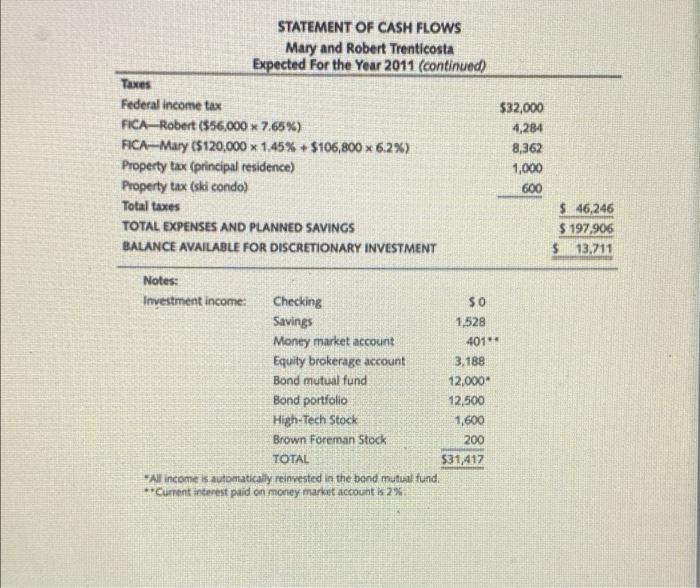

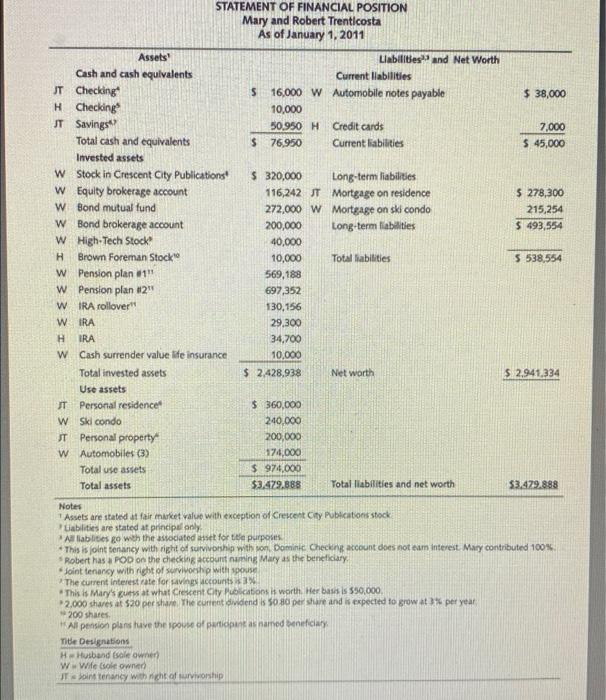

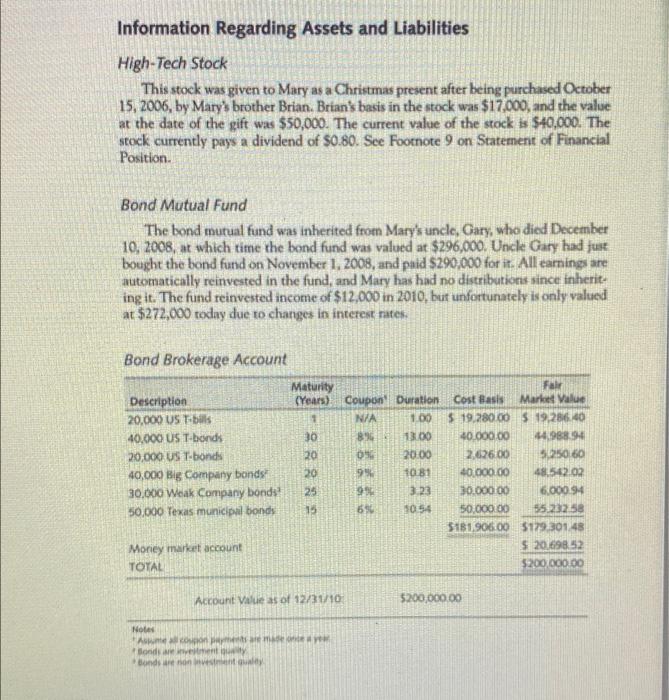

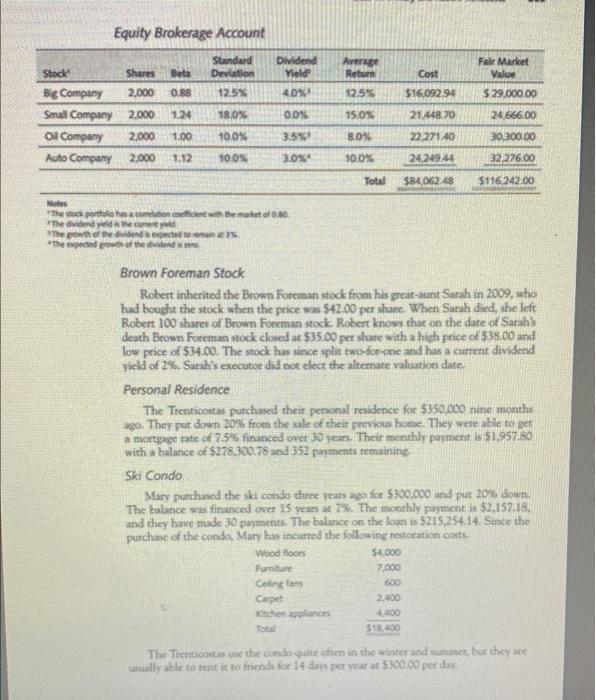

196 Personal Financial Planning Cases and Applications Textbook ?th Edition Today is January 1, 2011. Mary and Robert Trenticosta have come to you, a finan- cial planner, for help in developing a plan to accomplish their financial goals. From your initial meeting together, you have gathered the following information Personal Background and Information Mary Trenticosta (Age 45) Mary owns an 80% interest in a closely held company, Crescent City Publications, She has recently been diagnosed with cancer and is considering selling the business or transferring some or all of the business to her son Dominic. Robert Trenticosta (Age 24) Robert is a nurse who works for an orthopedist in the building where Mary has her office The Trenticostas Mary and Robert met when Mary sought treatment at the orthopedic clinic after she hurt her back. Mary and Robert have been married for two years. They live in a community property state but have a prenuptial agreement declaring that all property owned is separate property. The Children Mary and Robert have no children together. Mary has two children from a formet marriage: Valorie, age 18, who is a college student, and Dominic, age 27. who works in the publications business with Mary. The children's father is deceased. Personal and Financial Objectives 1. They plan to retire when Mary reaches age 65. 2. They need adequate retirement income 3. They want to avoid or minimize death taxes at the death of the first spouse. 4. They want to minimize death taxes at the death of the second spouse 5. They want to provide adequate estate liquidity Economic Information They expect inflation to average 4.0% annually, both currently and for the long term. They each expect salaries and net income to increase at 4.0% annually, both cur- rently and long term. They believe the S&P 500 is a good measure of the market's performance. It has a historical rate of return of 12%, which is expected to continue. Assumed Treasury Yield Curve 7.50 7.00 7.00 6.50 6:20 6.80 6.00 5.50 5.80 550 5.00 5.00 4.50 4.00 4.00 3.50 13.20 3.00 1 3 5 10 15 20 25 30 Economic Outlook--Investments Return 13% 11% Small company stocks Large company stocks 56P 500 Corporate bonds Long term treasury bonds T- 12% 85% 7.0% 3.7% Standard Deviation 15% 12% 1234 6% 5% 2% Insurance Information Life Insurance Policy 1 Polley 2 Policy 31 Insured Mary Trenticosta Mary Trenticosta Robert Trenticosta Face amount $1 million $300,000 $56,000 Type Universal life Term Term Cash surrender value $10,000 $0 $0 Annual premium $3,000 $300 556 Beneficiary Robert Trenticosta Robert Trenticosta Mary Trenticosta Owner Mary Trenticosta Mary Trenticosta Robert Trenticosta Contingent Estate of Mary Estate of Mary Dominic and beneficiary Trenticosta Trenticosta? Valerie "Robert's term policy is employer provided. The current year premium has not been paid Mary isted her estate as the contingent beneficiary because she was concerned about her husband's ability to pay off their debt obligations in the event that she should have an untimely death Health Insurance Robert cutrently has a health plan provided through his employer. Robert and Mary are both covered by his plan. Robert's plan has the following characteristics. $1,000 individual deductible $2,500 family deductible $4,000 stop-loss limit 80/20 coinsurance Note: Valerie is also covered under this plan as a dependent. Crescent City Publications does not have a health insurance plan. Dominic is cur rently covered under Dominic's wife's health insurance policy, Disability Insurance Robert has disability coverage provided through his employer (60% of gross pay coverage, own occupation, 90-day elimination period). Crescent City Publications does not provide disability insurance to its employees. Mary has purchased a disability policy on her cwn. The policy is own occupation and provide: 65% of gross pay cover: age and a 180-day elimination period. The premium for this policy is $2,400 per year, and the policy provides benefits to age 65. Property and Liability Auto Insurance Type Liability (bodily injury Property damage Medical payments Physical damage, own car Uninsured motorist Collision deductible Comprehensive deductible Annual premium Mary and Robert's Cars Personal auto policy $250,000/3500.000 $100.000 $2.000 Actual Cash Value $250,000/5500.000 51.000 $1000 $3,600 (two cars Valerie's Car Personal auto policy $100,000/5300.000 $50,000 52.000 Actual cash value NIA N/A N/A $2,700 Homeowners Insurance Personal Residence Type HO-3 Dwelling $300.000 Other structures $ 30,000 Personal property $150.000 Personal ability $200,000 Medical payments $ 2.000 Deductible $ 500 Coinsurance requirement 80 Annual premium $ 3,000 1.000 on owner's additions and alterations Skl Condo HO-6 SO $0 $150.000 $200.000 $ 2,000 $1,000 80 5 2.200 Umbrella Liability Insurance The policy coverage for $4 milion, and their premium is 5600 per year: Investment Information The Trentices have a neque rate of term of 9%. They consider themselves to be moderate to moderate aceste investors and they consider 5100.000 an adequate amount for an emergency fund Income Tax Information In 2010, the Trenticostas are in the 28% marginal tax bracket for federal income tax, and capital gains are taxed at 15%. For 2011, capital gains are taxed at the 20% rate (18% for assets held over five years), and dividends are taxed at the ordinary income tax rate. Assume a 30% 2011 federal income tax rate. There is no state income tax. Retirement Information Robert is eligible to participate in his employer's Section 401(k) plan, but he has chosen not to participate. His employer provides a dollar-for-dollar match of up to 3% of his gross salary. There have never been any contributions made to the account on Robert's behalf by the employer. Mary does not have a retirement plan at Crescent City Publications, but she usu- ally makes individual retirement account (IRA) contributions for Robert and herself. Mary has several other retirement accounts from previous employers, all of which are qualified plan assets. Mary and Robert would both like to retire when Mary reaches age 65. They believe that together they would need about $150,000 (in today's dollars) annual pre-tax income during their retirement. This amount would decrease by one-third at the death of the first spouse. Although Mary is battling cancer, they believe that her condition is not terminal and expect her to live to age 95. Robert also expects to live to age 95. Gifts, Estates, Trusts, and will Information Gifts Neither Mary nor Robert has made any previous taxable gifts. Estates Mary and Robert estimate that funeral expenses will be $50,000 and administrative expenses will be $80,000 for each of them Wills Mary has a will that leaves $1 million to each child with the remainder of the estite going to the surviving spouse, Robert has a will that leaves everything to Mary Mary is interested in other estate planning techniques that would maximize the actual transfer to the children but still protect Robert for his life. STATEMENT OF CASH FLOWS Mary and Robert Trenticosta Expected for the Year 2011 CASH INFLOWS Salary-Mary Salary-Robert Investment income Rental income TOTAL CASH INFLOWS $120,000 56.000 31.417 4.200 $21167 CASH OUTFLOWS Ordinary living expenses Saving-RA contributions Savings-bond mutual fund income reinvestment Food Clothing Travel Entertainment at home Utilities Telephone Auto maintenance Pool service Lawn service Church Total ordinary living expenses Other payments Automobile payment Mortgage payment principal residence) Mortgage payment is condo) Total other payments Insurance premiums Automobile Disability Homeowners ute Umbrella Total insurance premium $10,000 12.000 9,600 5.000 7.000 3.000 6,000 7,200 4800 1.400 1.680 2.400 570.080 5 54,400 23.494 25886 563.750 $ 6300 2.400 5.200 3.300 600 5 17.800 Cordone STATEMENT OF CASH FLOWS Mary and Robert Trenticosta Expected for the Year 2011 (continued) Taxes Federal income tax FICA-Robert ($56,000 x 7.65%) FICA-Mary ($120,000 x 1.45% +$106,800 x 6.2%) Property tax (principal residence) Property tax (ski condo) Total taxes TOTAL EXPENSES AND PLANNED SAVINGS BALANCE AVAILABLE FOR DISCRETIONARY INVESTMENT $32,000 4,284 8,362 1,000 600 $ 46,246 $ 197,906 $ 13,711 so Notes: Investment income: Checking Savings 1,528 Monty market account 401" Equity brokerage account 3,188 Bond mutual fund 12.000* Bond portfolio 12,500 High-Tech Stock 1,600 Brown Foreman Stock 200 TOTAL $31,417 *All income is automatically reinvested in the bond mutual fund. **Current interest paid on money market account is 2% STATEMENT OF FINANCIAL POSITION Mary and Robert Trenticosta As of January 1, 2011 Assets Liabilities and Net Worth Cash and cash equivalents Current liabilities UT Checking $ 16,000 W Automobile notes payable $ 38,000 H Checking 10,000 JT Savings? 50.950 H Credit cards 7,000 Total cash and equivalents $ 76,950 Current liabilities $ 45,000 Invested assets W Stock in Crescent City Publications! $ 320,000 Long-term liabilities WEquity brokerage account 116,242 JT Mortgage on residence $ 278,300 W Bond mutual fund 272,000 W Mortgage on ski condo 215,254 W Bond brokerage account 200,000 Long-term liabilities $493,554 W High-Tech Stock 40,000 Brown Foreman Stock 10,000 Total abilities 5 538,554 W Pension plan 11 569,188 w Pension plan 12" 697,352 W RA rollover" 130,156 W TRA 29,300 H IRA 34,700 W Cash surrender value life insurance 10,000 Total invested assets $ 2,428,938 Net worth $ 2.941,334 Use assets JT Personal residence $360,000 w Ski condo 240.000 JT Personal property 200,000 w Automobiles (3) 174,000 Total use assets $974,000 Total assets $3.479.888 Total liabilities and net worth 53.479.888 Notes Assets are stated at fir market value with exception of Crescent City Publications stock abilities are stated at principal only Al llabilities go with the associated set for title purposes * This is joint tenancy with right of survivonship with son Dominic Checking account does not eam interest Mary contributed 100% Robert has a POD on the checking accounting Mary as the beneficiary Joint tenancy with right of survivors with souse The current interest rate for savings accounts This is Mary's at what Crescent City Publication is worth Her bass is 550.000, 2.000 shares at $20 per than the current dividend is 50 80 per share and is expected to grow at 3 per year 200 shares Al pension plans have the one of partidpure as nanod beneficiary Title Designation HHusband sale owner) W Wife stolt owned Join tenancy with nicht vorship Information Regarding Assets and Liabilities High-Tech Stock This stock was given to Mary as a Christmas present after being purchased October 15, 2006, by Mary's brother Brian Brian's basis in the stock was $17.000, and the value at the date of the gift was $50,000. The current value of the stock is $40,000. The stock currently pays a dividend of $0.80. See Footnote 9 on Statement of Financial Position w Bond Mutual Fund The bond mutual fund was inherited from Mary's uncle, Gary, who died December 10, 2008, at which time the bond fund was valued at $296,000. Uncle Gary had just bought the bond fund on November 1, 2008, and paid $290,000 for it. All earnings are automatically reinvested in the fund, and Mary has had no distributions since inherit. ing it . The fund reinvested income of $12,000 in 2010, but unfortunately is only valued at $272,000 today due to changes in interest rates Bond Brokerage Account Description 20,000 US T-bills 40,000 US T-bonds 20,000 US T-bonds 40,000 Big Company bonds 30.000 Weak Company bonds? 50,000 Texas municipal bonds Maturity (Years). Coupont Duration N/A 1.00 30 896 13100 20 0% 20:00 20 99 1081 25 9 3.23 15 69 30.54 Fall Cost Basis Market Value $ 19.280100 $ 19,286.40 40.000.00 4.988.94 2.626.00 550.60 40.000,00 48502.02 301000100 6.000 94 50,000.00 55.23258 $181.906.00 $129,301.48 $ 20,698.52 $200,000.00 Money market account TOTAL Account Value as of 12/31/10 5200,000.00 NO Am Bonds are vetment Bonds are not Equity Brokerage Account Standard Deviation Average Return Beta Dividend Yield 40% Fair Market Value Shares 2.000 Cost 0.88 12.5% 125% $16.092.94 $ 29,000.00 Stock Big Company Smail Company ol Company Auto Company 1.24 18.0" 0.0% 15.0% 21.48.70 24.666.00 2.000 2.000 100% 3.59 8.0% 22.271 40 30 300.00 1.00 1.12 2.000 100 3.0% 100% 24,249.44 32 276.00 Total $84,06248 $116.242.00 Notes The portfolio "The them. he The Brown Foreman Stock Robert inherited the Brown Foreman stock from his great-aunt Sarah in 2009, who had bought the stock when the price was $42.00 per share. When Sarah died, she left Robert 100 shares of Brown Foreman stock. Robert knows that on the date of Sarah death Brown Foreman stock closed at $35.00 per share with a high price of 536.00 and low price of $34.00. The stock has since splittwo-for-ce and has a current dividend yield of 2%. Sarah's executor did not elect the alternate valuation date, Personal Residence The Trenticostas purchased their personal residence for $350.000 nine months ago. They put down 20% from the sale of their previous home. They were able to get amortgage rate of 75% financed over 30 years. Their monthly payment is $1.957.80 with a balance of $278,300.78 and 352 payments remaining Ski Condo Mary purchased the ski condo three years ago for 5300,000 and put 20% down The balance was financed over 15 years at 7%. The monthly payment is $2.157.18 and they have made 30 payments. The balance on the loan is $215.254.14. Since the purchase of the condo, Many has incurred the following restoration costs. Wood Hoon 54,000 Furniture 7.000 Celingam 600 Carpet 2.400 the places Tot 516.400 The Trenticostas use the condo quite often in the winter and summer, but they are usually able to rent it to friends for 14 days per year at 5.300.00 per 4. Can they meet their goals? Do a Cash Flow study to see if they can meet their goals. If they cannot, what are your recommendations? 5. If Mary and Robert can earn their required rate of return, how much would they need when Mary is age 65 to provide for both of them in retirement. (round to the nearest thousand and assume they both live to age 95.) 6. Based on the PASS system in Ch. 11, what would you estimate their risk tolerance is. Based on their Risk Tolerance would you change their assets if so why and how 7. Based on your changes, what assets would you change and what would you replace them with? 8. Create an investment policy statement for the Trenticostas based on case information and changes you suggested. 196 Personal Financial Planning Cases and Applications Textbook ?th Edition Today is January 1, 2011. Mary and Robert Trenticosta have come to you, a finan- cial planner, for help in developing a plan to accomplish their financial goals. From your initial meeting together, you have gathered the following information Personal Background and Information Mary Trenticosta (Age 45) Mary owns an 80% interest in a closely held company, Crescent City Publications, She has recently been diagnosed with cancer and is considering selling the business or transferring some or all of the business to her son Dominic. Robert Trenticosta (Age 24) Robert is a nurse who works for an orthopedist in the building where Mary has her office The Trenticostas Mary and Robert met when Mary sought treatment at the orthopedic clinic after she hurt her back. Mary and Robert have been married for two years. They live in a community property state but have a prenuptial agreement declaring that all property owned is separate property. The Children Mary and Robert have no children together. Mary has two children from a formet marriage: Valorie, age 18, who is a college student, and Dominic, age 27. who works in the publications business with Mary. The children's father is deceased. Personal and Financial Objectives 1. They plan to retire when Mary reaches age 65. 2. They need adequate retirement income 3. They want to avoid or minimize death taxes at the death of the first spouse. 4. They want to minimize death taxes at the death of the second spouse 5. They want to provide adequate estate liquidity Economic Information They expect inflation to average 4.0% annually, both currently and for the long term. They each expect salaries and net income to increase at 4.0% annually, both cur- rently and long term. They believe the S&P 500 is a good measure of the market's performance. It has a historical rate of return of 12%, which is expected to continue. Assumed Treasury Yield Curve 7.50 7.00 7.00 6.50 6:20 6.80 6.00 5.50 5.80 550 5.00 5.00 4.50 4.00 4.00 3.50 13.20 3.00 1 3 5 10 15 20 25 30 Economic Outlook--Investments Return 13% 11% Small company stocks Large company stocks 56P 500 Corporate bonds Long term treasury bonds T- 12% 85% 7.0% 3.7% Standard Deviation 15% 12% 1234 6% 5% 2% Insurance Information Life Insurance Policy 1 Polley 2 Policy 31 Insured Mary Trenticosta Mary Trenticosta Robert Trenticosta Face amount $1 million $300,000 $56,000 Type Universal life Term Term Cash surrender value $10,000 $0 $0 Annual premium $3,000 $300 556 Beneficiary Robert Trenticosta Robert Trenticosta Mary Trenticosta Owner Mary Trenticosta Mary Trenticosta Robert Trenticosta Contingent Estate of Mary Estate of Mary Dominic and beneficiary Trenticosta Trenticosta? Valerie "Robert's term policy is employer provided. The current year premium has not been paid Mary isted her estate as the contingent beneficiary because she was concerned about her husband's ability to pay off their debt obligations in the event that she should have an untimely death Health Insurance Robert cutrently has a health plan provided through his employer. Robert and Mary are both covered by his plan. Robert's plan has the following characteristics. $1,000 individual deductible $2,500 family deductible $4,000 stop-loss limit 80/20 coinsurance Note: Valerie is also covered under this plan as a dependent. Crescent City Publications does not have a health insurance plan. Dominic is cur rently covered under Dominic's wife's health insurance policy, Disability Insurance Robert has disability coverage provided through his employer (60% of gross pay coverage, own occupation, 90-day elimination period). Crescent City Publications does not provide disability insurance to its employees. Mary has purchased a disability policy on her cwn. The policy is own occupation and provide: 65% of gross pay cover: age and a 180-day elimination period. The premium for this policy is $2,400 per year, and the policy provides benefits to age 65. Property and Liability Auto Insurance Type Liability (bodily injury Property damage Medical payments Physical damage, own car Uninsured motorist Collision deductible Comprehensive deductible Annual premium Mary and Robert's Cars Personal auto policy $250,000/3500.000 $100.000 $2.000 Actual Cash Value $250,000/5500.000 51.000 $1000 $3,600 (two cars Valerie's Car Personal auto policy $100,000/5300.000 $50,000 52.000 Actual cash value NIA N/A N/A $2,700 Homeowners Insurance Personal Residence Type HO-3 Dwelling $300.000 Other structures $ 30,000 Personal property $150.000 Personal ability $200,000 Medical payments $ 2.000 Deductible $ 500 Coinsurance requirement 80 Annual premium $ 3,000 1.000 on owner's additions and alterations Skl Condo HO-6 SO $0 $150.000 $200.000 $ 2,000 $1,000 80 5 2.200 Umbrella Liability Insurance The policy coverage for $4 milion, and their premium is 5600 per year: Investment Information The Trentices have a neque rate of term of 9%. They consider themselves to be moderate to moderate aceste investors and they consider 5100.000 an adequate amount for an emergency fund Income Tax Information In 2010, the Trenticostas are in the 28% marginal tax bracket for federal income tax, and capital gains are taxed at 15%. For 2011, capital gains are taxed at the 20% rate (18% for assets held over five years), and dividends are taxed at the ordinary income tax rate. Assume a 30% 2011 federal income tax rate. There is no state income tax. Retirement Information Robert is eligible to participate in his employer's Section 401(k) plan, but he has chosen not to participate. His employer provides a dollar-for-dollar match of up to 3% of his gross salary. There have never been any contributions made to the account on Robert's behalf by the employer. Mary does not have a retirement plan at Crescent City Publications, but she usu- ally makes individual retirement account (IRA) contributions for Robert and herself. Mary has several other retirement accounts from previous employers, all of which are qualified plan assets. Mary and Robert would both like to retire when Mary reaches age 65. They believe that together they would need about $150,000 (in today's dollars) annual pre-tax income during their retirement. This amount would decrease by one-third at the death of the first spouse. Although Mary is battling cancer, they believe that her condition is not terminal and expect her to live to age 95. Robert also expects to live to age 95. Gifts, Estates, Trusts, and will Information Gifts Neither Mary nor Robert has made any previous taxable gifts. Estates Mary and Robert estimate that funeral expenses will be $50,000 and administrative expenses will be $80,000 for each of them Wills Mary has a will that leaves $1 million to each child with the remainder of the estite going to the surviving spouse, Robert has a will that leaves everything to Mary Mary is interested in other estate planning techniques that would maximize the actual transfer to the children but still protect Robert for his life. STATEMENT OF CASH FLOWS Mary and Robert Trenticosta Expected for the Year 2011 CASH INFLOWS Salary-Mary Salary-Robert Investment income Rental income TOTAL CASH INFLOWS $120,000 56.000 31.417 4.200 $21167 CASH OUTFLOWS Ordinary living expenses Saving-RA contributions Savings-bond mutual fund income reinvestment Food Clothing Travel Entertainment at home Utilities Telephone Auto maintenance Pool service Lawn service Church Total ordinary living expenses Other payments Automobile payment Mortgage payment principal residence) Mortgage payment is condo) Total other payments Insurance premiums Automobile Disability Homeowners ute Umbrella Total insurance premium $10,000 12.000 9,600 5.000 7.000 3.000 6,000 7,200 4800 1.400 1.680 2.400 570.080 5 54,400 23.494 25886 563.750 $ 6300 2.400 5.200 3.300 600 5 17.800 Cordone STATEMENT OF CASH FLOWS Mary and Robert Trenticosta Expected for the Year 2011 (continued) Taxes Federal income tax FICA-Robert ($56,000 x 7.65%) FICA-Mary ($120,000 x 1.45% +$106,800 x 6.2%) Property tax (principal residence) Property tax (ski condo) Total taxes TOTAL EXPENSES AND PLANNED SAVINGS BALANCE AVAILABLE FOR DISCRETIONARY INVESTMENT $32,000 4,284 8,362 1,000 600 $ 46,246 $ 197,906 $ 13,711 so Notes: Investment income: Checking Savings 1,528 Monty market account 401" Equity brokerage account 3,188 Bond mutual fund 12.000* Bond portfolio 12,500 High-Tech Stock 1,600 Brown Foreman Stock 200 TOTAL $31,417 *All income is automatically reinvested in the bond mutual fund. **Current interest paid on money market account is 2% STATEMENT OF FINANCIAL POSITION Mary and Robert Trenticosta As of January 1, 2011 Assets Liabilities and Net Worth Cash and cash equivalents Current liabilities UT Checking $ 16,000 W Automobile notes payable $ 38,000 H Checking 10,000 JT Savings? 50.950 H Credit cards 7,000 Total cash and equivalents $ 76,950 Current liabilities $ 45,000 Invested assets W Stock in Crescent City Publications! $ 320,000 Long-term liabilities WEquity brokerage account 116,242 JT Mortgage on residence $ 278,300 W Bond mutual fund 272,000 W Mortgage on ski condo 215,254 W Bond brokerage account 200,000 Long-term liabilities $493,554 W High-Tech Stock 40,000 Brown Foreman Stock 10,000 Total abilities 5 538,554 W Pension plan 11 569,188 w Pension plan 12" 697,352 W RA rollover" 130,156 W TRA 29,300 H IRA 34,700 W Cash surrender value life insurance 10,000 Total invested assets $ 2,428,938 Net worth $ 2.941,334 Use assets JT Personal residence $360,000 w Ski condo 240.000 JT Personal property 200,000 w Automobiles (3) 174,000 Total use assets $974,000 Total assets $3.479.888 Total liabilities and net worth 53.479.888 Notes Assets are stated at fir market value with exception of Crescent City Publications stock abilities are stated at principal only Al llabilities go with the associated set for title purposes * This is joint tenancy with right of survivonship with son Dominic Checking account does not eam interest Mary contributed 100% Robert has a POD on the checking accounting Mary as the beneficiary Joint tenancy with right of survivors with souse The current interest rate for savings accounts This is Mary's at what Crescent City Publication is worth Her bass is 550.000, 2.000 shares at $20 per than the current dividend is 50 80 per share and is expected to grow at 3 per year 200 shares Al pension plans have the one of partidpure as nanod beneficiary Title Designation HHusband sale owner) W Wife stolt owned Join tenancy with nicht vorship Information Regarding Assets and Liabilities High-Tech Stock This stock was given to Mary as a Christmas present after being purchased October 15, 2006, by Mary's brother Brian Brian's basis in the stock was $17.000, and the value at the date of the gift was $50,000. The current value of the stock is $40,000. The stock currently pays a dividend of $0.80. See Footnote 9 on Statement of Financial Position w Bond Mutual Fund The bond mutual fund was inherited from Mary's uncle, Gary, who died December 10, 2008, at which time the bond fund was valued at $296,000. Uncle Gary had just bought the bond fund on November 1, 2008, and paid $290,000 for it. All earnings are automatically reinvested in the fund, and Mary has had no distributions since inherit. ing it . The fund reinvested income of $12,000 in 2010, but unfortunately is only valued at $272,000 today due to changes in interest rates Bond Brokerage Account Description 20,000 US T-bills 40,000 US T-bonds 20,000 US T-bonds 40,000 Big Company bonds 30.000 Weak Company bonds? 50,000 Texas municipal bonds Maturity (Years). Coupont Duration N/A 1.00 30 896 13100 20 0% 20:00 20 99 1081 25 9 3.23 15 69 30.54 Fall Cost Basis Market Value $ 19.280100 $ 19,286.40 40.000.00 4.988.94 2.626.00 550.60 40.000,00 48502.02 301000100 6.000 94 50,000.00 55.23258 $181.906.00 $129,301.48 $ 20,698.52 $200,000.00 Money market account TOTAL Account Value as of 12/31/10 5200,000.00 NO Am Bonds are vetment Bonds are not Equity Brokerage Account Standard Deviation Average Return Beta Dividend Yield 40% Fair Market Value Shares 2.000 Cost 0.88 12.5% 125% $16.092.94 $ 29,000.00 Stock Big Company Smail Company ol Company Auto Company 1.24 18.0" 0.0% 15.0% 21.48.70 24.666.00 2.000 2.000 100% 3.59 8.0% 22.271 40 30 300.00 1.00 1.12 2.000 100 3.0% 100% 24,249.44 32 276.00 Total $84,06248 $116.242.00 Notes The portfolio "The them. he The Brown Foreman Stock Robert inherited the Brown Foreman stock from his great-aunt Sarah in 2009, who had bought the stock when the price was $42.00 per share. When Sarah died, she left Robert 100 shares of Brown Foreman stock. Robert knows that on the date of Sarah death Brown Foreman stock closed at $35.00 per share with a high price of 536.00 and low price of $34.00. The stock has since splittwo-for-ce and has a current dividend yield of 2%. Sarah's executor did not elect the alternate valuation date, Personal Residence The Trenticostas purchased their personal residence for $350.000 nine months ago. They put down 20% from the sale of their previous home. They were able to get amortgage rate of 75% financed over 30 years. Their monthly payment is $1.957.80 with a balance of $278,300.78 and 352 payments remaining Ski Condo Mary purchased the ski condo three years ago for 5300,000 and put 20% down The balance was financed over 15 years at 7%. The monthly payment is $2.157.18 and they have made 30 payments. The balance on the loan is $215.254.14. Since the purchase of the condo, Many has incurred the following restoration costs. Wood Hoon 54,000 Furniture 7.000 Celingam 600 Carpet 2.400 the places Tot 516.400 The Trenticostas use the condo quite often in the winter and summer, but they are usually able to rent it to friends for 14 days per year at 5.300.00 per 4. Can they meet their goals? Do a Cash Flow study to see if they can meet their goals. If they cannot, what are your recommendations? 5. If Mary and Robert can earn their required rate of return, how much would they need when Mary is age 65 to provide for both of them in retirement. (round to the nearest thousand and assume they both live to age 95.) 6. Based on the PASS system in Ch. 11, what would you estimate their risk tolerance is. Based on their Risk Tolerance would you change their assets if so why and how 7. Based on your changes, what assets would you change and what would you replace them with? 8. Create an investment policy statement for the Trenticostas based on case information and changes you suggested